Banks create money. To be more precise, when a bank grants a loan, it simultaneously creates a deposit. Bank deposits are functionally equivalent to cash.

The insight that bank lending creates money is a direct result of basic accounting, and has been explained many times. See for example the Bank of England, Positive Money, this blog, and most recently the Bundesbank (h/t Benjamin Braun) and Norges Bank (h/t Frank van Lerven).

A while ago, Daniela Gabor pointed out that economists have know this for a long time (see the replies to her tweet for even earlier references):

Waldo Mitchell, writing in 1923(!) on banks' power to create money ex-nihilo. Incredible we're still debating this. https://t.co/rAuoG0ALeu pic.twitter.com/JI5vHN2dk6

— Daniela Gabor (@DanielaGabor) March 21, 2017

I wouldn’t be surprised if the Renaissance bankers who understood double-entry bookkeeping were well aware of the fact that they were creating money.

So how is it possible that some famous economists still don’t know that banks really do create money? Why do they insist that banks lend out savings?

Economics education apparantly fails to pass on some elementary knowledge to students.

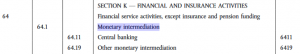

It doesn’t help that the activities of banks are often described as ‘monetary intermediation’. Intermediation implies that bankers are the middle men between borrowers and savers.

Monetary intermediation is even an official term in the statistical classification of economic activities in Europe:

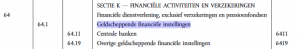

However, there exists a much better description for banks. In Dutch, the formal description of banks is “geldscheppende financiële instellingen”, which literally means “money-creating financial institutions”:

As far as I can tell, Dutch is the only European language in which banks are described as active money creators1. All other languages use ‘monetary intermediation’.

Maybe everybody should take a cue from Dutch and start saying ‘money creating institutions’ from now on, so we don’t have this debate a hundred years from now

===

I explain how banks create money in Bankers are people, too. After you’ve read my book, you’ll know more about banking than many PhD economists!

Update 20 October 2019: the link to the Bank of England paper was broken. It’s fixed now, thanks to Anna for notifying me!