Update 1, 12/12/2017: Prof. Kimball replied on Twitter. I have added his remarks just before the discussion section.

Update 2, 12/12/2017: See my follow-up post with more details on the distributional and stimulative effects of deeply negative ECB rates.

Central banks around the developed world have been struggling to meet their inflation targets. Economists are divided on what the Fed, the ECB or the Bank of Japan should do.

Massive amounts of quantitative easing have proven to be ineffective at boosting inflation. Some economists have proposed that central banks raise inflation expectations.

At the 5th Bruegel – Graduate School of Economics, Kobe University conference1, Eric Lonergan and professor Miles Kimball advocated their preferred solutions: helicopter money and deep negative interest rates, respectively.

Because I like to clarify ideas by thinking through the implementation details, I’ll flesh out their proposals in this post.

In essence, both Eric and Miles want monetary policy to stimulate aggregate demand which would increase inflationary pressure. Their views diverge on the best way the central bank can achieve this.

The carrot: Eric Lonergan’s helicopter money

According to author and fund manager Eric Lonergan, the central bank should create new money and give it to consumers. Note that Eric and I co-wrote an opinion piece in defense of helicopter money earlier this year.

Eric’s full explanation (video starts at his presentation):

Eric points out that the European Central Bank has already made ‘helicopter drops’ of money to banks, even if few people realize it.

How? The ECB lends money (reserves) to banks under the TLTRO programs. If the banks make enough loans to households and non-financial businesses, the ECB charges a negative interest rate on its loans to the banks. So the ECB subsidizes banks: they have to pay back less money than they received from the ECB in the first place.

Eric Lonergan proposes to use the TLTRO mechanism to give money to each adult citizen in the euro area. The helicopter money in disguise would be passed on to people by the banks, rather than by fiscal authorities.2

Suppose the ECB wants to give €1000 to each adult citizen in the euro area.

First of all, let’s guesstimate how much money we’re talking about. Total euro area population is 340 million. Taking 75% of that number to exclude minors and non-citizen residents gives approximately 250 million people. So the ECB should transfer €250 billion to the banks, who have to pass that money to the people.

For reference, the balance sheet of the ECB stood at €4,441 billion on December 1, 2017. So €250 billion of helicopter money is trivial in comparison.

If the ECB wants to add €1000 to each qualifying person’s bank account, the extra deposits (liabilities for commercial banks) have to be matched by extra reserves (assets for commercial banks). Reserves are money that commercial banks hold at the central bank. For more details on reserves and (central) bank accounting, see Central bank liabilities and profits or read my book.

To get the commercial banks on board, the ECB declares that these new reserves have a 0% interest rate in perpetuity. In other words, the central bank creates ‘tiered’ reserves. There would be one class of reserves on which the ECB can adjust the interest rate to conduct ‘normal’ monetary policy. The new class of reserves guarantees that commercial banks won’t suffer a loss if they participate in the helicopter drop.

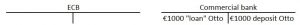

How would it work in practice? A commercial bank gives a loan of €1000 to Otto Normalverbraucher. The “loan” charges no interest and never has to be repaid. No sane person would refuse such a loan. It’s free money!

On the other hand, no sane banker would issue such a “loan”. The bank takes on a liability for a worthless asset:

But here’s the thing. The ECB promises to buy the loan at nominal value from the commercial bank. This is the result:

Otto is €1000 richer. As said above, Otto’s deposit is matched by new reserves on the asset side of his bank’s balance sheet.

Evidently, the ECB has to verify that individuals don’t receive €1000 at multiple banks.

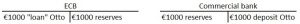

If the ECB insists on continuing its TLTRO obfuscation, here’s how to do it. The ECB lends €1000 to the commercial bank.

Although banks don’t lend out reserves, the ECB demands that the commercial bank makes a perpetual “loan” of €1000 at 0% to Otto, corresponding to the €1000 the commercial bank received from the ECB.

As soon as the commercial bank grants the “loan” to Otto, the ECB charges a negative 100% interest rate on its own loan to the commercial bank. This erases the commercial bank’s debt to the ECB. The commercial bank is able to write off its €1000 “loan” to Otto without taking a loss.

The end result is that the commercial bank has €1000 in reserves and Otto has €1000 in his bank account, as before.

My personal favorite way of implementing helicopter money would be if every Otto, Matti and Jan in the euro area sent a postcard to

Mario Draghi

European Central Bank

60640 Frankfurt am Main

Germany

In return, Santa Mario would give all of them €1000.

![]()

In summary, Eric Lonergan’s proposal

- creates a wealth effect for all adult citizens, not just for the owners of financial securities

- uses commercial banks as transmission channel for the ECB’s monetary policy

- results in a modest predetermined loss for the ECB (in contrast to the unpredictable credit losses that result from the ECB’s asset purchase programs, a.k.a. QE)

- doesn’t interfere with interest rates on bank deposits, government bonds, or credit to the non-financial private sector (unlike QE)

- has no effect on the profit and loss of commercial banks3

The stick: Miles Kimball’s negative rates

Professor Miles Kimball wants the central bank to cut interest rates far below zero percent. Negative interest rates incentivize savers to spend more. Negative rates reduce the debt burden of borrowers.

Miles’ full explanation (video starts at his presentation):

To see how negative rates would work, here’s an extremely simplified representation of the balance sheets of the relevant economic agents:

Savers and debtors are the non-financial sector: households, firms and governments. ‘Loans’ is shorthand for all credit: loans and bonds. Most lending in Europe is done by banks, so there’s no need to show loans on the asset side of the balance sheet of savers.

Obviously debtors can also own cash and deposits. Non-banks like pension funds also hold bonds. But let’s keep things as simple as possible.

What order of magnitude of the assets and liabilities are we talking about in the euro area?

- Cash (banknotes in circulation) is a bit over €1.1 trillion.

- Reserves are about €2.0 trillion.4

- Bank loans to the non-financial private sector add up to €9.6 trillion: €4.1 trillion to businesses and €5.5 trillion to households.5

- Government debt is €9.7 trillion.

- Bank deposits6 are €7.4 trillion: €5.7 trillion from households and €1.7 trillion from non-financial corporates.7

To put these figures in perspective, eurozone GDP was €10.8 trillion in 2016.

Miles proposes that the central bank would aggressively lower its short term interest rates when the economy stalls. For example, the ECB could lend to banks at -4%.

For reference, commercial banks can currently borrow reserves at 0% from the ECB’s main refinancing operations. The ECB’s deposit facility stands at -0.4%. So banks have to pay 0.4% of interest on their reserves to the ECB.

How would a central bank interest rate of -4% affect banks and non-financial savers and borrowers?

If the ECB lends reserves at -4% to banks, the interest rate on the deposit facility should also be -4% or slightly lower. If not, banks would borrow limitless amounts to earn the spread between the ECB’s lending and deposit rates.

Because banks can get short term funding at the ECB at -4%, they will adjust the interest on deposits to a similarly negative rate.

If the ECB keeps its rates at -4% for half a year, the eurozone banking sector as a whole will earn 4%/year x 0.5 year x (€7.4 trillion [deposits] – €2.0 trillion [reserves]) = €108 billion.

“Hold on a minute!”, you’re probably thinking. “Won’t depositors withdraw their money from the banks if they have to pay -4%?”

That’s a great point. Professor Kimball has anticipated this objection. He proposes that cash money is also subject to negative rates. So in case the ECB has held its interest rates at -4% for 6 months, your €50 banknote would only buy you €48 worth of goods in shops.8

If savers don’t want to hold a depreciating asset (cash and deposits), they should spend it. Spending on consumption and investment gives a boost to GDP. While the money doesn’t disappear at the aggregate level, it’s rational for individuals to treat cash as a hot potato.

If the ECB keeps its rates at -4% for half a year, eurozone savers (holders of cash and deposits) as a whole will lose 4%/year x 0.5 year x (€1.1 trillion [cash] + 7.4 trillion [deposits]) = €170 billion.

If the ECB keeps its rates at -4% for half a year, the ECB will earn 4%/year x 0.5 year x (€1.1 trillion [cash] + 2.0 trillion [reserves]) = €62 billion.

This seigniorage profit could be distributed to the governments.9

How will negative rates benefit borrowers?

Of the €9.6 trillion non-financial private sector debt, only €1.1 trillion has an agreed maturity of less than a year. Examples of short term credit are revolving loans to businesses or credit card debt.

Imagine that banks respond to the ECB’s -4% interest rate by allowing borrowers to refinance their short term debt at a 4% lower interest rate than usual. A lot of corporate borrowers would then get negative rates on their short term debt. Short term household credit would still have positive interest rates.

If the ECB keeps its rates at -4% for half a year, eurozone borrowers (households and businesses) as a whole will pay less interest to the tune of 4%/year x 0.5 year x €1.1 trillion10 = €22 billion.

The mirror image of the €22 billion saved by borrowers is €22 billion in lost income for the banking sector. Note that Miles Kimball envisions the negative interest rates as a shock therapy for the economy. Because negative rates aren’t needed for long, interest rates on longer term debt will only be marginally affected.

Finally, negative rates are good news for governments. Let’s extrapolate figures from the German Finanzagentur, which manages the country’s debt. 39% of Germany’s federal government bonds mature in the coming 3 years. If the maturity profile of other eurozone nations government debt is similar, about 6.5% (one sixth of 39%) of €9.7 trillion government debt can be refinanced at -4%.

If the ECB keeps its rates at -4% for half a year, eurozone governments will pay less interest amounting to 4%/year x 0.5 year x 6.5% x €9.7 trillion = €13 billion.

Again, the flip side of this €13 billion saved by sovereigns is €13 billion less income for owners of government securities.

In summary, Miles Kimball’s proposal

- incentivizes holders of cash and bank deposits to spend their money

- uses commercial banks as transmission channel for the ECB’s monetary policy

- results in seigniorage revenue for the ECB (in contrast to losses from helicopter money)

- interferes with interest rates on bank deposits, government bills and short term credit to the non-financial private sector

- recapitalizes commercial banks thanks to a reduction in funding costs11

Update 12/12/2017:

Jan, I answered this one:

"One is if household increase their savings rate, to make up for the negative rates."

The borrower on the other side has a higher MPC, so it is still stimulative even if households that lend do increase their savings rate.

— Miles Kimball (@mileskimball) December 11, 2017

In three blog posts, professor Kimball makes the point that for every lender who might reduce his spending in response to negative rates, there’s a borrower with a higher marginal propensity to consume (MPC).

However, I don’t agree with this view. As this post makes clear, the ‘borrower’ with the biggest windfall from negative rates are commercial banks. Banks ‘borrow’ deposits from the real economy. Yet banks are mainly owned by rich people, who have a low MPC.

In fact, Miles does recognize that negative rates are a subsidy for banks. He even advocates that the extra profit stays in the bank. But that means that the wealth transferred from savers to banks has a MPC of 0! Quote from Miles blog, emphasis mine:

“If the central bank lending rate is in line with the target rate and interest on reserves, any redistribution is between savers and those banks borrowing from the central bank, with the central bank only a conduit and not itself subject to much of a wealth effect. But the positive wealth effect for banks is particularly important, since it helps preserve the bank capital needed for financial stability (hopefully in conjunction with a high capital conservation buffer that avoids the dissipation of scarce bank capital into dividends).”

Here are the three posts recommended by Miles:

- Even Central Bankers Need Lessons on the Transmission Mechanism for Negative Interest Rates

- Responding to Joseph Stiglitz on Negative Interest Rates

- Negative Rates and the Fiscal Theory of the Price Level

In post 1, Miles discusses channels of transmission mechanisms of negative rates. The problem is that he doesn’t quantify the size of those channels.

As I show for the eurozone in this post, the wealth transfer to banks is huge: €73 billion (+€148 bln from lower funding costs, -€40 bln from negative rates on reserves, -€22 bln missed interest from private sector loans, -€13 bln missed interest from government T-bills). In a follow-up post, I am even more explicit about the economic effects of negative rates.

Key quote on post 1, repeated in post 2 (emphasis mine):

“In any nook or cranny of the economy where interest rates fall, whether in the positive or negative region, those lower interest rates create more aggregate demand by a substitution effect on both the borrower and lender, while other than any expansion of the economy overall, wealth effects that can be large for individual economic actors largely cancel out in the aggregate.”

In post 3, Miles summarizes why negative rates should stimulate aggregate demand, so I’ll copy his arguments verbatim:

- The negative shock to effective wealth of the lender is matched by an equal and opposite shock to the effective wealth of the borrower.

- In almost all cases, the marginal propensity to consume is higher for the borrower than for the lender, so that adding up the effects on borrower and lender, the wealth effects add up to an increase in spending.

- In addition to the wealth effects on the non-interest spending of the borrower and lender, there is a substitution effect on both borrower and lender toward spending more now simply because spending now is relatively cheaper compared to spending later when the interest rate is lower.

Discussion

In both the United States and in the eurozone, inflation has been muted ever since the global financial crisis. Economic output is below its pre-crisis trend, leading to talk about secular stagnation.

Monetary policy is stuck at the (quasi) zero lower level bond. Quantitative easing has massively expanded central banks’ balance sheets.

How do the proposals of Eric and Miles compare to each other and to current policy? I’ll look at several aspects: (1) how these plans stimulate growth, (2) their impact on borrowers, (3) the effect on inequality, and (4) the consequences for future monetary policy and the financial system.

1. Stimulating growth

Eric Lonergan’s helicopter money is a carrot that entices people to spend more. A number of households would save12 all of the helicopter money they get from the ECB. But some would use (part) of the money to increase their consumption or investments. Thus economic activity would rise.

Negative rates as proposed by professor Kimball are a stick whipping savers. Savers can avoid ‘getting hit’ by getting rid of their money, i.e. by spending it. But there are two ways the negative rates could backfire. One is if household increase their savings rate, to make up for the negative rates. As a result, consumption would drop. A second potential response that wouldn’t help the real economy (i.e. consumption and investment) would be if savers reallocate their portfolio to other assets (stocks, bonds, crypto- or foreign currencies, gold…).

QE proved to be inefficient in stimulating the real economy. It’s an asset swap that trades bonds for reserves. The wealth effect should spur asset owners to spend more, but the rich have the lowest marginal propensity to consume.

2. Impact on borrowers

Indebted households can use the helicopter money to repay debts.

Borrowers (households, corporates and governments) with short term debt benefit from negative rates. The only assumption here is that banks are willing to pass on the negative rates to their clients.

By buying up debt with different maturities under their QE programs, central banks have flattened the yield curve, which is benificial to borrowers.

3. Inequality

Helicopter money reduces inequality: every adult receives the same amount, irrespective of his or her wealth.

Negative rates are a mixed bag for inequality. On the one hand, they are bad for savers. Deposits make up a smaller fraction of total financial assets with increasing net household wealth (see Table A6.B – Percentile of wealth on page 99 of this document). Poorer savers would suffer disproportionately.

On the other hand, those on the lower percentiles of the income distribution have relatively more non-mortgage debt than the rich (see Table A9.A – Share of debt components on total debt on page 110 of this document). Poor borrowers would benefit disproportionately.

To (partially) shield savers from negative rates, Miles Kimball has proposed that banks could not charge negative rates on the first €1000 euro of people’s primary bank account. In return, the ECB would exempt an equivalent amount of reserves held by the commercial bank from negative rates. This amendment makes Miles’ plan more progressive.

QE resulted in a reach for yield. This has increased wealth inequality, as the rich owners of stocks, bonds and real estate saw their assets rise in value.

4. Constraints on future monetary policy

The biggest objection to helicopter money is that it results in a loss for the central bank. The ECB has a capital and reserves worth €102 billion. Doing a helicopter drop of €250 billion would result in negative capital. While a central bank can still do its job with negative capital, the political credibility of central bankers would be compromized. Future seigniorage profits would probably be used to recapitalize the ECB instead of flowing to the national treasuries.

Secondly, the helicopter drop creates tiered reserves. In pre-crisis times, central banks paid (positive) interest on reserves. But we saw that ‘helicopter money reserves’ had to have a fixed 0% rate, to make sure commercial banks would participate in the helicopter drop. Once the crisis has passed, banks will prefer to hold regular reserves on which they earn an income. They will prefer to use the ‘helicopter money reserves’ to settle interbank payments. ‘Helicopter money reserves’ will be treated as bad money and trade at a discount to regular reserves, see Gresham’s law.13

Miles Kimball’s proposal does not limit the operation of the central bank going forward.

QE has inflated the balance sheet of the ECB with trillions of euros. As far as I know, no central banker has formulated a clear exit strategy for QE yet.

Overall, I think both Eric’s and Miles’ proposals would be improvements over quantitative easing. Besides, there’s no need to pick one single policy. A monetary policy committee could combine helicopter money with negative rates while engaging in QE.

However, Miles’ idea of deeply negative interest rates will also result in deeply negative sentiments among the general public. People will have to pay more than the sticker price in the supermarket if they pay in cash. Their savings will diminish every day. And negative rates are a massive wealth transfer from savers to commercial banks, governments, and the ECB.

Miles has a valid point when he says that people should understand that debt isn’t bad by definition. He talks about “virtuous borrowers”14, similar to the “virtuous savers“. But savers will still have the feeling that they are being ‘punished’ by negative rates. As Marianne Nessén said during the discussion at Bruegel: don’t underestimate how unpopular negative rates are.

Helicopter money doesn’t have such problems. While savers might worry about inflation15, with a bit of marketing spin most people will be happy to receive a ‘citizens dividend’ from Europe.

===

If you like this kind of analysis, check out Bankers are people, too: How finance works! My book makes debates between monetary experts – like the one between Eric Lonergan and Miles Kimball – accessible to the general public.

Feel free to comment below or on Twitter!

Follow @JanMusschoot

- My notes on the conference are here.

- I listed a number of political problems with helicopter money in an earlier post.

- Neglecting second order positive effects for banks from fewer credit defaults.

- Cash and reserves don’t add up to the total €4.4 trillion balance sheet of the ECB mentioned earlier in this post. That’s because the ECB has other liabilities, e.g. deposits of governments and of foreign central banks. The total balance sheet can be found here and an explanation of the balance sheet items is available here (liabilities start at page 33).

- €4.1 trillion of the €5.5 trillion in household debt is for mortgages.

- I include overnight deposits and deposits redeemable at notice of up to 3 months.

- Bank deposits are less than bank assets in the highly simplified picture. That’s because I don’t show other sources of bank funding like long term deposits and bonds, bank deposits from public sector entities, or equity.

- The same €48 bill could be paid with €48 from a checking account, because your bank would reduce the balance of your deposit every day according to the ECB’s negative rate.

- Via the national central banks that are the shareholders of the ECB.

- Assuming all debt with a maturity < 1 year is refinanced.

- Although the banks earn less on their (short term) credit portfolios and pay for reserves, these negative effects are small compared to the funding windfall.

- Or they’d buy other assets with the money, which doesn’t help GDP.

- A possible solution would be that the helicopter money reserves have a 0% interest rate as long as central bank rates are at or below zero. After the crisis is over, they would be converted into regular reserves.

- Think of students who take out a student loan so they can earn more later. Or entrepreneurs who borrow to invest in their business.

- But inflation is precisely what the ECB wants right now!

2 thoughts on “Carrot or stick? The Lonergan-Kimball debate”