Summary:

The war in Ukraine, the rise of China, economic stagnation, and deteriorating relations with Africa are some of Europe’s most pressing geopolitical challenges.

In this episode, I talk about how banks reflect these geopolitical shifts.

Until the 2022 invasion of Ukraine, EU politicians and bankers treated Russia like any other Central and Eastern European country. Banks like UniCredit, Raiffeisen Bank International, Société Générale and others had significant subsidiaries in Russia, just as they had in e.g. the Czech Republic, Poland or Bulgaria.

Vice versa, Russian banks did business in Europe.

However, since the invasion, all but one Russian bank in the EU have been forced to shut down. In contrast, European banks continue to operate in Russia, to the chagrin of European and American officials.

As the visit of Xi Jinping to Hungary and Serbia demonstrates, good political relations and Chinese investment go hand in hand. Usually, the larger a country’s GDP, the more foreign banks it attracts. But although Hungary has a small economy, it has more Chinese banks than e.g. Austria, Sweden or Romania.

Macron talked about the need for cross-border consolidation of European banks. It’s easy to suspect ulterior motives, as BNP Paribas and Crédit Agricole are well placed to buy foreign competitors. But given the single European market, the dominance of local banks in the biggest euro countries doesn’t seem right.

Finally, as France’s military and political power in Africa wanes, French banks have been selling their African subsidiaries to local banks.

Future episodes will be about how to sell SocGen, the effect of higher interest rates, and the frozen Russian central bank assets at Euroclear.

Transcript/blog version:

Hello and welcome to another season of the Finrestra Podcast!

I’ve been on hiatus for more than a year, but now I’m back with a lot of new content. But more on that at the end of this episode.

Today’s topic is the geopolitics of banking. I’m gonna talk about foreign banks in Europe and European banks in the rest of the world based on presidents Putin, Xi and Macron.

So first of all, Vladimir Putin.

Since Putin’s invasion of Ukraine in 2022, a lot has changed for banks, both for Russian banks in Europe and for European banks in Russia.

Almost immediately after the invasion, Russian banks in Europe were sanctioned or they suffered bank runs, and then the European regulators shut them down.

Sberbank, the largest Russian bank, had a number of subsidiaries in Central Europe. It had bought these from Austrian Volksbank in 2012, at a time when Russia was still seen as a “normal” country.

Sberbank Europe failed in the days after the invasion. Its operations in countries like Slovenia and Croatia were sold to local competitors.

Russia’s second largest bank, VTB, was also active in a couple of European countries before the war. Those operations are liquidated.

But there were also some smaller Russian banks that you probably never heard of.

For example, the fourth largest bank on Cyprus was RCB, formerly known as Russian Commercial Bank. RCB doesn’t exist anymore.

In the Netherlands, there was Amsterdam Trade Bank. Despite the name, it was owned by Russian Alfa Bank. Amsterdam Trade Bank was sanctioned and then closed.

Recently, in Luxembourg, the East-West United Bank was also closed down. East-West United Bank started as a Soviet bank during the Cold War, but its story ended thanks to Putin and the European sanctions.

Luxembourg is also the only country in the EU that still has an active Russian bank, Gazprombank. The EU is still buying gas from Russia, and the payments go through Gazprombank.

So that covers the Russian banks in the EU.

If we look at the European banks in Russia, the story is quite different.

Maybe I should start with the situation before the invasion.

According to the Russian central bank, there were three European banks with significant operations in Russia: UniCredit, Raiffeisen Bank International and Société Générale.

Intesa Sanpaolo, OTP, ING and a couple of others also did business there.

These are all banks who had expanded not just into Russia, but also into other former communist countries like Poland, the Czech Republic or Bulgaria.

Of these European banks, only Société Générale has fully left Russia.

SocGen’s subsidiary Rosbank was sold to a Russian oligarch.

The ECB and the Americans are trying to force banks like Raiffeisen to leave Russia.

Janet Yellen has even threatened European banks with sanctions if they don’t comply.

It’s funny that I didn’t read any warnings from Yellen to JPMorgan and Citibank, who also still operate in Moscow.

I guess it shows you who’s the boss in international politics and finance.

Geopolitics aside, you can question the wisdom of selling a profitable bank to a friend of Putin.

But given the fate of the Russian banks in Europe, it’s strange that the Western ones can still do business in Russia.

Maybe it’s for propaganda: unlike the West, Russia respects the rule of law.

Or it could be because they’re useful for facilitating international payments.

Or maybe Putin believes that European bankers can influence politics.

That would be pretty naive.

In Europe, politicians are much more powerful than bankers (see Brexit).

It’s probably more likely that Putin thinks it’s good to retain some leverage over Western banks, because billions of euros of the Russian Central Bank are frozen in the EU.

Western politicians want to use that money for Ukraine, so Putin could retaliate by nationalizing their banks.

So that was the Putin chapter of this banking and geopolitics episode.

Next, let’s move on to China.

Xi Jinping, the Chinese president, was in Europe last month.

He visited three countries: France, Hungary and Serbia.

France is a logical destination: it’s the second largest economy in the EU, and the only one with nuclear weapons.

But why did Xi go to Hungary and Serbia?

Well, obviously because they have the best political relations with China.

And those relations result in Chinese investment: from BYD factories in Hungary, mines in Serbia and the railway between Budapest and Belgrade.

What’s the geopolitical banking angle here?

If you’re a Chinese company that’s gonna invest abroad, why would you depend on Western banks?

It’s more convenient to deal with banks that you know, and who speak your language.

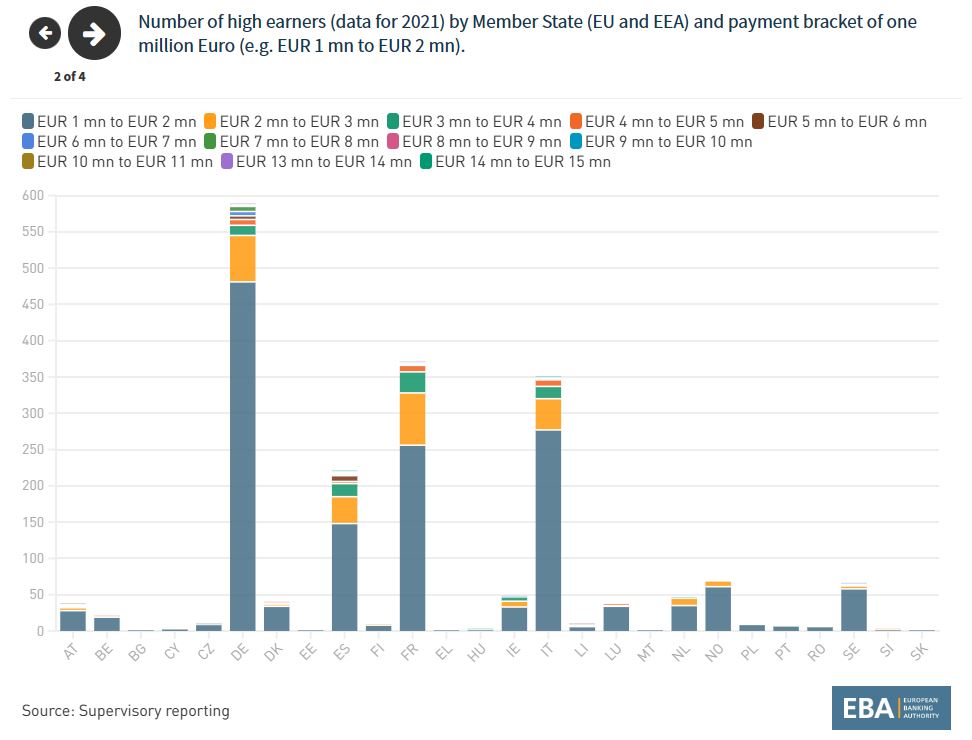

So there are two Chinese banks in Hungary: China Construction Bank and Bank of China. Bank of China even has a regional headquarters in Budapest. And it has a branch in Belgrade.

For comparison, there’s only one Chinese bank in countries like Austria, Sweden, Ireland and Romania, who have much larger economies than Hungary and especially Serbia.

And that’s remarkable, because there’s a strong correlation between a country’s GDP and the number of international banks that operate there.

But taking into account the geopolitics explains why Hungary and Serbia are outliers: Chinese banks are attracted by more than GDP alone.

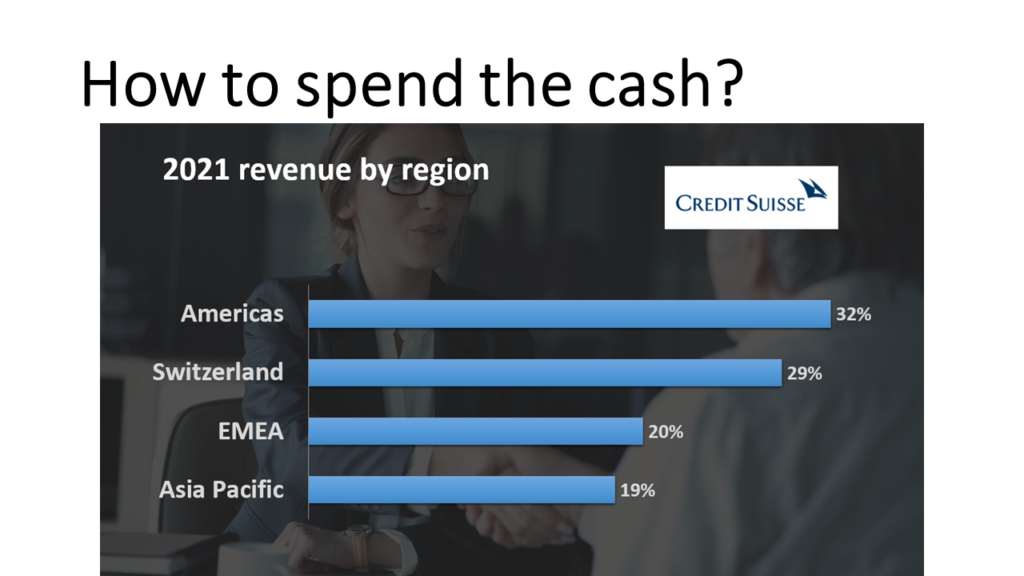

Now with all of this talk about two small countries, I don’t want to give you the impression that Chinese banks only follow geopolitics.

In fact, there are five major Chinese banks in Paris and Frankfurt, so the “law” of financial geography does apply.

However, here’s a fun fact: the EU country with most Chinese banks is not France or Germany, but… tiny Luxembourg.

That’s for another episode.

So that was the story of Xi Jinping and the Chinese banks in Europe.

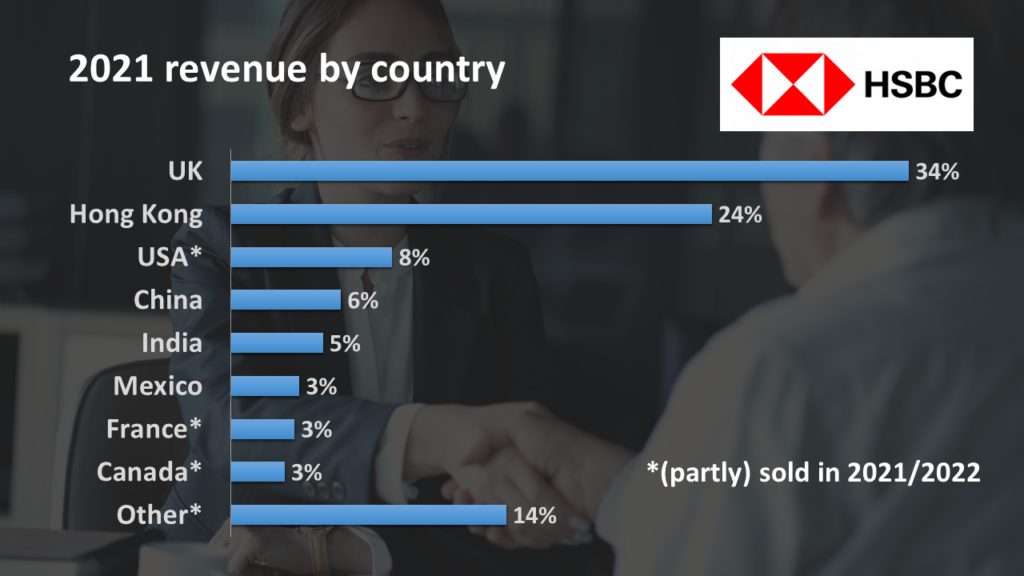

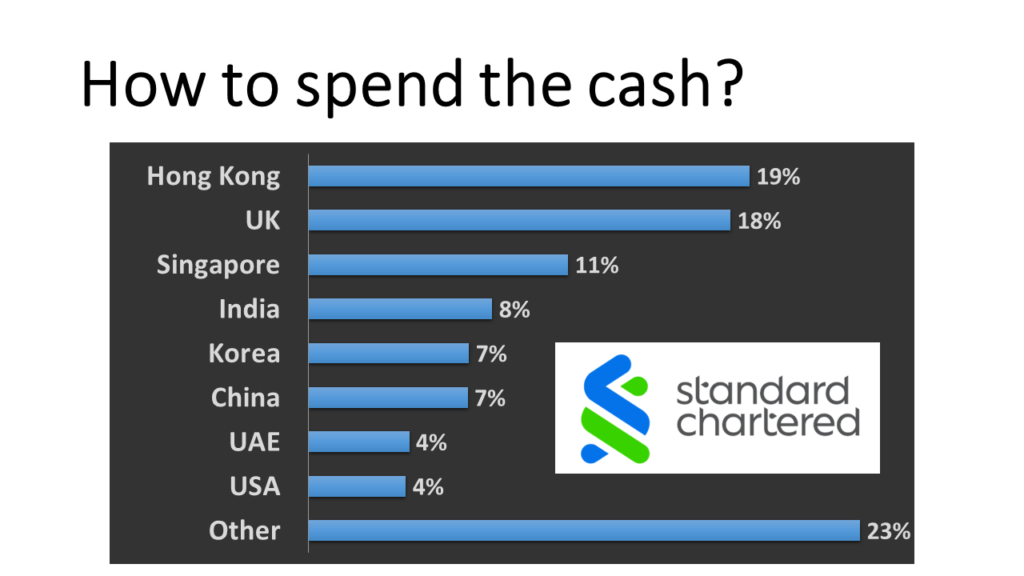

What about European banks in China?

China’s economy relies almost entirely on its own domestic banks.

European banks do more business in Hong Kong than in mainland China, a country with more than a billion people.

Compared to making cars or chips, banking is pretty simple. So the Chinese didn’t need foreign banks to learn how to run their banks.

Finally, I wanna talk about Emmanuel Macron, the French president.

Macron recently talked to Bloomberg about the need for cross-European banks.

Personally, I don’t believe that should be a political target.

The banking union is an obsession of people in Brussels. But it won’t help the economy of the EU.

Although I have to say, I’m not surprised that Macron, a former Rothschild banker, is pushing for cross-border bank mergers in the EU.

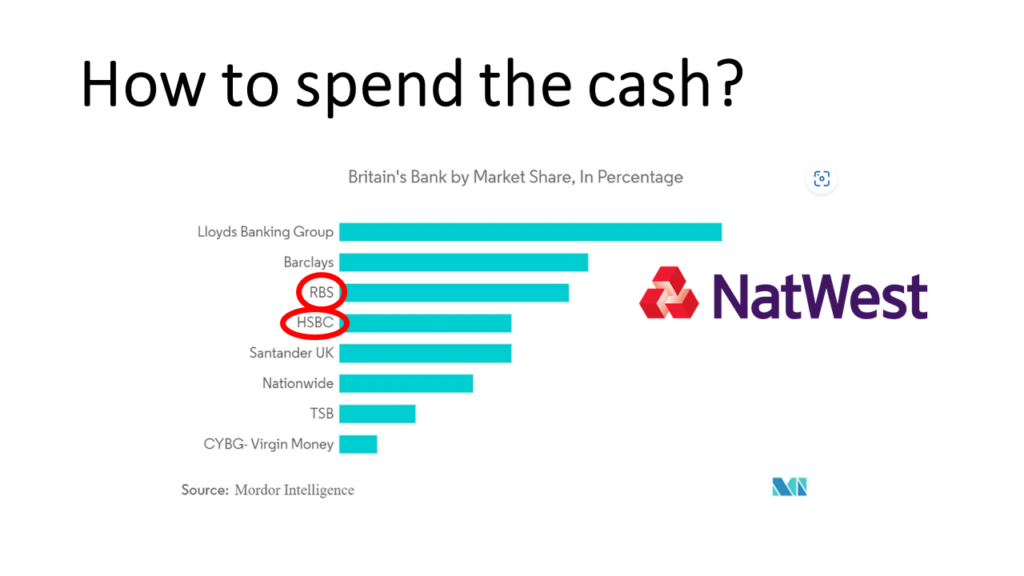

BNP Paribas and Crédit Agricole, the two largest banks in the EU, are French.

So they are in pole position to consolidate the industry in Europe.

But if we give Macron the benefit of the doubt, who doesn’t just want to create French banking empires, he actually does have a point.

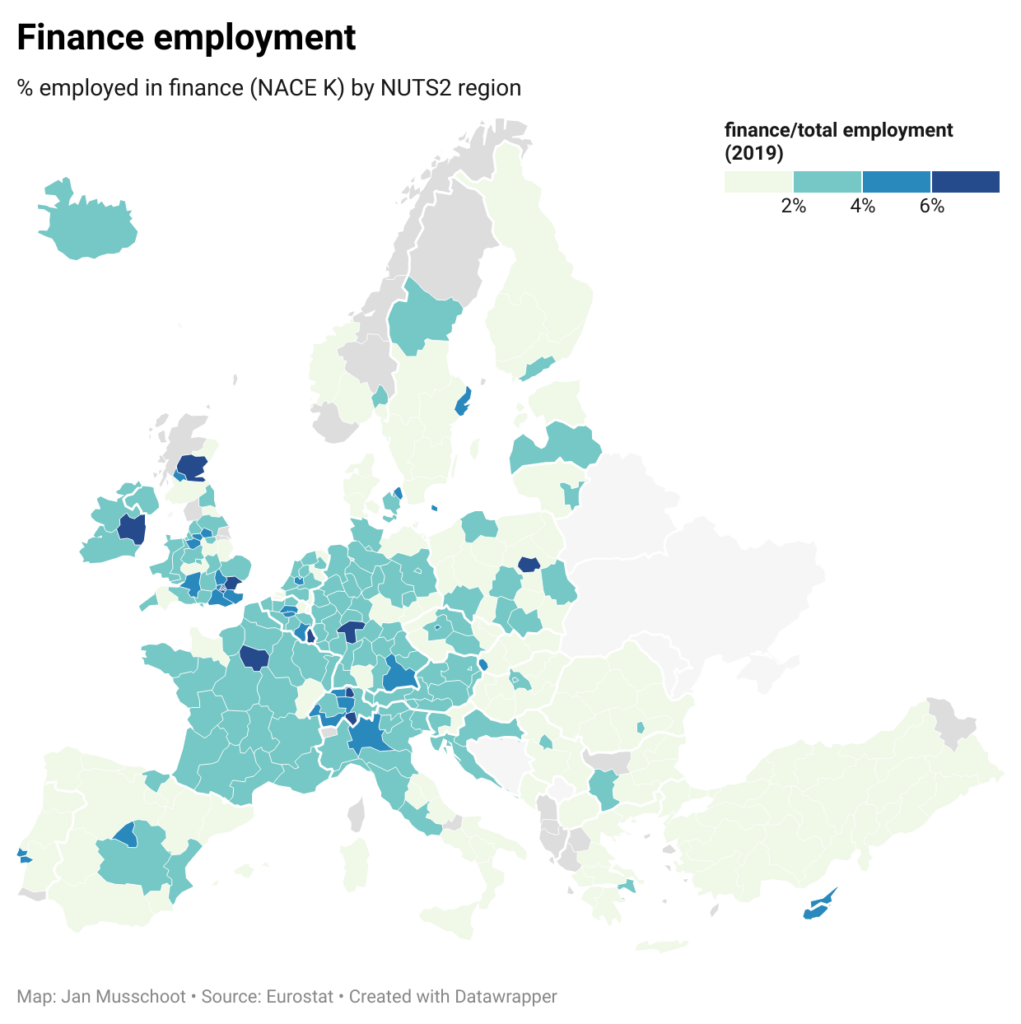

In the big five euro countries, Germany, France, Italy, Spain and the Netherlands, the biggest banks are all domestic players.

In contrast, Central and Eastern Europe is much closer to Macron’s pan-European vision.

Their banking systems are a mix of foreign and domestic banks.

There are some financial and historical reasons for this difference between East and West.

A top bank in a small economy might cost a couple of billion euros, while a similar bank in a large country could cost an order of magnitude more.

So twenty years ago, Western banks bought banks in Eastern Europe, where GDP was much lower than it is today.

A similar expansion in the West would have been extremely capital intensive.

For example, Dutch ABN AMRO was valued at 71 billion euros when it was acquired in 2007.

The 1990s and 2000s were also a period of geopolitical optimism and openness to foreign investment.

But in 2024, politicians wouldn’t be happy that foreigners buy the local banking champions, even if they’re from other EU members.

Remember that this episode is about geopolitics.

If any ‘Western’ banks have enough capital to buy big French banks, it’s the Americans or Canadians.

And although the US and Canada are his NATO allies, there’s no way Macron would give JPMorgan permission to buy BNP Paribas.

In fact, when the journalist asked if Macron would agree with the sale of Société Générale, the French President said “Dealing as Europeans means you need consolidation as Europeans.”

In the interview, they suggested Santander as the buyer.

That wouldn’t be my suggestion. I’ll do another podcast episode about how I would sell SocGen.

OK, so that’s about France and French banks in Europe.

Finally I wanna comment on France and its banks in Africa.

The French military recently ended its missions in the Sahel region.

France isn’t popular on the African continent, where it’s viewed as the former colonizer.

For example, the CFA franc in Western and Central Africa is controlled by Paris.

Over the past years, the large French banks have sold most of their African subsidiaries to local banks.

Although this is part of a global trend where banks focus on core markets, it’s hard not to think that geopolitics played a role in these decisions.

To wrap up the story of this episode, banks follow geopolitics.

We’re seeing a fragmentation of a globalized world into power blocks, and banks follow these geopolitical shifts.

Western European banks expanded into the former communist bloc after the Cold War, and they did well in Central and Eastern Europe.

However, expansion into Russia has proven unsustainable since the invasion of Ukraine.

In the future, European banks will probably operate more within politically friendly regions, similar to Chinese banks.

OK, that was it.

As I mentioned at the beginning, I want to pick up this podcast again.

I have a lot in the pipeline.

In the past, I started episodes with financial news.

Now, I’ll talk less about current events and more about long term trends.

And especially about my own ideas about European banks, the ECB and the euro economy.

Next episode will be about how to sell SocGen.

Other episodes in the pipeline are about the effects of higher interest rates, Russian assets at Euroclear, and Lagarde vs Draghi.

Thanks for listening and till next time!