This is the blog version of episode 12 of The Finrestra podcast: “What can the ECB do when inflation is driven by energy costs? Three proposals” (listen on Spotify, Apple Podcasts or YouTube).

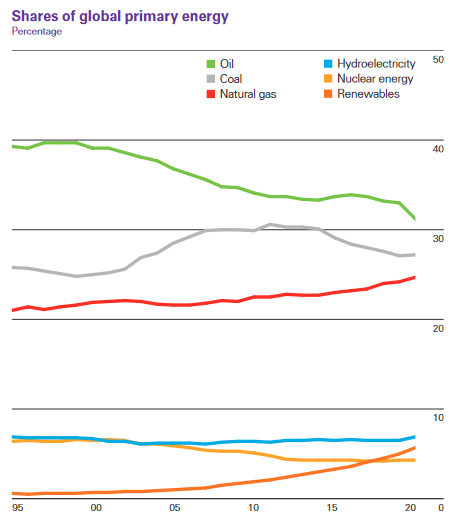

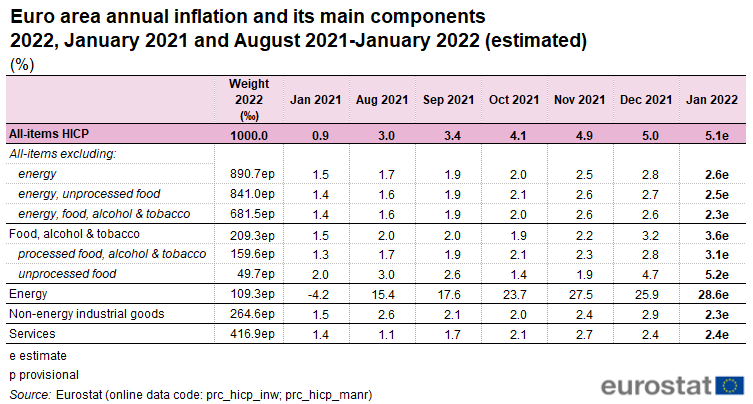

Euro area inflation was estimated at 5.1% in January 2022. That’s mainly due to energy costs. Furthermore, businesses will try to pass on their higher costs (transport, heating, materials) to consumers.

According to Isabel Schnabel, “Monetary policy cannot reduce the price of oil or gas.“

I disagree, as I told the ECB back in 2020. If instead of government bonds, the ECB had bought a controlling stake in oil & gas majors, it could force them to lower prices.

That’s probably too radical for conservative central bankers.

But there are other, more conventional paths.

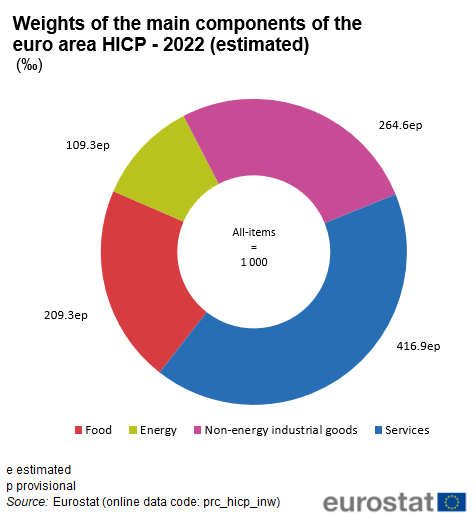

Energy makes up about 11% of Eurostat’s basket of harmonized index of consumer prices.

What if that percentage was lower? Volatile (fossil) energy prices would have less of an effect on inflation. This would make the ECB’s job easier.

To be clear, I’m not suggesting that the ECB interferes with how Eurostat measures inflation.

Rather, the central bank could reduce our dependence on (fossil) energy.

How? Years ago, in 2017, I wrote a proposal for green investments in Europe. A European Green Infrastructure Company (EGIC) would install solar panels, build energy-efficient schools, networks of charging stations for electric vehicles… All of this infrastructure would be funded by the ECB. Why? It’s hard to imagine now, but we’ve had years were inflation was too low, i.e. below the target of the ECB. In my proposal, the EGIC would build in countries with low inflation and high unemployment. In case of the economy is overheating, new projects would be put on hold, so real resources like workers, machines and building materials can be used elsewhere in the economy.

If the EU had done this, there would be an abundance of renewable energy. This would price fossil fuels out of the market, making international energy prices almost irrelevant for European inflation.

Of course, in the real world EU politicians and central bankers have wasted the opportunity of low inflation and low interest rates.

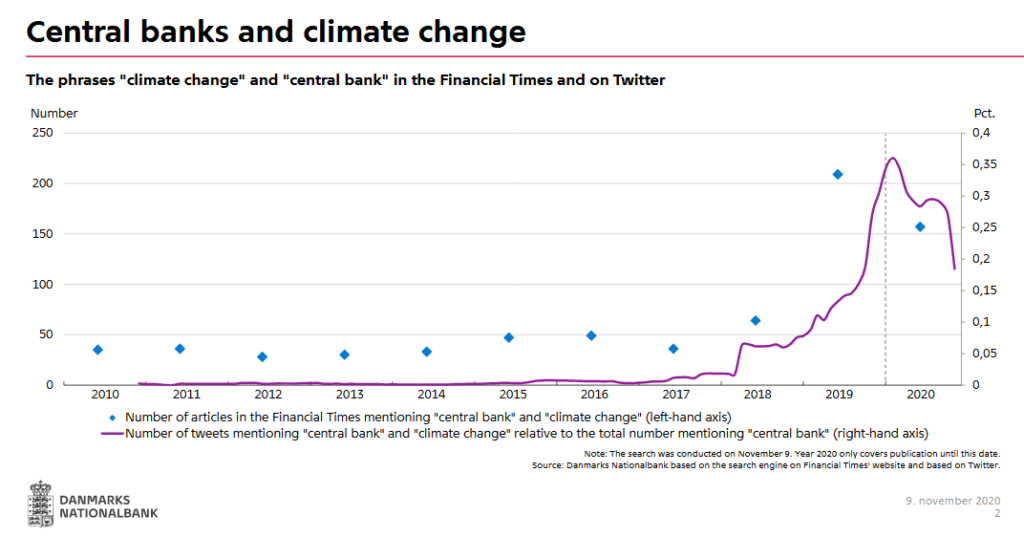

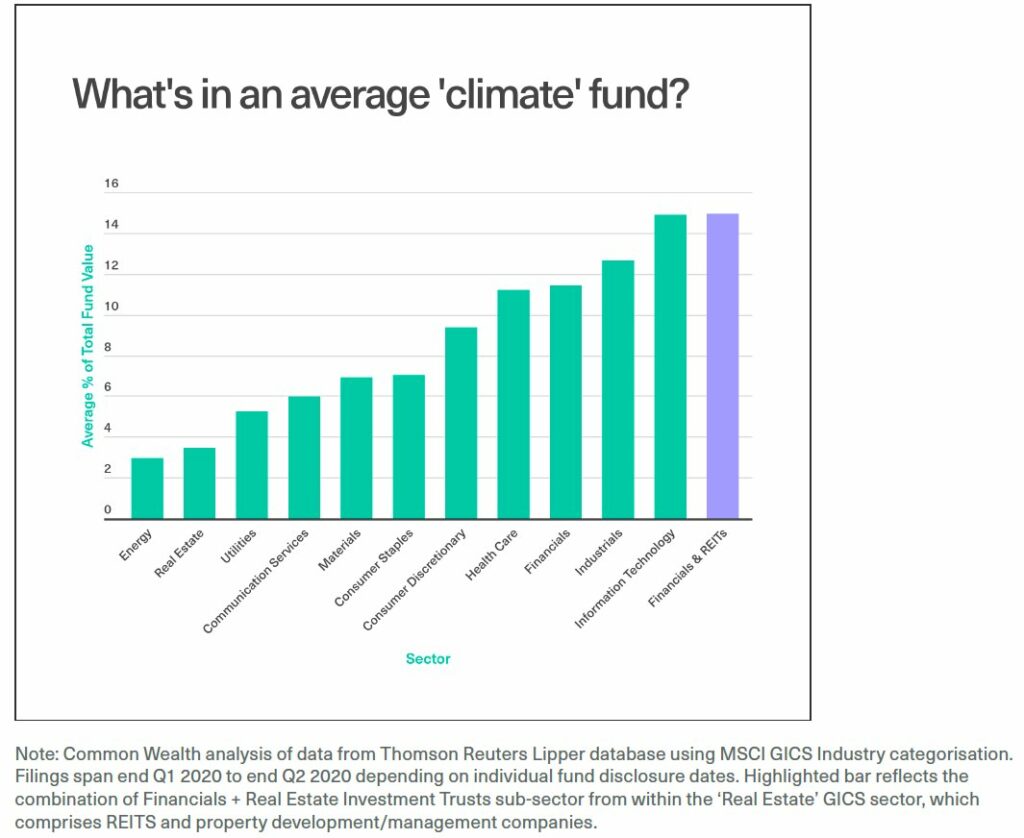

But it’s never too late. Even without a European Green Infrastructure Company, the ECB can reduce the weight of (fossil) energy in consumers’ expenditure. High energy prices make it attractive to make buildings more energy efficient. In fact, central bankers like Isabel Schnabel have argued that the slow transition to a carbon-neutral economy is a market failure (see also this video).

The ECB could correct this market failure by making loans for energy-efficiency cheaper, for example by charging a negative rate of -5%. Banks would pass this on homeowners and landlords. At the same time, the ECB could raise rates on other loans. This would stimulate investments in building improvements, and reduce the demand for consumer loans. Companies would respond by increasing the production of building materials. It would also alleviate the labor shortage, because workers would be attracted by higher wages in the renovation business relative to other jobs.

Further reading:

The ECB can help fix the energy price crisis: Play the long game