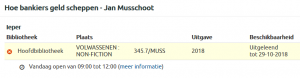

Verschillende bibliotheken hebben een exemplaar van Hoe bankiers geld scheppen opgenomen in hun catalogus 🙂

Voor Vlaamse lezers: je kan gemakkelijk checken welke boeken in jouw plaatselijke bibliotheek zitten door te surfen naar

<naam stad of gemeente>.bibliotheek.be

Bijvoorbeeld: ieper.bibliotheek.be of antwerpen.bibliotheek.be

Bovenaan de pagina staat een zoekbalk waarin je de naam van de auteur of van het boek kan invullen.

Zo kan je bijvoorbeeld zien dat mijn boek momenteel uitgeleend is in Ieper.

Wist je trouwens dat je aan de bibliothecaris/bibliothecaresse kan vragen om een boek te bestellen?