- Your favorite DSGE sucks

- Paris overtakes London as Europe’s biggest stock exchange (but read the fine print)

- SNB not alone with a balance sheet loss

- The fiscal cost of QE (about €600 billion)

- Shifting economies in the EU (cartograms showing GDP per country)

- Benjamin Hennig’s website has many brilliant cartograms, e.g. on diamond production, world population and GDP, inequality in Europe, wealth on the British Isles

- Create cartograms online

- UBS strategy defies crisis

- Cost of mitigating high energy prices

Month: November 2022

ECB interest rates explained

Transcript with links to sources:

The European Central Bank is raising interest rates.

Here is ECB President Lagarde:

“The Governing Council decided today to raise the three key ECB interest rates by 75 basis points. […] The Governing Council also decided to change the terms and conditions of the third series of targeted long-term refinancing operations, known as TLTRO III.” (press release, video)

In this video, I’ll explain what it all means.

Why is the ECB raising interest rates?

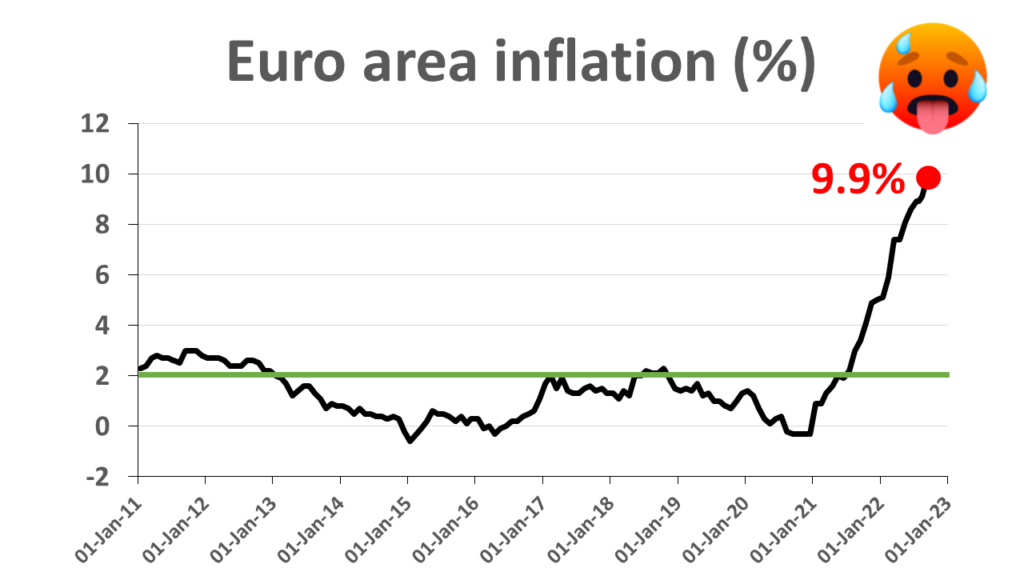

The ECB is responsible for price stability in the euro area. It defines price stability as an annual inflation of two percent. But since the summer of 2021, inflation has exploded far above the two percent target. In September of 2022, inflation was 9.9 percent.

So what is the ECB doing about inflation?

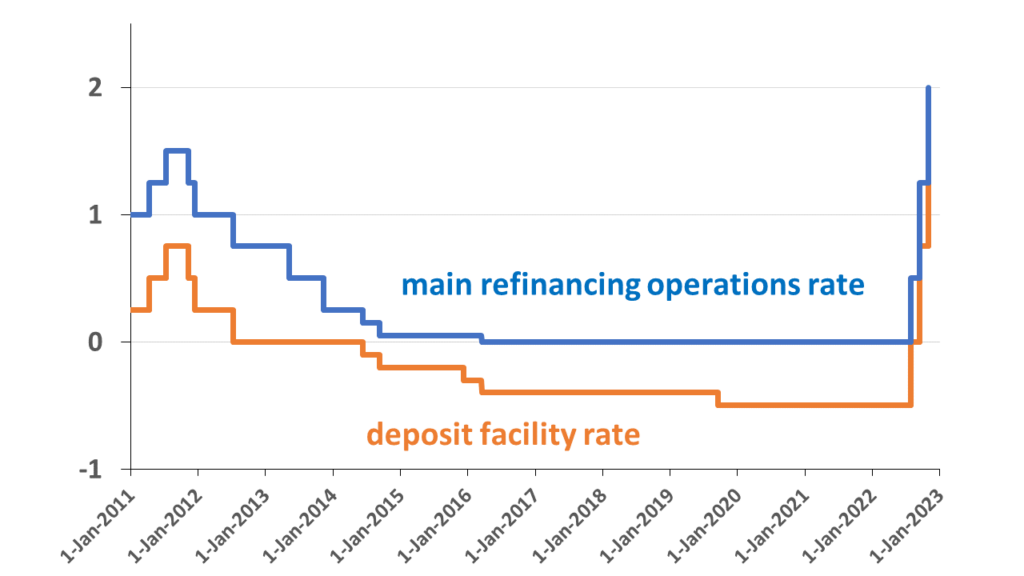

The ECB has raised two1 key interest rates.

The ECB pays the deposit facility rate on money that banks have deposited at the ECB. That’s similar to the interest rate you receive on your savings account.

Banks can also borrow money from the ECB for a short period. These seven day loans are called “main refinancing operations” (MRO). The main refinancing operations rate is the interest rate that the ECB receives on these loans.

The ECB has increased the deposit facility rate and the main refinancing operations rate already three times in 2022.

Before these rate hikes, the deposit facility rate had been negative since 2014. And for previous rate hikes, we even have to go back to the year 2011. As of 2 November 2022, the deposit facility rate will be 1.5 percent and the main refinancing operations rate will be 2 percent.

How much money will the ECB pay to banks or receive from banks?

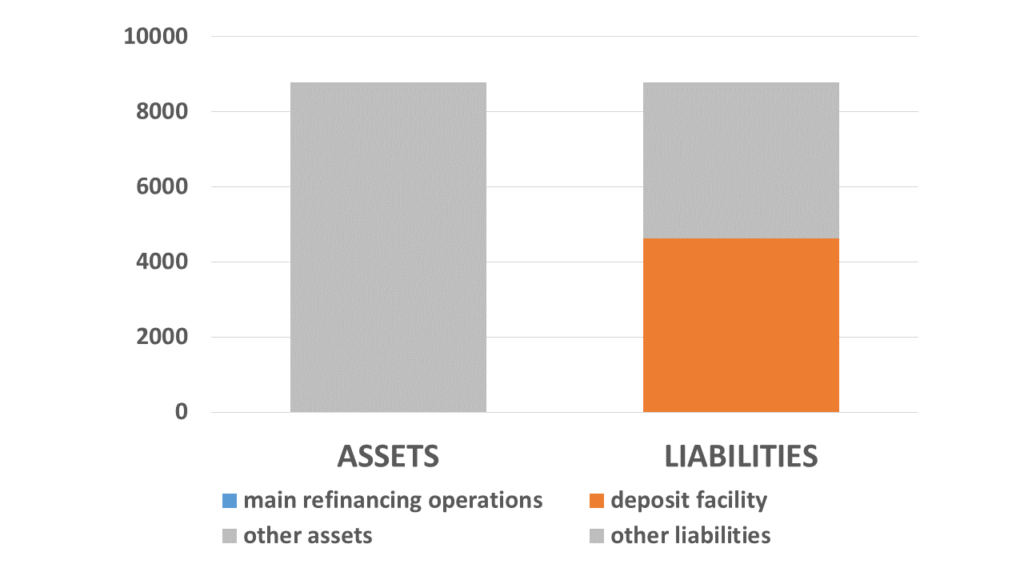

To answer that question, we need to look at the balance sheet of the ECB. The ECB has a balance sheet of almost 8.8 trillion euro (8,800 billion euro).

At 4.6 trillion euro, the deposits of banks in the deposit facility make up a little more than half of the ECB’s liabilities.

I didn’t forget to include the main refinancing operations, but these loans are less than 4 billion euro, so you cannot see them on the asset side of the balance sheet.

How much will the ECB pay to banks?

4.6 trillion deposits times a deposit facility rate of 1.5 percent means that the ECB will pay 69 billion euro to banks. The ECB will actually pay a little more, because banks also have something called “minimum reserves” at the ECB. And by the end of 2022, the ECB will also pay the deposit facility rate on these minimum reserves. Before [21 December 2022], it paid the main refinancing operations rate.

Lagarde: “The Governing Council also decided to change the terms and conditions of the third series of targeted long-term refinancing operations known as TLTRO III.”

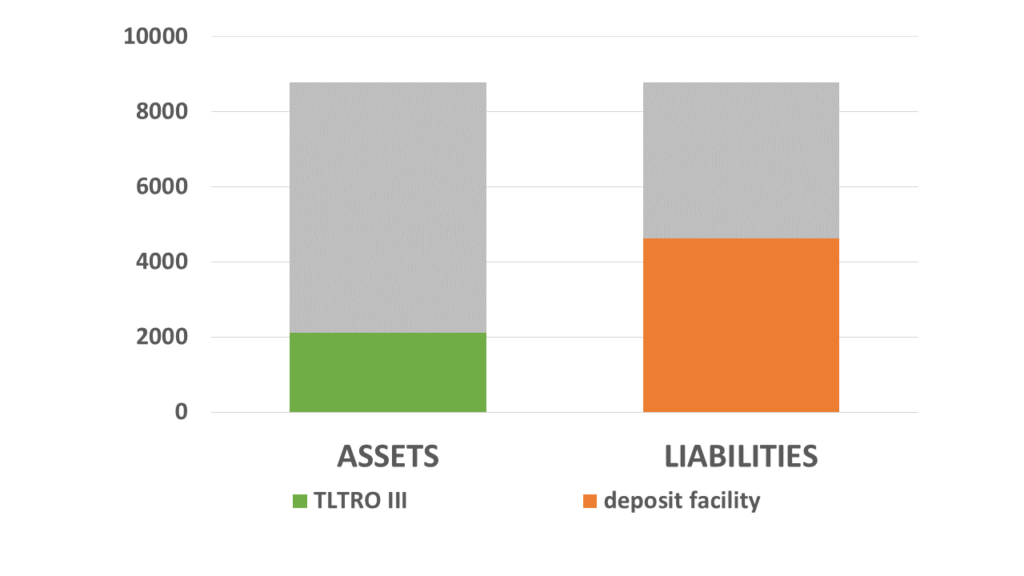

So TLTRO III are three-year loans made by the ECB to commercial banks. The ECB offered these loans between the end of 2019 and the end of 2021. What was special about these three-year loans is that banks had to pay a negative interest rate to the ECB. So in fact they could borrow money from the ECB and pay back less than they had borrowed in the first place.

You can ask “why did the ECB do that?” Well, if you look at the inflation chart, you can see that at the time when the TLTRO loans were initiated, inflation was below the two percent target of the ECB. But now that inflation is far above the two percent target, the ECB has decided that these negative rates on the TLTRO loans are no longer justified.

And so they have decided to increase the interest rate for the remainder of the TLTRO period to the deposit facility rate. For banks that have outstanding TLTRO loans and also deposits in the deposit facility, the ECB has made it possible to repay the TLTRO III loans early3. This will have the effect that both the assets and the liabilities of the ECB go down, so this will shrink the balance sheet of the ECB.

To recap: the ECB has increased the main refinancing operations rate to 2% and the deposit facility rate to 1.50%. The ECB will pay the deposit facility rate on the deposits and minimum reserves of banks and it will receive the deposit facility rate on the TLTRO III loans of banks.

Taking into account the interest that the ECB pays on the deposit facility and the minimum reserves, and the interest it receives from the TLTRO loans, in one year the ECB should be paying 41 billion euro to banks at the current level of the deposit facility rate (1.5%).

If you are Christine Lagarde and you want to improve your communication, I suggest you read my book Bankers are people too, in which I explain how banks and central banks work using cartoons and also a lot of balance sheets but especially lots of stories about banks and central banks.

I have focused on the technical details of higher interest rates and the TLTRO loans, but of course since the ECB is

responsible for price stability, the question is: will higher rates actually help to reduce inflation?

I did an entire video on inflation in Europe (not just in the euro area, but also in countries with other central banks than the ECB) and to be honest, it doesn’t look very promising.

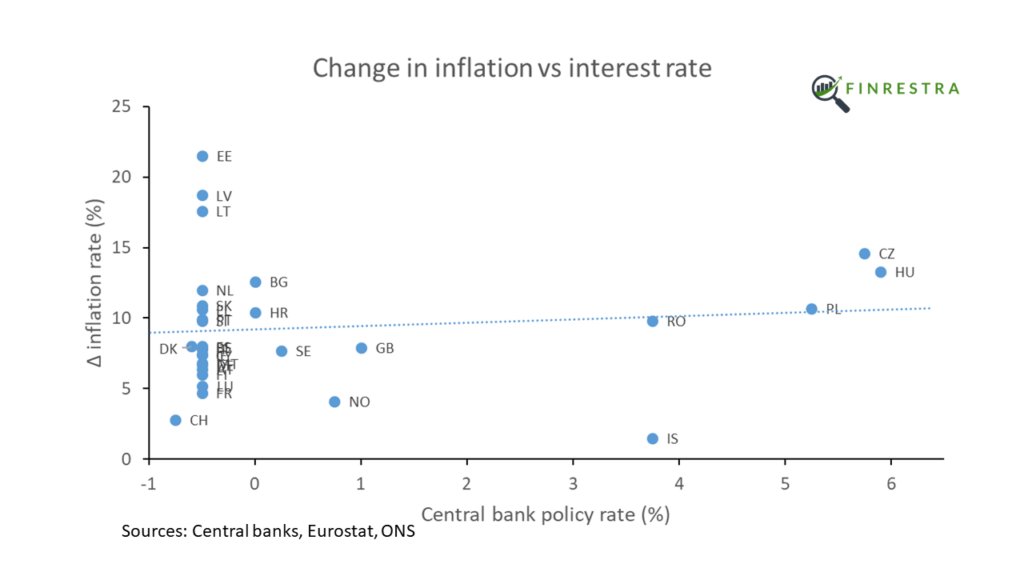

So here’s a slide that shows the increase in inflation and the central bank interest rate.

And so you can see that in certain central European countries like the Czech Republic and Poland the central bank has already increased interest rates a lot more than the ECB. But you can still see that there is no correlation between the central bank interest rate and the change in inflation in European countries.

Also from that previous video, you can see what is causing the different inflation rates between countries is mostly the energy intensity of the economy. So if an economy needs more energy to produce a euro of economic output, then the inflation in that country tends to be higher. This inflation has nothing to do with deposit facilities or TLTROs.

If you want to learn more about the ECB or European banks in general, please subscribe to this channel!

Thanks for watching!

Financial news July August September October 2022

General finance

- European Parliament includes gas and nuclear in the sustainable finance taxonomy

- Euro falls below the dollar for the first time 20 years

- Porsche IPO in Frankfurt, the largest European IPO since 1996

- Sell-off in UK government bonds led to a spike in interest rates and problems for pension funds

- ECB releases climate risk stress test

Banks

- Credit Suisse (2 minute profile) is restructuring, firing thousands of bankers

- Belgian sustainable bank NewB shuts down its banking operations (I predicted NewB’s failure years ago)

Inflation/central banks

- Inflation in the euro area keeps going up, reaching 10.7% in October

- ECB raised interest rates for the first time in 11 years. See my video explainer of the ECB’s interest rates

- ECB introduced the Transmission Protection Instrument (TPI), a bond buying scheme to prevent spreads blowing up

- Swiss National Bank reports a loss of 142 billion CHF for the first three quarters of 2022

- National Bank of Belgium announces first loss in 70 years (its stock also crashed)