How can the European Central Bank (ECB) support a sustainable recovery? In a report for Positive Money Europe and Sustainable Finance Lab, Jens van ‘t Klooster and Rens van Tilburg propose that the ECB starts a Green TLTRO program.

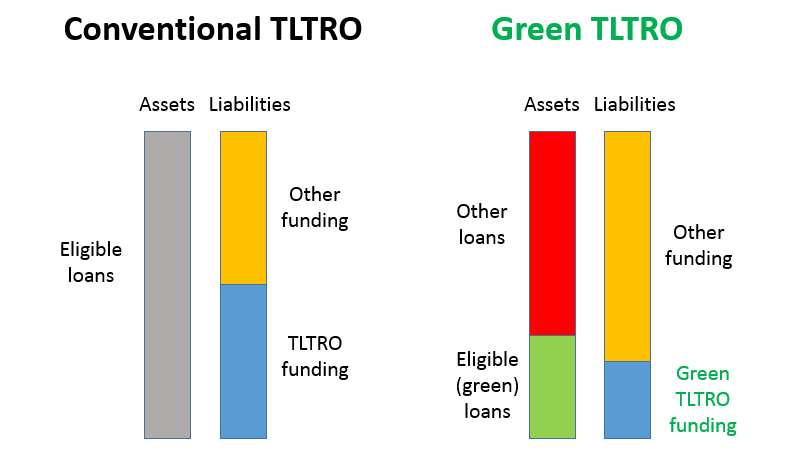

Green TLTRO is a refinancing program for commercial banks. Banks can fund their green loans with longer term (several years) deposits from the European Central Bank (ECB). Green loans are bank loans that comply with the EU’s Green Taxonomy.

The figure below shows the balance sheet of a commercial bank with conventional (left) and green (right) TLTRO. Under TLTRO-III, the ECB funds 50% of a bank’s eligible assets. Under green TLTRO, the ECB funding is only available for green bank loans.

The interest rate on the Green TLTRO is determined by the volume of green bank loans. More green loans result in a lower interest rate on the funding from the ECB. With negative interest rates, banks have to pay back less to the ECB than they borrowed. This provides a strong incentive to banks to increase their lending to green projects, and to pass on the low rates to borrowers.

Is Green TLTRO a pie in the sky proposal? Only if you’re not keeping up with the times.

TLTROs are a well-established monetary policy tool. The ECB is currently doing TLTRO-III.

In a recent speech, ECB Executive Board Member Isabel Schnabel pointed out that climate change is a market failure. She said that collective action, including by the ECB, should correct this market failure and accelerate the transition towards a carbon-neutral economy.

Asked about the Green TLTRO report by MEP Bas Eickhout, ECB President Lagarde said that “climate change has to be part and parcel of our strategy review. Not because it is a secondary objective, but because of its impact on price stability, because of its significant impact on risk assessment and risk management. And the Green TLTRO, as you called it, is a matter that is of interest and that we will look at.”

What volume of green loans should the ECB target during the first 3 years? How low should the interest rate on Green TLTRO be? Should the eligible bank assets include loans to households for house purchases, a category that is currently exluded from TLTRO?

In a webinar on 12 October 2020, Jens van ‘t Klooster discusses the Green TLTRO proposal with Isabel Vansteenkiste (ECB) and Frederik Ducrozet (Pictet).

Update 2020/10/18: this is the video

Full disclosure: I have done consulting work for this report.