This episode is available on Apple podcasts, Spotify and YouTube.

Transcript:

Hello and welcome to another episode of the Finrestra podcast! I am Jan Musschoot.

In this episode, I will talk about the sale of HSBC Canada and especially what HSBC can do with the cash it will receive from this sale. But first, let’s do a quick recap of the financial news of November.

FTX, a crypto trading platform, went bankrupt and its founder SBF went from being a multi-billionaire to essentially being broke.

In the euro area, inflation finally went down a little. Inflation was 10% in November whereas inflation was still 10.6 percent in October. Inflation is going down a little thanks to lower energy prices.

There was also news from two large European banks: Swiss Credit Suisse and Italian Monte dei Paschi di Siena both raised capital.

In other banking news – and also the topic of today’s episode – HSBC sold its Canadian subsidiary to Royal Bank of Canada (one of the largest Canadian banks). This fits into a broader pattern that I in one of the previous episodes of the Finrestra podcast called Go big or go home.

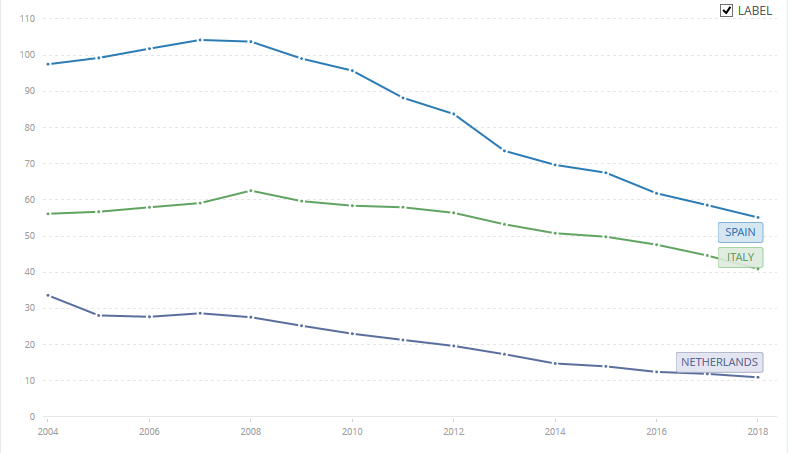

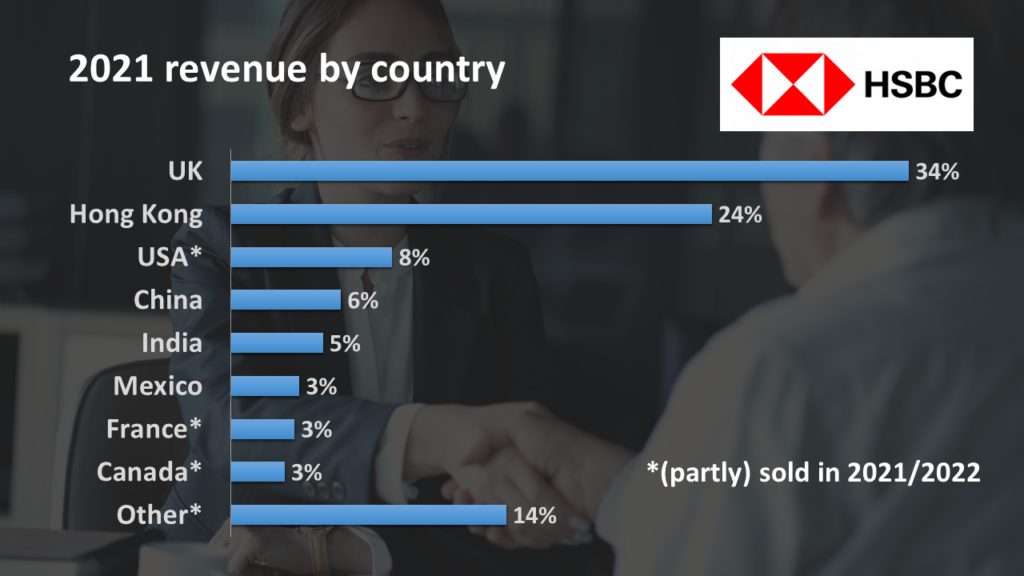

If you look at where HSBC derives its revenue from, Canada is barely three percent of revenue. It’s about four percent of profits and also four percent of the balance sheet. So banking in Canada is just a small part of the global group that is HSBC.

So it makes sense to exit this market, because you cannot have the scale you want to be highly profitable. Canada also has some big domestic banks who dominate banking in the country, so it makes sense for HSBC to exit the market, especially given that they received a good price for it.

This Go big or go home strategy is something that HSBC has been following for a few years now. For example, last year they also announced that they would exit [part of] the retail banking business in the US and that they would sell the French retail banking business, which was also about three percent of the group’s revenue. But they cannot compete to with the large French banks in France. And then in November 2022, so last month, HSBC also sold its bank in Oman (in the Middle East) to a local bank.

And this ‘let’s go big or go home’ strategy is not unique to HSBC. For instance last year I did a podcast episode about the sale of Bank of the West by BNP Paribas. The French multinational bank sold its US retail banking division to focus more on its core markets. And that’s also what HSBC has been doing here with the sale of HSBC Canada.

In financial terms, it seems that HSBC has done a pretty good deal because they received 13.5 billion Canadian dollars (which is about 10 billion US dollars). That’s about eight percent of HSBC group’s market cap. So that’s actually a good deal. If you look into the financial statements, they say they will make a net profit of more than 5 billion dollars on this sale above the book value1. And of course, selling the Canadian division will also shrink HSBC’s assets by a little less than 100 billion US dollars. So the sale provides a good boost to the capital ratio of HSBC as well.

Now let’s focus on what HSBC could do with the cash that it will receive.

One possibility is just to return it to the shareholders in a dividend. But that’s kind of boring, so what I would do is to follow the Go big or go home strategy and ‘go big’ in the core markets of HSBC.

HSBC’s core markets are firstly in Asia, where it’s the biggest bank in Hong Kong and also has significant operations in China, India, in the Middle East, and in some other Asian countries.

So what could we do with the cash (or the cash plus some extra borrowed money)?

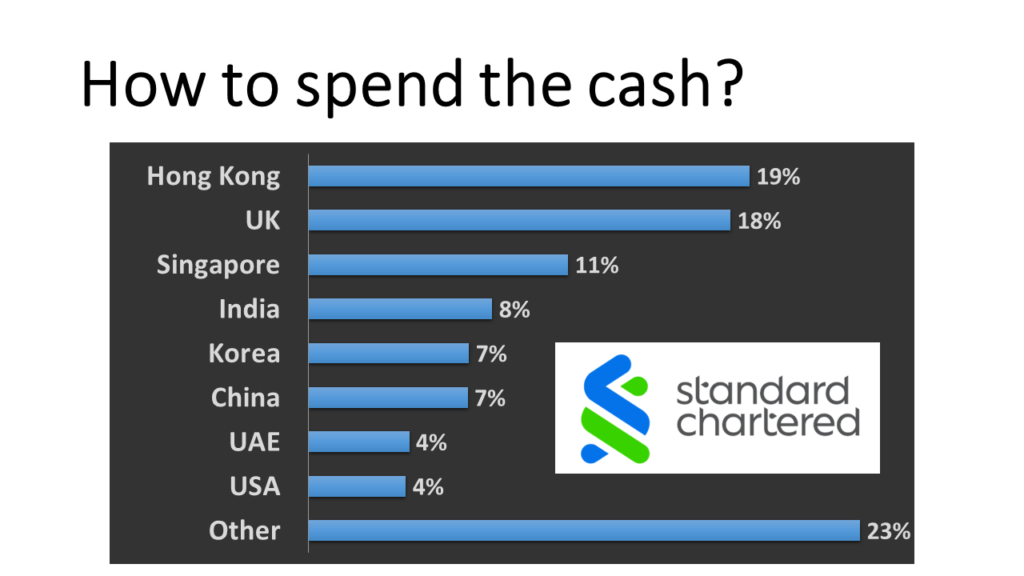

The obvious takeover candidate would be Standard Chartered. Standard Chartered is another British bank that is based in London and is mostly operational in the Far East (and also partly in Africa and the Middle East). If HSBC were to buy Standard Chartered, there would be synergies of course in the London offices. I’m not sure if they would be allowed to take over the Hong Kong division of Standard Chartered because maybe HSBC would become too dominant in Hong Kong, but at least buying the Asian divisions would be a huge boost to HSBC in Singapore and it would also strengthen the bank in China, India and South Korea. Also in the United Arab Emirates and Asian economies like Malaysia, Indonesia, Vietnam. All those countries would contribute to a higher market share of HSBC and hopefully also to higher profitability and economies of scale.

I already mentioned that they should probably sell the Hong Kong division of Standard Chartered. And I guess they should also sell the African subsidiaries of Standard Chartered because I don’t see a lot of synergies there. And HSBC is mostly focused on Asia and not on Africa. So that would also bring in some extra cash because the 10 billion US dollars won’t be enough to buy standard Charters. But I think there’s a very clear business case to purchase Standard Chartered.

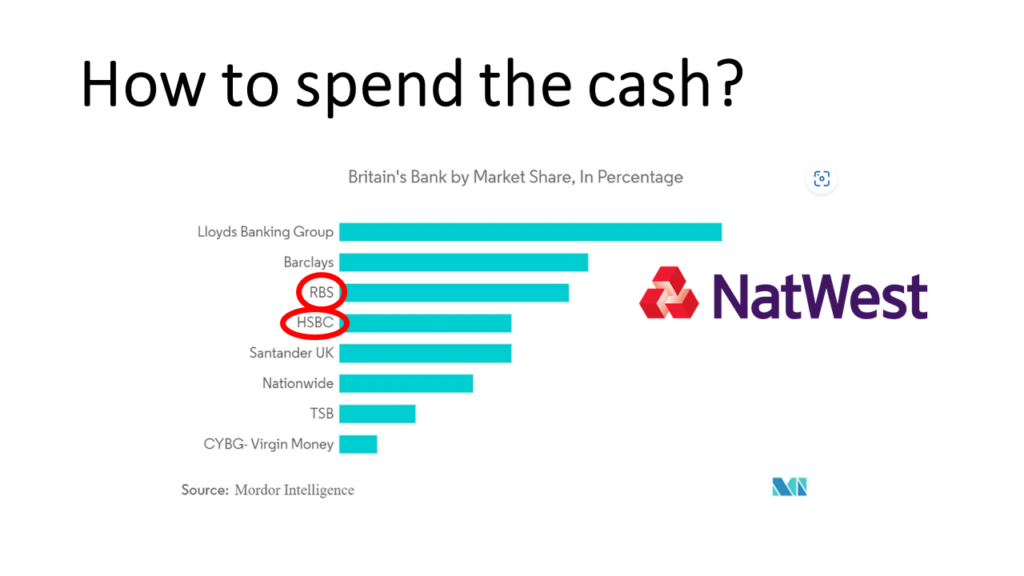

Another possibility would be to stay in the United Kingdom. So I found some research by Mordor Intelligence showing the market share of banks in the British market. You see that Lloyds is the clear market leader while HSBC is only the fourth largest retail bank in the UK (together with Santander UK). So a possible takeover target would be NatWest, which is the parent company above Royal Bank of Scotland – which is currently the third largest bank in Britain. Together with HSBC, they would be about as large as Lloyds Banking Group. So they would be the first or second largest bank in the United Kingdom. This [acquisition] would definitely provide some economies of scale on its British home market and would be quite easy to integrate. I think that deal makes a lot of sense also from a business perspective. Compared to Standard Chartered, where you would need to do a lot of divestments and integration in a lot of markets, the NatWest acquisition would be quite simple in terms of geography. You would also only need the approval of the British authorities. So I think that makes a lot of sense as well.

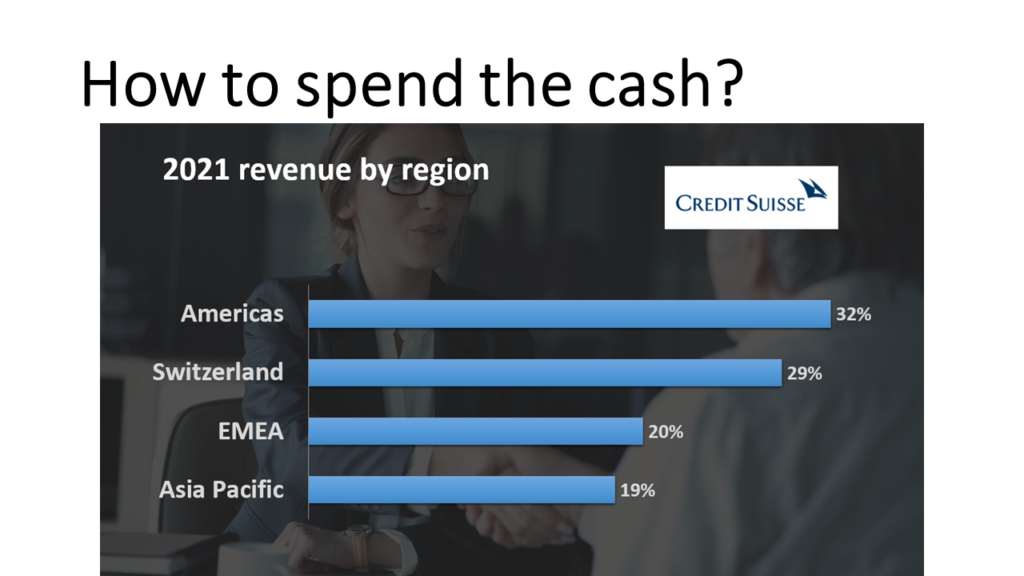

And then finally, thinking out of the box, we could also look at Credit Suisse. I wouldn’t suggest to buy the entirety of Credit Suisse, although its market cap is so low that with $10 billion you could almost buy the entire bank.

But what is probably a better idea is if HSBC would buy the Asia Pacific operations and maybe also the Middle Eastern operations of Credit Suisse. So I guess you don’t need the entire amount of 10 billion dollars. But by buying the Asia Pacific operations of Credit Suisse, HSBC could strengthen its wealth management in countries like China but also in Singapore and in other East Asian countries. And maybe also strengthen some of the investment banking operations in Asia. I think management of Credit Suisse would probably be happy to sell those divisions because then Credit Suisse can focus more on its core divisions in Switzerland and the Americas. While now CS are a global bank but they don’t have the size they need to be a real global bank.

So these have been three ideas. HSBC has sold its Canadian division for a lot of money. They could either buy Standard Chartered, or NatWest, or the Asian activities of Credit Suisse. I’m very curious of course what you think. Should they just return the money to their shareholders? Or should they buy other banks? Or do you have any other ideas? Maybe they should focus on share buybacks.

As always, you can reach me by mail at jan.musschoot@finrestra.com. Or you can find me on Twitter, I’m @janmusschoot or you can connect with me on LinkedIn.

This has been another episode of the Finrestra podcast. Thanks a lot for listening and till next time!