Listen to this episode on Spotify, Apple or YouTube!

Transcript:

“Hello and welcome to another episode of The Finrestra Podcast. My name is Jan Musschoot. We were off last week due to the banking holiday on November 1st. So here is a recap of the European financial news of October.

- The governing council of the ECB discussed inflation, but central bankers expect no rate hikes in 2022.

- Italy and UniCredit ended negotiations over the sale of Monte Paschi di Siena.

- Swedish Handelsbanken will leave Denmark and Finland. This fits into a trend that I discussed in episode 3 of the Finrestra podcast.

- Volvo Cars had its IPO in Stockholm, one of the largest European IPOs this year

- French government bonds were traded on a blockchain with central bank digital currency

- ING phases out its payment subsidiary Payvision

- ABN AMRO passes on anti money laundering costs to coffeeshops, which can increase fees up to 1000%

- French bank La Banque Postale will exit oil and gas by 2030

- Dutch pension fund ABP stops investing in fossil fuel producers by 2023

- Finally, COP26 started. COP26 is the climate summit in Glasgow.

And that brings us to the deep dive of this episode.

What do banks do against climate change?

The website Our world in data has a nice overview of the greenhouse gas emissions by sector. The majority of global emissions come from energy use in industry, transport and buildings. Other activities that emit a lot of greenhouse gases include agriculture and the production of cement.

Banking or finance aren’t explicitly mentioned. Not surprising, because you only need an office and a computer to generate financial services. So the direct CO2 emissions of banks are negligible.

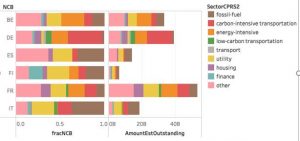

On the other hand, banks provide funding to coal miners, oil and gas companies, and other carbon intensive industries. Asset managers and pension funds invest in the stocks and bonds of fossil fuel producers. These assets contribute to the so-called ‘Scope 3 emissions’ of the financial industry. According to Greenpeace and the WWF, UK financial institutions are responsible for nearly double the UK’s annual carbon emissions.

But banks can also steer their clients towards lower emissions. They can refuse credit for power plants that burn coal, and divert the money to wind farms. Loans for real estate, both residential and commercial, are a big chunk of banks’ assets. Banks can stimulate borrowers to make buildings energy-efficient.

To formalize their climate commitments, 50 European banks have joined the Net-Zero Banking Alliance. This alliance is convened by the United Nations and led by the banking industry. The members of the Net-Zero Banking Alliance commit to transition their lending and investment portfolios to align with net-zero by 2050. The signatories include sustainable banks like Triodos and GLS Bank. But without the big banks, this initiative wouldn’t have much effect. However, the CEOs of most large European banks have also signed the Commitment Statement of the Net-Zero Banking Alliance. Members currently include global systemically important banks such as HSBC, BNP Paribas, Santander, Deutsche Bank and UniCredit. So far, no Belgian banks have joined.

Is the Net-Zero Banking Alliance yet another case of greenwashing? Is it all blah blah blah, as Greta Thunberg would say? It shouldn’t be.

Banks that join the Alliance have to disclose targets on how they will support the temperature goals of the Paris Agreement. These targets will be reviewed to ensure consistency with climate science. Everybody will be able to check whether banks keep their promises, because they have to report the emissions of their lending and investment portfolios annually.

This has been another episode of The Finrestra Podcast. If you have suggestions for topics or guests, you can mail me at jan.musschoot@finrestra.com. You can find me on twitter @janmusschoot. Thanks for listening!”