Computer-aided design (CAD) enables engineers to create products much faster and cheaper compared to trial and error.

But did you know that innovators have used abstract modeling long before the existence of computers?

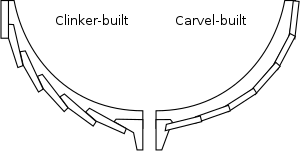

Anton Howes, a historian of innovation, tells the story of Matthew Baker. Baker was a 16th century shipbuilder who improved the construction of carvel ships.

As Howes explains:

What Matthew Baker did in the 1570s was to take the design process out of the shipyard, and onto paper. He drew his ships, to scale. And by using pen and paper, with geometry to make such drawings possible, he opened up grand new possibilities for design. […] He drew out new designs for frames, using geometry to work out how any variation would affect the overall shape of the hull, as well as its weight and carrying capacity – all at the cost of only time, ink, and paper, and avoiding the huge potential waste of conducting experiments at full scale in wood. His process allowed him to innovate more easily, and even to design new measuring instruments.

Interestingly, the new methods were not quickly adopted in the rest of Europe:

By the 1580s, new English ships were among the most technically advanced in Europe, and even in the mid-seventeenth century, ship plans were apparently still unknown in France. Having once lagged far behind, geometry began to give English shipbuilding the edge.

It’s still true today that good business practices (a) can save you a lot of money and (b) are hard to copy.