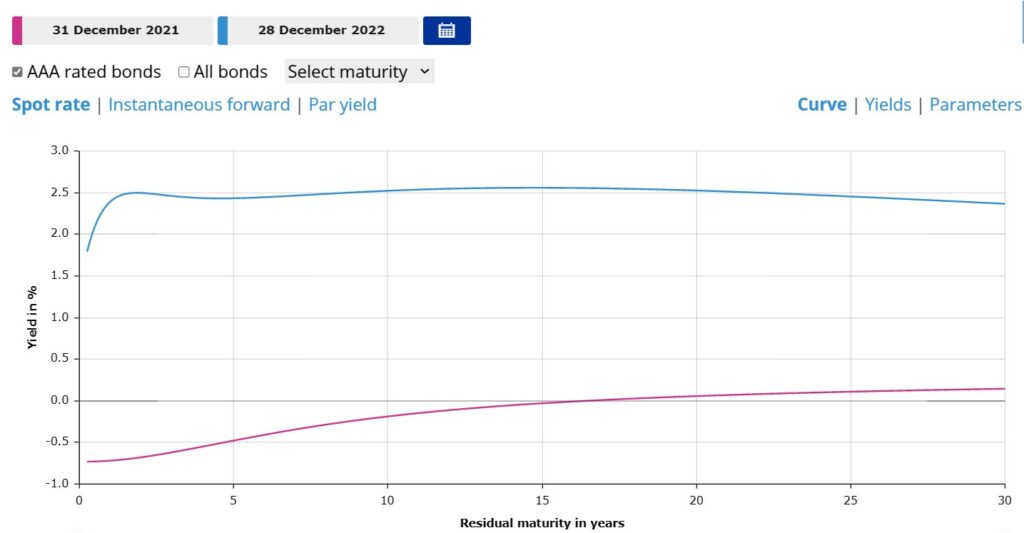

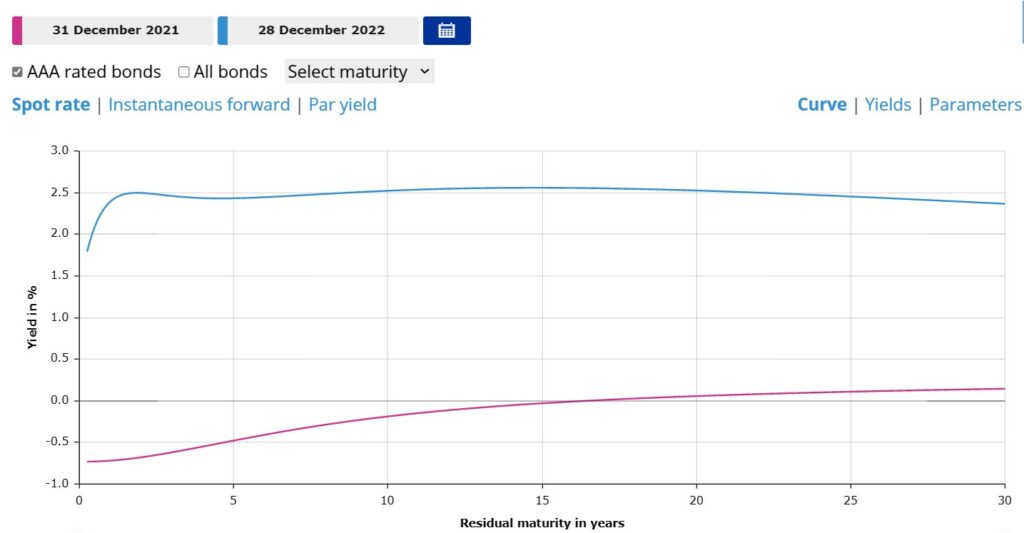

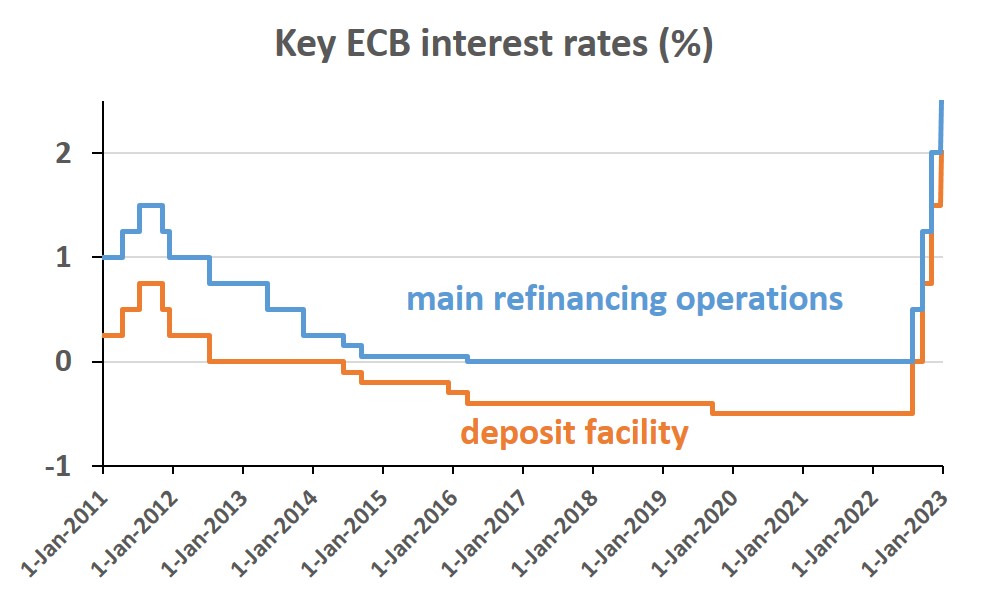

- Interest rates rose across the yield curve

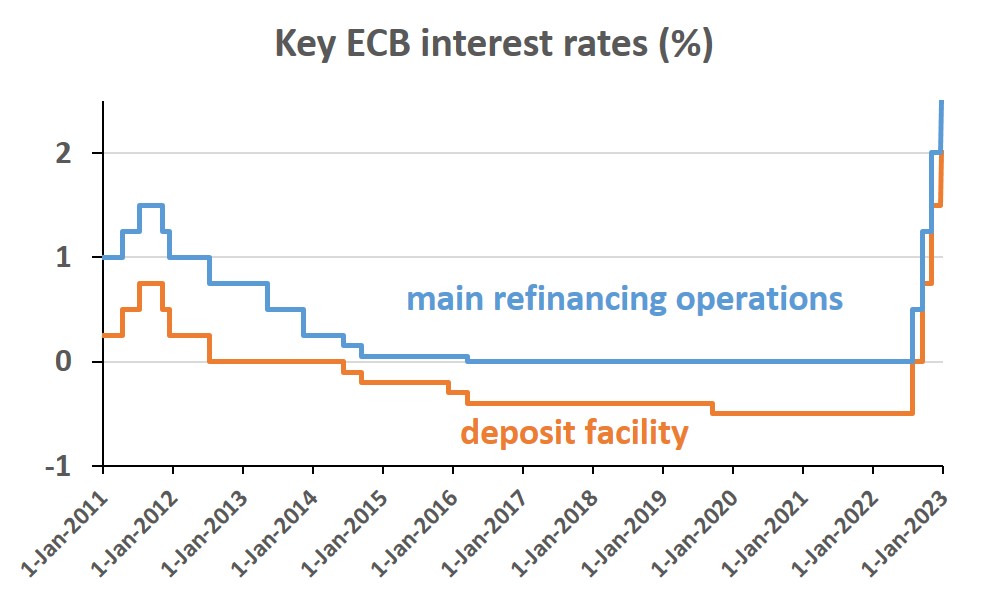

- After much hesitation, the ECB raised its key interest rates for the first time since 2011

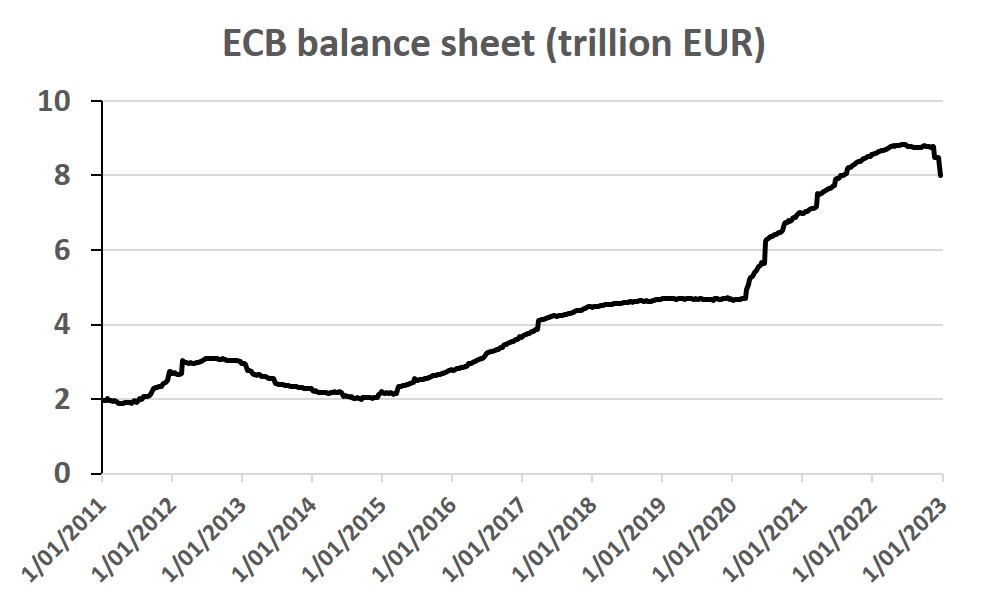

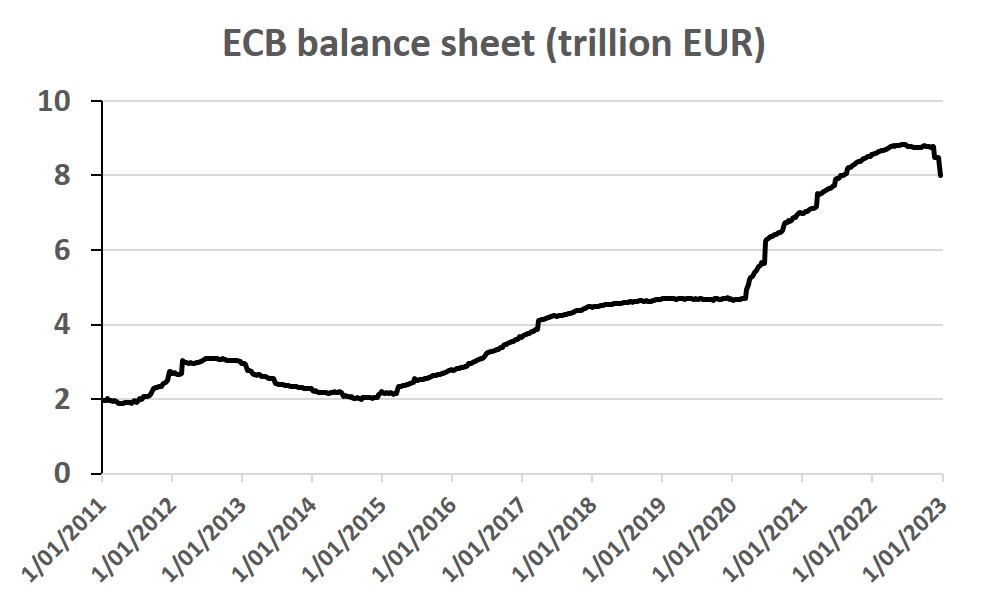

- The Eurosystem shrank its balance sheet

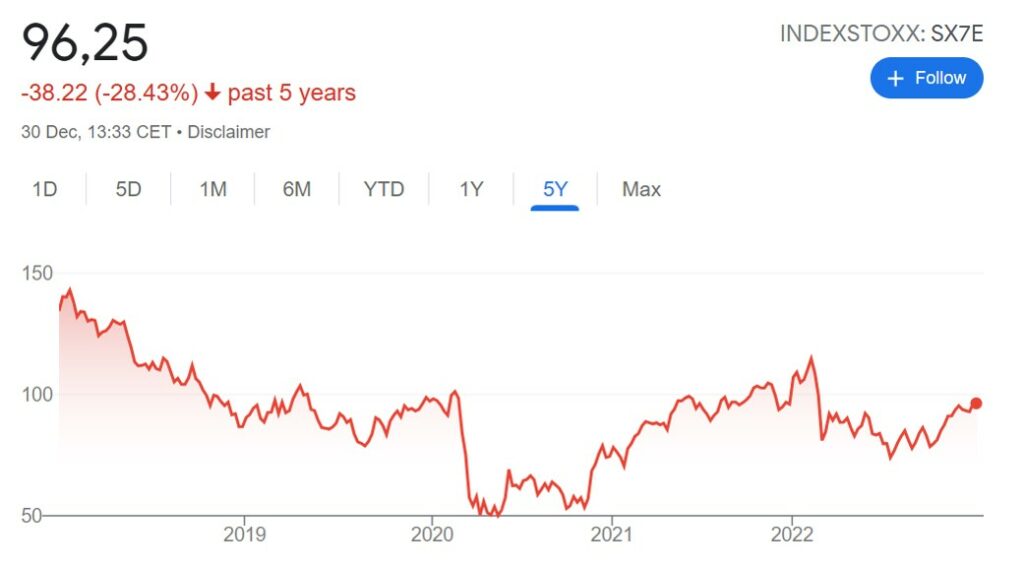

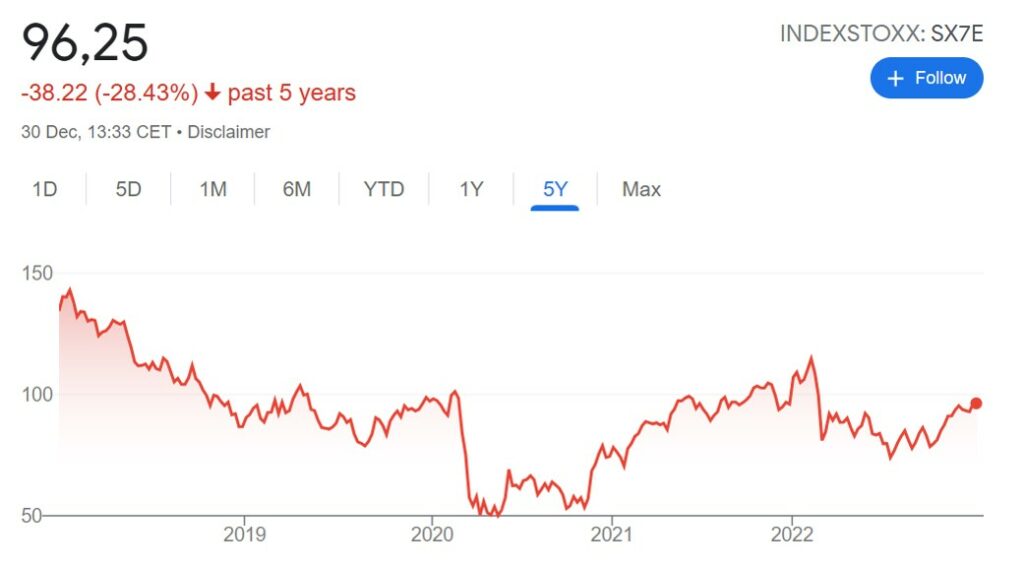

- European bank stocks dropped, but recovered

This episode is available on Apple podcasts, Spotify and YouTube.

Transcript:

Hello and welcome to another episode of the Finrestra podcast! I am Jan Musschoot.

In this episode, I will talk about the sale of HSBC Canada and especially what HSBC can do with the cash it will receive from this sale. But first, let’s do a quick recap of the financial news of November.

FTX, a crypto trading platform, went bankrupt and its founder SBF went from being a multi-billionaire to essentially being broke.

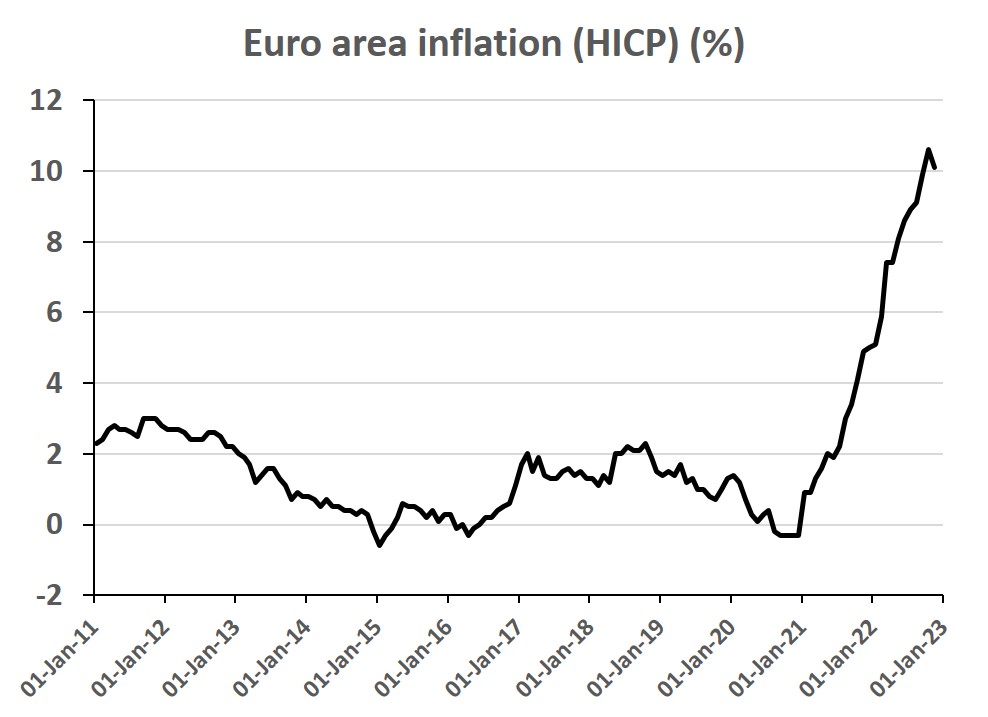

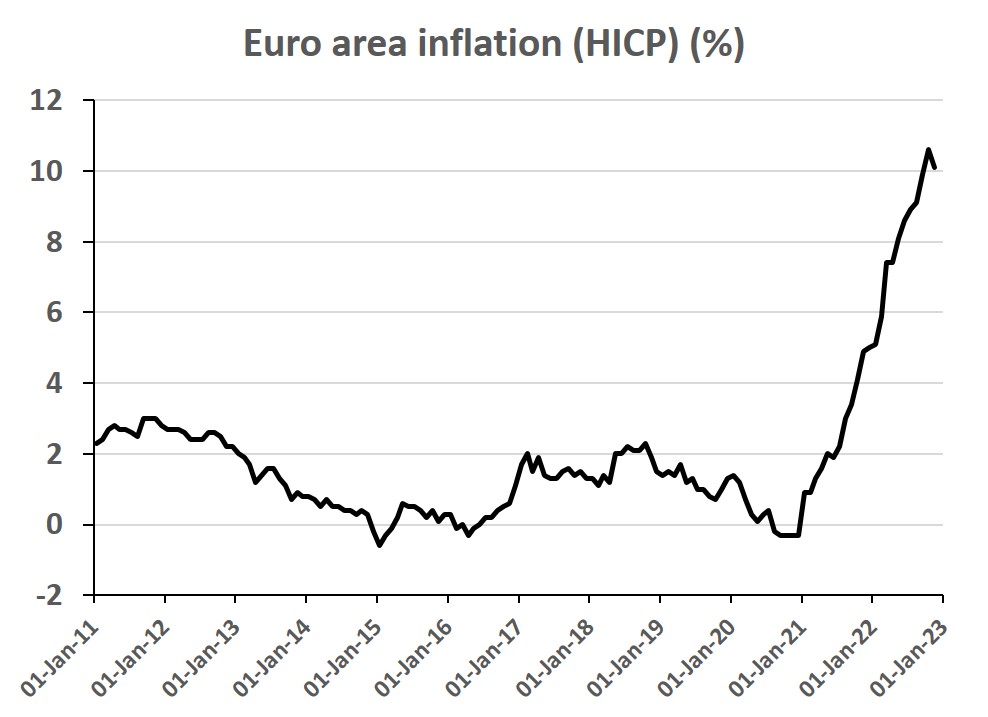

In the euro area, inflation finally went down a little. Inflation was 10% in November whereas inflation was still 10.6 percent in October. Inflation is going down a little thanks to lower energy prices.

There was also news from two large European banks: Swiss Credit Suisse and Italian Monte dei Paschi di Siena both raised capital.

In other banking news – and also the topic of today’s episode – HSBC sold its Canadian subsidiary to Royal Bank of Canada (one of the largest Canadian banks). This fits into a broader pattern that I in one of the previous episodes of the Finrestra podcast called Go big or go home.

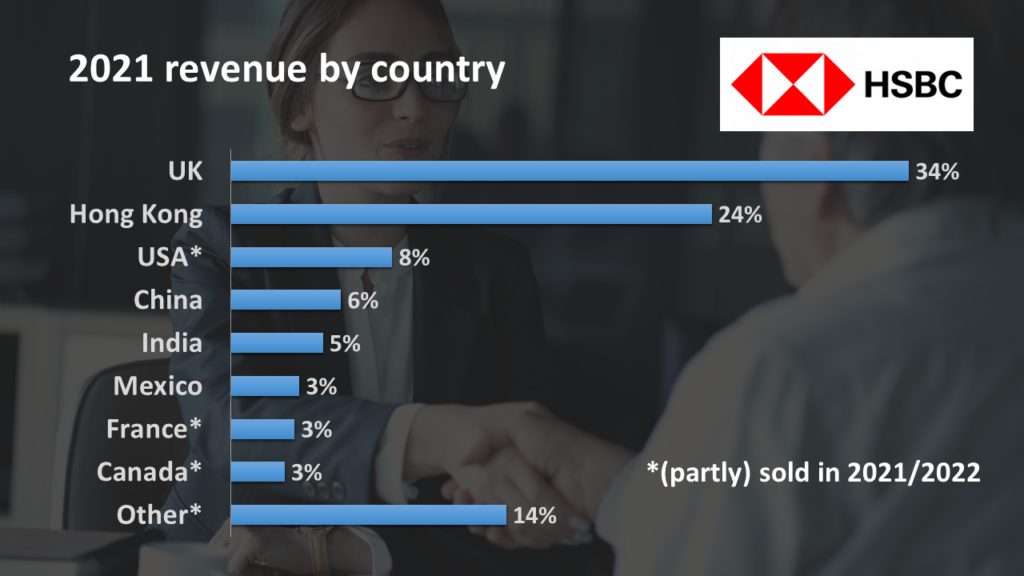

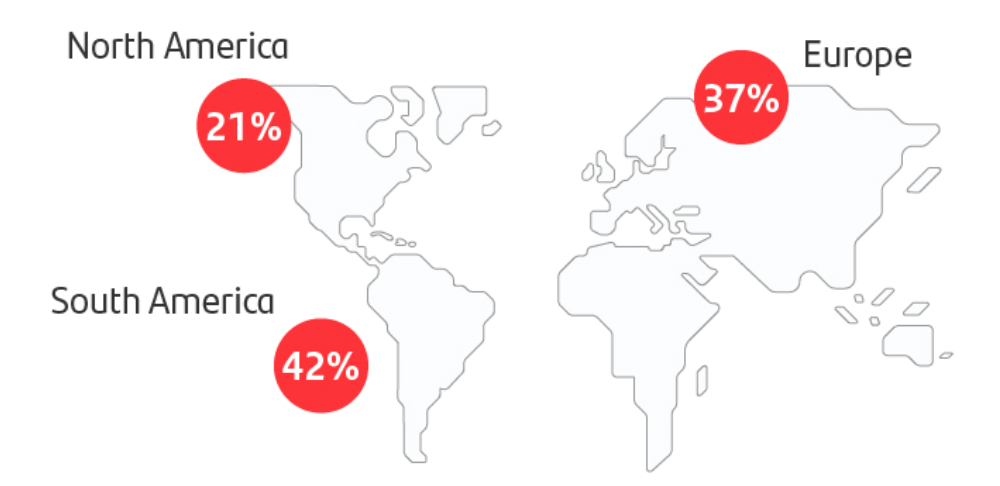

If you look at where HSBC derives its revenue from, Canada is barely three percent of revenue. It’s about four percent of profits and also four percent of the balance sheet. So banking in Canada is just a small part of the global group that is HSBC.

So it makes sense to exit this market, because you cannot have the scale you want to be highly profitable. Canada also has some big domestic banks who dominate banking in the country, so it makes sense for HSBC to exit the market, especially given that they received a good price for it.

This Go big or go home strategy is something that HSBC has been following for a few years now. For example, last year they also announced that they would exit [part of] the retail banking business in the US and that they would sell the French retail banking business, which was also about three percent of the group’s revenue. But they cannot compete to with the large French banks in France. And then in November 2022, so last month, HSBC also sold its bank in Oman (in the Middle East) to a local bank.

And this ‘let’s go big or go home’ strategy is not unique to HSBC. For instance last year I did a podcast episode about the sale of Bank of the West by BNP Paribas. The French multinational bank sold its US retail banking division to focus more on its core markets. And that’s also what HSBC has been doing here with the sale of HSBC Canada.

In financial terms, it seems that HSBC has done a pretty good deal because they received 13.5 billion Canadian dollars (which is about 10 billion US dollars). That’s about eight percent of HSBC group’s market cap. So that’s actually a good deal. If you look into the financial statements, they say they will make a net profit of more than 5 billion dollars on this sale above the book value1. And of course, selling the Canadian division will also shrink HSBC’s assets by a little less than 100 billion US dollars. So the sale provides a good boost to the capital ratio of HSBC as well.

Now let’s focus on what HSBC could do with the cash that it will receive.

One possibility is just to return it to the shareholders in a dividend. But that’s kind of boring, so what I would do is to follow the Go big or go home strategy and ‘go big’ in the core markets of HSBC.

HSBC’s core markets are firstly in Asia, where it’s the biggest bank in Hong Kong and also has significant operations in China, India, in the Middle East, and in some other Asian countries.

So what could we do with the cash (or the cash plus some extra borrowed money)?

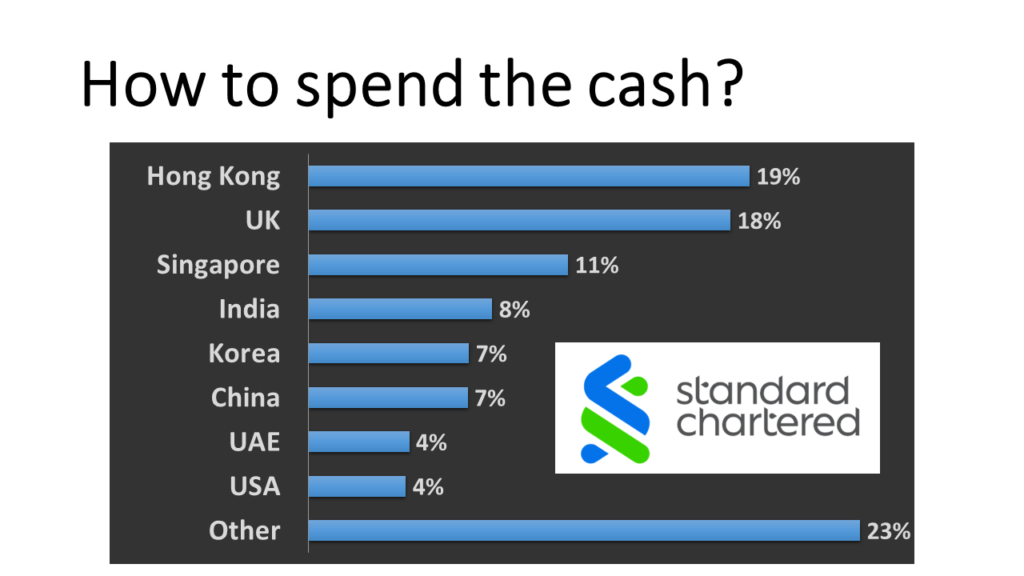

The obvious takeover candidate would be Standard Chartered. Standard Chartered is another British bank that is based in London and is mostly operational in the Far East (and also partly in Africa and the Middle East). If HSBC were to buy Standard Chartered, there would be synergies of course in the London offices. I’m not sure if they would be allowed to take over the Hong Kong division of Standard Chartered because maybe HSBC would become too dominant in Hong Kong, but at least buying the Asian divisions would be a huge boost to HSBC in Singapore and it would also strengthen the bank in China, India and South Korea. Also in the United Arab Emirates and Asian economies like Malaysia, Indonesia, Vietnam. All those countries would contribute to a higher market share of HSBC and hopefully also to higher profitability and economies of scale.

I already mentioned that they should probably sell the Hong Kong division of Standard Chartered. And I guess they should also sell the African subsidiaries of Standard Chartered because I don’t see a lot of synergies there. And HSBC is mostly focused on Asia and not on Africa. So that would also bring in some extra cash because the 10 billion US dollars won’t be enough to buy standard Charters. But I think there’s a very clear business case to purchase Standard Chartered.

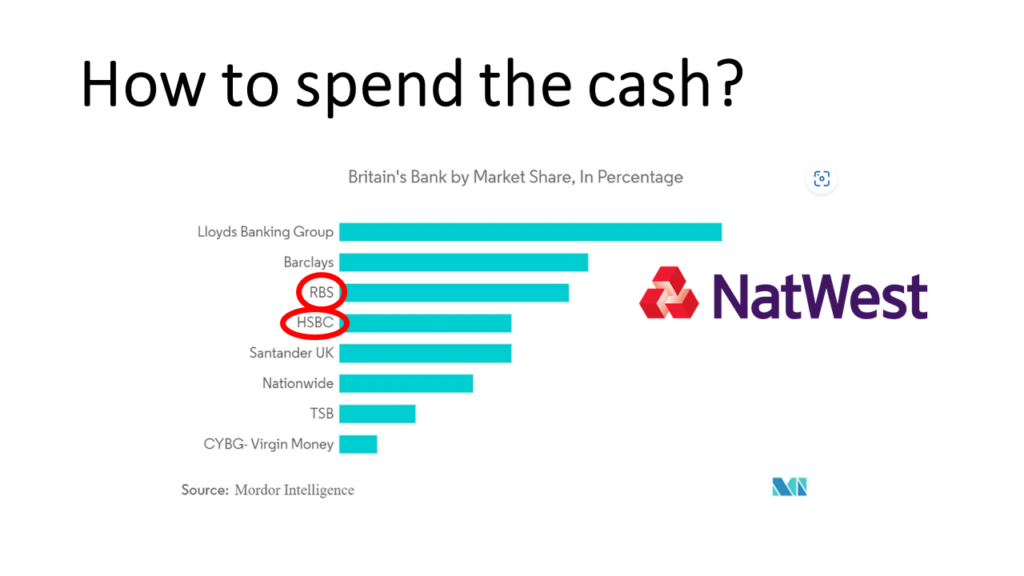

Another possibility would be to stay in the United Kingdom. So I found some research by Mordor Intelligence showing the market share of banks in the British market. You see that Lloyds is the clear market leader while HSBC is only the fourth largest retail bank in the UK (together with Santander UK). So a possible takeover target would be NatWest, which is the parent company above Royal Bank of Scotland – which is currently the third largest bank in Britain. Together with HSBC, they would be about as large as Lloyds Banking Group. So they would be the first or second largest bank in the United Kingdom. This [acquisition] would definitely provide some economies of scale on its British home market and would be quite easy to integrate. I think that deal makes a lot of sense also from a business perspective. Compared to Standard Chartered, where you would need to do a lot of divestments and integration in a lot of markets, the NatWest acquisition would be quite simple in terms of geography. You would also only need the approval of the British authorities. So I think that makes a lot of sense as well.

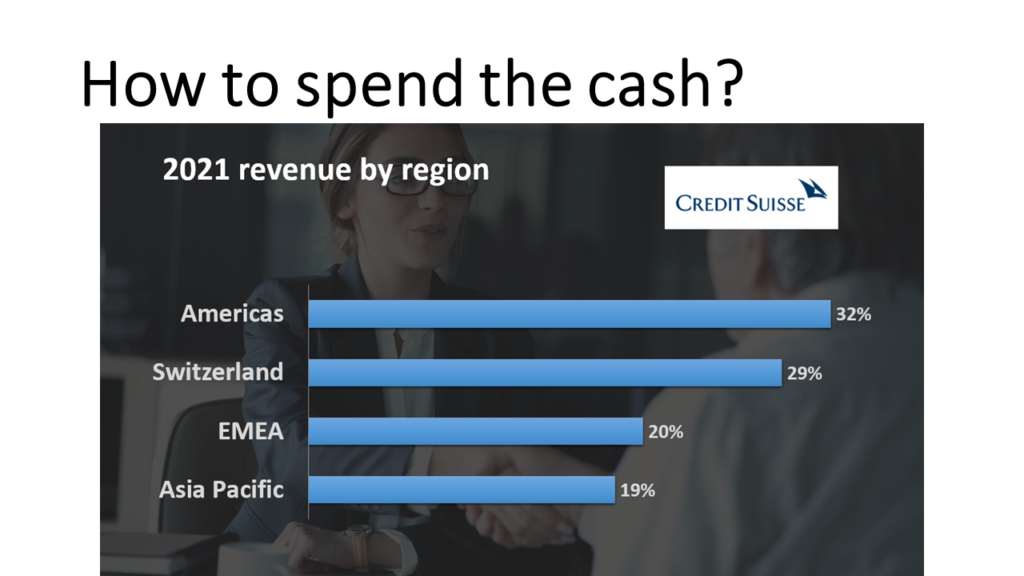

And then finally, thinking out of the box, we could also look at Credit Suisse. I wouldn’t suggest to buy the entirety of Credit Suisse, although its market cap is so low that with $10 billion you could almost buy the entire bank.

But what is probably a better idea is if HSBC would buy the Asia Pacific operations and maybe also the Middle Eastern operations of Credit Suisse. So I guess you don’t need the entire amount of 10 billion dollars. But by buying the Asia Pacific operations of Credit Suisse, HSBC could strengthen its wealth management in countries like China but also in Singapore and in other East Asian countries. And maybe also strengthen some of the investment banking operations in Asia. I think management of Credit Suisse would probably be happy to sell those divisions because then Credit Suisse can focus more on its core divisions in Switzerland and the Americas. While now CS are a global bank but they don’t have the size they need to be a real global bank.

So these have been three ideas. HSBC has sold its Canadian division for a lot of money. They could either buy Standard Chartered, or NatWest, or the Asian activities of Credit Suisse. I’m very curious of course what you think. Should they just return the money to their shareholders? Or should they buy other banks? Or do you have any other ideas? Maybe they should focus on share buybacks.

As always, you can reach me by mail at jan.musschoot@finrestra.com. Or you can find me on Twitter, I’m @janmusschoot or you can connect with me on LinkedIn.

This has been another episode of the Finrestra podcast. Thanks a lot for listening and till next time!

Background:

European inflation is driven by energy (intensity). Inflation falls as energy prices drop.

Credit Suisse profile

HSBC profile

As part of my research on European banks, I looked at hundreds of websites. Here are some bloopers I encountered.

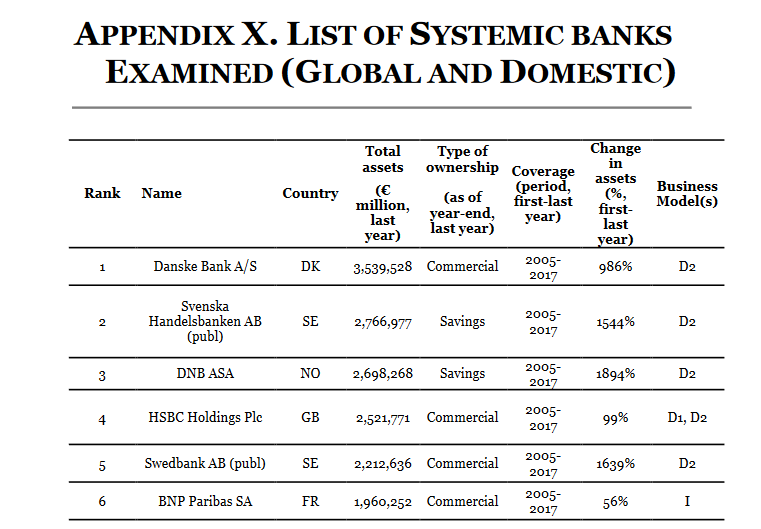

Please take into account exchange rates, Ayadi et al. Even if you don’t know that HSBC and BNP Paribas are the largest banks in Europe, the change in assets of the Nordic banks should have been a huge red flag.

The same study classifies HSBC as a retail bank and La Banque Postale as an investment/wholesale bank. I’ll take common sense over fancy statistical software any day…

The financial news was dominated by the response to the Russian invasion of Ukraine

Listen to this episode on Spotify, Apple or YouTube!

Transcript:

“Hello and welcome to another episode of The Finrestra Podcast. My name is Jan Musschoot.

This is our first episode of December, so here is a quick recap of the European financial news of November 2021.

There was also consolidation news:

The news of record high stock prices brings us to the topic of this episode: European bank CEOs should be ashamed.

Why?

Because their stocks have been horrible investments. Despite a nice rally in 2021, most large European banks still trade 70, 80 or 90 percent below their 2007 highs.

Or look at banks by market capitalization. The biggest European bank, HSBC, is only worth a quarter of American JP Morgan. And you could argue that HSBC isn’t even really a European bank, as most of its profit is generated in Hong Kong.

What’s the second largest European bank by market cap? Surely it must be a German, British or French one? Nope. It’s actually Sberbank of Russia. Russia, a country with a GDP smaller than Italy’s.

I can hear some CEOs already. How they are victims of low interest rates, low growth, overcapacity. Blah blah blah.

Instead of making excuses, take a hard look at banks like DNB, KBC, Nordea and SEB. Why are these relatively small banks worth more than giants like Deutsche Bank, Société Générale and UniCredit?

I know the answer. But do bank CEOs?

Here’s some free advice. Listen to episode 3 of the Finrestra podcast. And watch the “Bank in two minutes” series on our YouTube channel.

What will you learn? That successful banks focus. Focus on a few countries. Focus on one client segment, or at least on very complementary segments.

In contrast, banks with low profitability are often monsters of Frankenstein. They are part retail bank, part investment bank. They are active in dozens of countries.

They are big, but do they deliver what clients and investors want? The market doesn’t think so.

Now dear listener, before I go, I want to ask you a favor. For an upcoming episode, I would like to talk about Industry, the series about junior investment bankers. I recognized a lot of situations in the series. So if you work in a bank, watched Industry and would like to talk about it, please contact me! This has been another episode of The Finrestra Podcast. If you have suggestions for topics or guests, you can mail me at jan.musschoot@finrestra.com. You can find me on twitter @janmusschoot. Thanks for listening!”

Listen to this episode on Spotify, Apple or YouTube!

Transcript:

“Hello and welcome to another episode of The Finrestra Podcast. My name is Jan Musschoot. We were off last week due to the banking holiday on November 1st. So here is a recap of the European financial news of October.

And that brings us to the deep dive of this episode.

What do banks do against climate change?

The website Our world in data has a nice overview of the greenhouse gas emissions by sector. The majority of global emissions come from energy use in industry, transport and buildings. Other activities that emit a lot of greenhouse gases include agriculture and the production of cement.

Banking or finance aren’t explicitly mentioned. Not surprising, because you only need an office and a computer to generate financial services. So the direct CO2 emissions of banks are negligible.

On the other hand, banks provide funding to coal miners, oil and gas companies, and other carbon intensive industries. Asset managers and pension funds invest in the stocks and bonds of fossil fuel producers. These assets contribute to the so-called ‘Scope 3 emissions’ of the financial industry. According to Greenpeace and the WWF, UK financial institutions are responsible for nearly double the UK’s annual carbon emissions.

But banks can also steer their clients towards lower emissions. They can refuse credit for power plants that burn coal, and divert the money to wind farms. Loans for real estate, both residential and commercial, are a big chunk of banks’ assets. Banks can stimulate borrowers to make buildings energy-efficient.

To formalize their climate commitments, 50 European banks have joined the Net-Zero Banking Alliance. This alliance is convened by the United Nations and led by the banking industry. The members of the Net-Zero Banking Alliance commit to transition their lending and investment portfolios to align with net-zero by 2050. The signatories include sustainable banks like Triodos and GLS Bank. But without the big banks, this initiative wouldn’t have much effect. However, the CEOs of most large European banks have also signed the Commitment Statement of the Net-Zero Banking Alliance. Members currently include global systemically important banks such as HSBC, BNP Paribas, Santander, Deutsche Bank and UniCredit. So far, no Belgian banks have joined.

Is the Net-Zero Banking Alliance yet another case of greenwashing? Is it all blah blah blah, as Greta Thunberg would say? It shouldn’t be.

Banks that join the Alliance have to disclose targets on how they will support the temperature goals of the Paris Agreement. These targets will be reviewed to ensure consistency with climate science. Everybody will be able to check whether banks keep their promises, because they have to report the emissions of their lending and investment portfolios annually.

This has been another episode of The Finrestra Podcast. If you have suggestions for topics or guests, you can mail me at jan.musschoot@finrestra.com. You can find me on twitter @janmusschoot. Thanks for listening!”

Listen to this episode on Spotify, Apple or YouTube!

Transcript:

“Hello and welcome to another episode of The Finrestra Podcast.

My name is Jan Musschoot.

The topic of today’s episode: Go big or go home!

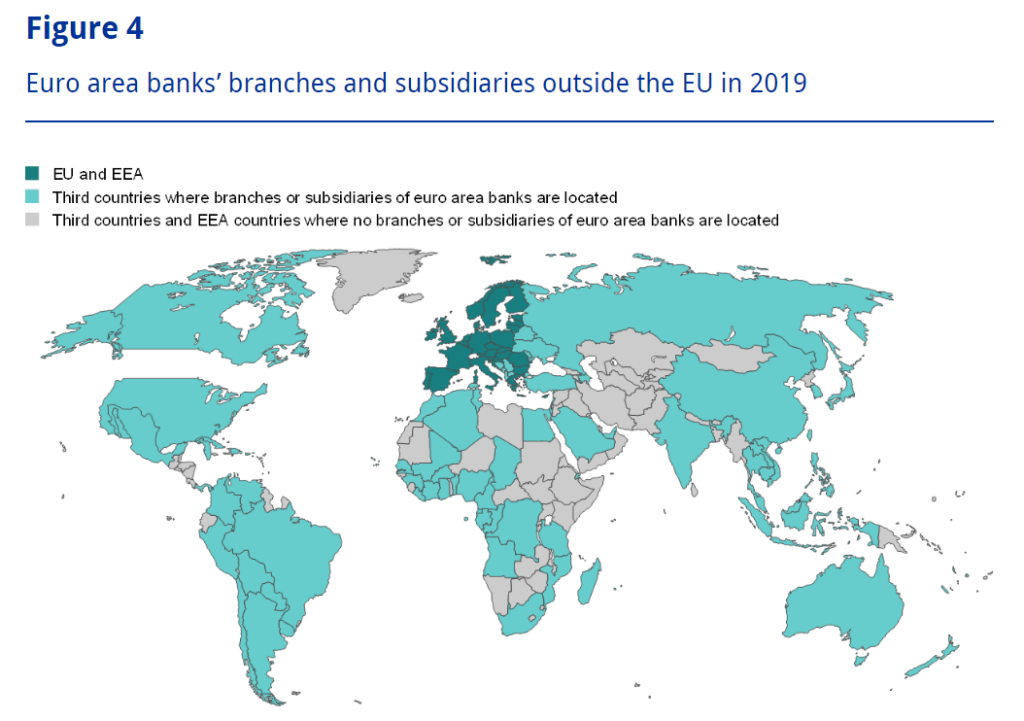

According to economic theory, banks have good reasons to expand abroad. Bigger banks should benefit from economies of scale. A broader geographic footprint results in a more diversified loan portfolio. So multinational groups should be more resilient against economic downturns.

However, cross-border expansion is not what we observe in the real world. In fact, multinational banks have been selling their foreign subsidiaries for years. Earlier this year, American Citibank announced that it would exit retail banking in 13 countries, most of them in Asia. Last year, Spanish bank BBVA sold its unit in the United States.

Banks are also selling their foreign activities in Europe. Here are some examples, all from 2021.

British HSBC was so desperate to get rid of its French retail bank, that it sold the unit for one symbolic euro. Dutch ING also plans to leave the French retail market. That same ING has sold its retail bank in Austria. Dutch Rabobank decided to wind down its Belgian retail activities, as it couldn’t find a buyer. British NatWest and Belgian KBC have announced they would exit the Republic of Ireland.

Bankers have good reasons to leave foreign markets. Because policymakers are scared of “too big to fail” banks, so-called systemically important banks need larger capital buffers. More countries also means higher costs for reporting and compliance. Banks have learned that there are few synergies between countries, even for branchless banks that only offer online services, like ING and Rabobank.

That’s why there is a clear trend towards deglobalization.

But that’s not the end of the story. Not all banks are returning to their domestic past.

Economies of scale are a thing, but not in the sense that bigger is always better.

What you want is to have scale within a market.

A good example is Societe Generale. The French financial services group sold most of its Central and Eastern European units. But SocGen kept its subsidiaries in the Czech Republic and in Romania. In both countries, these banks are the third largest in the market. Hungarian OTP sold its small subsidiary in neighboring Slovakia to KBC-owned CSOB. But OTP has also recently signed a deal to buy the second largest bank of Slovenia. Merged with its existing Slovenian subsidiary, it will become the market leader. And this silent consolidation isn’t limited to the East. French Credit Agricole has been gradually increasing its market share in Italy, for example.

So while European policymakers despair at the lack of cross-border mergers and acquisitions, the much needed consolidation is happening. Banks are reducing their geographic complexity.

And some groups have become robust multinational banks that have a significant market share in multiple countries.

If you want to discuss banks’ strategy, you can find me on Twitter @janmusschoot.

To learn more about our research and courses, check out our website, finrestra.com.

Thanks for listening!”