I have wanted to write a series on power in democracies ever since my How to win votes post from June 2016. Being elected is not enough (or necessary) to have real power. Policy need to be implemented. There can be opposition from civil servants and judges appointed by previous regimes. The press can selectively report on what politicians are (not) doing.

Unfortunately, I haven’t found the time yet to write down my general ideas on power, as I have been too busy with my book on banking. But right now, the Trump administration is exposing the hidden assumptions many commentators have about democracy. This makes the Trump regime a great case study for anyone interested in real world politics, rather than the fantasy version many people desperately want to believe in.

If you’re bored with the (very annoying and unoriginal) “Waaah, Trump is a meanie” fluff you can read everywhere, here are some interesting articles:

On leadership and politics:

This is why authoritarian leaders use the Big Lie (by Xavier Marquez)

Why do rulers follow the rule of law? Thoughts on Trump, Erdogan, and history (by Jared Rubin)

On institutions and the “deep state”:

Egypt’s failed revolution (by Peter Hessler)

Former Obama Officials, Loyalists Waged Secret Campaign to Oust Flynn (by Adam Kredo)

Hail to the Pencil Pusher (by Mike Konczal)

On life in non-democratic countries:

Everyday authoritarianism is boring and tolerable (by Tom Pepinsky)

On censorship and ideas:

Raining Frogs (by Isaac Simpson)

On trade:

What exactly does Mexico export to the US? (by J. W. Mason)

On culture:

Origins of political correctness, Lugenpresse found in panics (by Brett Stevens)

On Political Correctness (by William Deresiewicz)

James Burnham’s Managerial Elite (by Julius Krein)

What is global history now? (by Jeremy Adelman)

A Hard Future for a Soft Science (by Bradford Tuckfield)

Liturgy of liberalism (by Adrian Vermeule)

Biological Leninism (by spandrell)

Clarifying the First Law (by Lawrence Auster)

The Warlock Hunt (by Claire Berlinksi)

One of Many Reasons Why There Are So Few Conservatives in Academia (by “The Independent Whig”)

God Save Women From Other Women (by Christopher DeGroot)

On big data and statistics:

Do You Trust Big Data? Try Googling the Holocaust (by Cathy O’Neil)

On psychology/convictions:

Why Facts Don’t Change Our Minds (by Elizabeth Kolbert)

Dopamine Puppets (by Scott Adams)

On sociology:

A Miscellany of Foundations and First Principles for the Study of Sociology (by “Dissenting Sociologist”)

On ethnic conflict:

The Lost World of West Philadelphia (by Devin Helton)

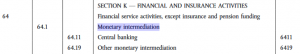

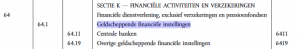

On monetary policy and central bank independence:

Why conservatives should fear a Trump Federal Reserve (by Peter Conti-Brown)

I’ll expand the list if I come across other good articles. Hat tip to pseudoerasmus and HappyAcres, who always share quality stuff.

Last update: January 30, 2018