How international is the European banking landscape?

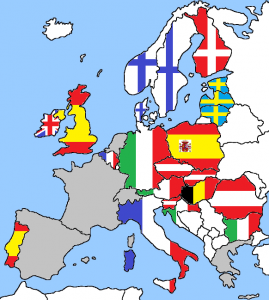

Jamie Dimon, CEO of American bank JPMorgan Chase, says that European banks need mergers across borders in order to become more competitive. I created the map below to illustrate that Dimon has a point (that’s why he’s richer than you).

Some remarks and observations:

- The largest foreign owned bank is usually not the largest bank in a country1. Exceptions include Belgium (BNP Paribas Fortis) and the Czech Republic (Česká spořitelna).

- The banking system in the gray countries (France, Greece, Spain, Switzerland and the Netherlands) is made up almost exclusively of domestic banks. Foreign players are as good as absent from these markets.

- Most subsidiaries are close to their parent’s home country2. The activities of Santander in the UK and in Poland are the exception that proves the rule.

- German banks are nowhere to be found (I’ll have more to say on that in another post).

- Although 19 European Union countries have adopted the euro, foreign subsidiaries tend to operate in a country with a different currency3.

- The map reflects banks’ international expansion between 1998 and 2009. In the decade following the global financial crisis, European banks have scaled back their international ambitions. Many have divested foreign subsidiaries. (The effect on the crisis on the ambitions and the M&A and integration capabilities of banks deserves another post.)

Looking at the map, what are your thoughts? Should there be more banking consolidation in Europe? Should politicians and regulators stimulate consolidation, or should they leave the decision to the private sector? Your comments are much appreciated!

List of subsidiaries (country) – parent (country)

Nordea (Denmark) – Nordea (Finland)

Nordea (Norway) – Nordea (Finland)

Nordea (Sweden) – Nordea (Finland)

Swedbank (Estonia) – Swedbank (Sweden)

Swedbank (Latvia) – Swedbank (Sweden)

Swedbank (Lithuania) – Swedbank (Sweden)

Bank Austria (Austria) – UniCredit (Italy)

HypoVereinsbank (Germany) – UniCredit (Italy)

Zagrebačka banka (Croatia) – UniCredit (Italy)

UniCredit Bulbank (Bulgaria) -UniCredit (Italy)

Česká spořitelna (Czech Republic) – Erste Group (Austria)

Slovenská sporiteľňa (Slovakia) – Erste Group (Austria)

BKS Bank AG, Bančna podružnica (Slovenia) – BKS Bank AG (Austria)

BCR (Romania) – Erste Group (Austria)

Santander Bank Polska (Poland) – Santander (Spain)

Santander Totta (Portugal) – Santander (Spain)

Santander UK (UK) – Santander (Spain)

BNP Paribas Fortis (Belgium) – BNP Paribas (France)

BNL (Italy) – BNP Paribas (France)

Dankse Bank (Finland) – Danske Bank (Denmark)

K&H (Hungary) – KBC (Belgium)

Ulster Bank (Ireland) – Royal Bank of Scotland (United Kingdom)

Technical notes:

I googled “largest banks in COUNTRY”4 of all EU countries (except Cyprus, Luxemburg and Malta) plus Norway and Switzerland. Google led to the CFI website5. Using the list of banks at CFI as a starting point, I did some cross-checks with other sources (Wikipedia, bank websites, news reports…). Only foreign owned banks with a market share over 8% (measured by assets) were retained to create the map. Furthermore, I demanded that the foreign parent owns more than 50% of its subsidiary.

- E.g. the largest bank in Italy is UniCredit, not BNL (BNP Paribas); the largest bank in Poland is PKO Bank Polski, not Santander Bank Polska.

- Nordic countries -> Finland; Baltic countries -> Sweden; Belgium and Italy -> France; Czech Republic, Slovakia and Slovenia -> Austria

- Country of subsidiary (currency) – country of parent (currency)

Denmark (Danish krone) – Finland (euro)

Norway (Norwegian krone) – Finland (euro)

Sweden (Swedish krone) – Finland (euro)

Estonia (euro) – Sweden (Swedish krone)

Latvia (euro) – Sweden (Swedish krone)

Lithuania (euro) – Sweden (Swedish krone)

Austria (euro) – Italy (euro)

Germany (euro) – Italy (euro)

Croatia (kuna) – Italy (euro)

Bulgaria (lev) – Italy (euro)

Czech Republic (koruna) – Austria (euro)

Slovakia (euro) – Austria (euro)

Slovenia (euro) – Austria (euro)

Romania (leu) – Austria (euro)

Poland (zloty) – Spain (euro)

Portugal (euro) – Spain (euro)

United Kingdom (British pound) – Spain (euro)

Belgium (euro) – France (euro)

Italy (euro) – France (euro)

Finland (euro) – Denmark (Danish krone)

Hungary (forint) – Belgium (euro)

Ireland (euro) – United Kingdom (British pound)

- Change COUNTRY by the actual name of the country, e.g. Italy.

- More specifically, https://corporatefinanceinstitute.com/resources/careers/companies/top-banks-in-COUNTRY/ (again, change COUNTRY by the actual name, e.g. italy).