Hello and welcome to another episode of the Finrestra Podcast! (Apple, Spotify, YouTube)

I am Jan Musschoot.

Warren Buffett once said: “Only when the tide goes out do you discover who’s been swimming naked.”

And boy, have people been swimming naked in 2022!

Investors saw the valuations of tech companies crash by 50, 70 or even more than 90%.

The so-called “geopolitical” European Commission – who wants the EU to be the first climate neutral continent – had to beg for gas around the world after boycotting Russia.

But the naked swimmer that I want to focus on is the ECB, a favorite of this podcast.

This is what Lagarde said about inflation at the end of 2021:

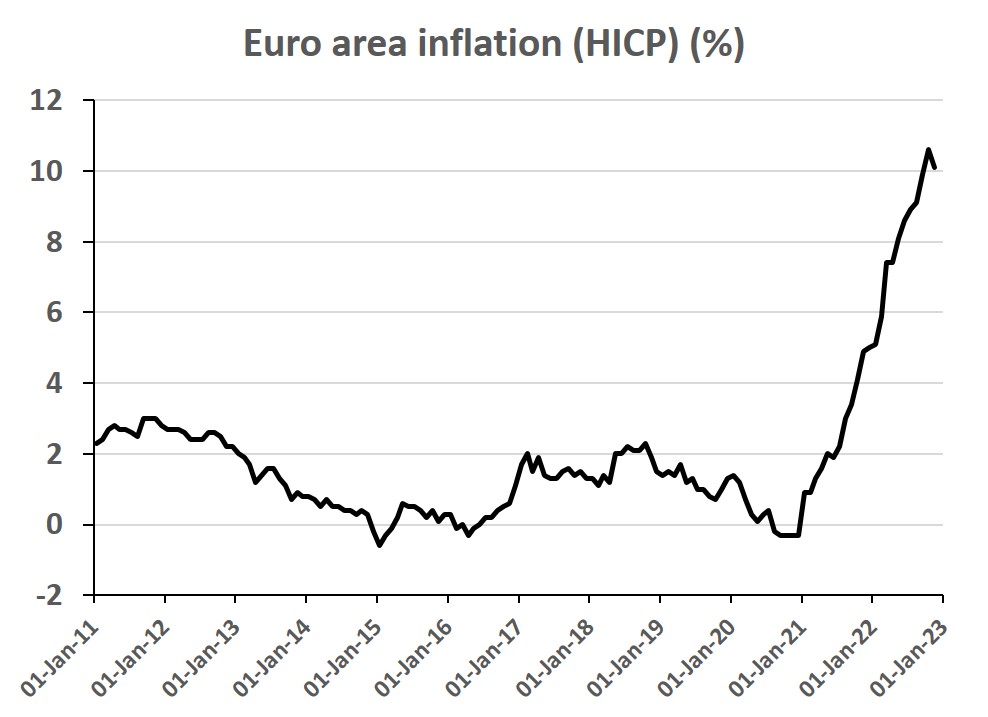

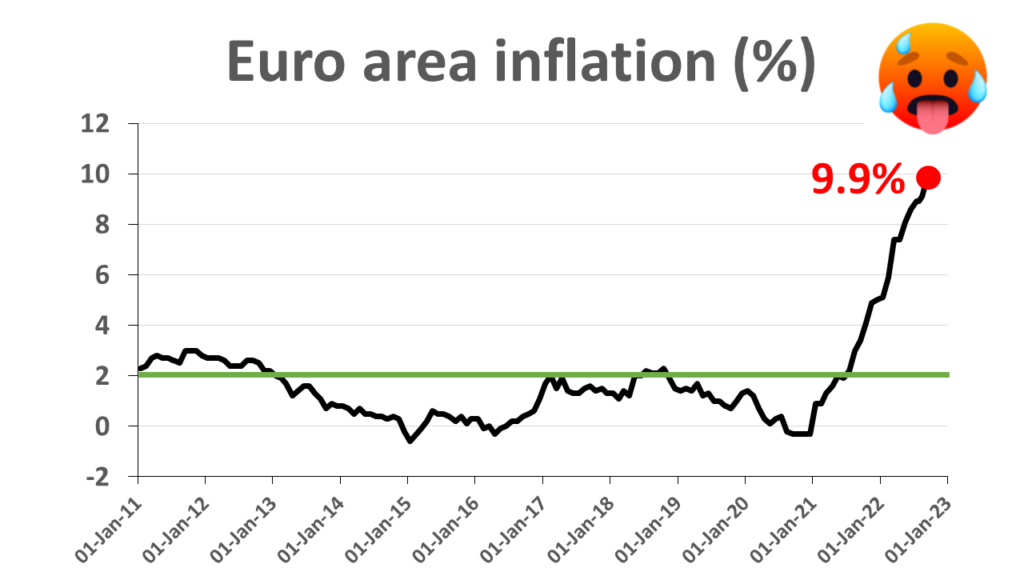

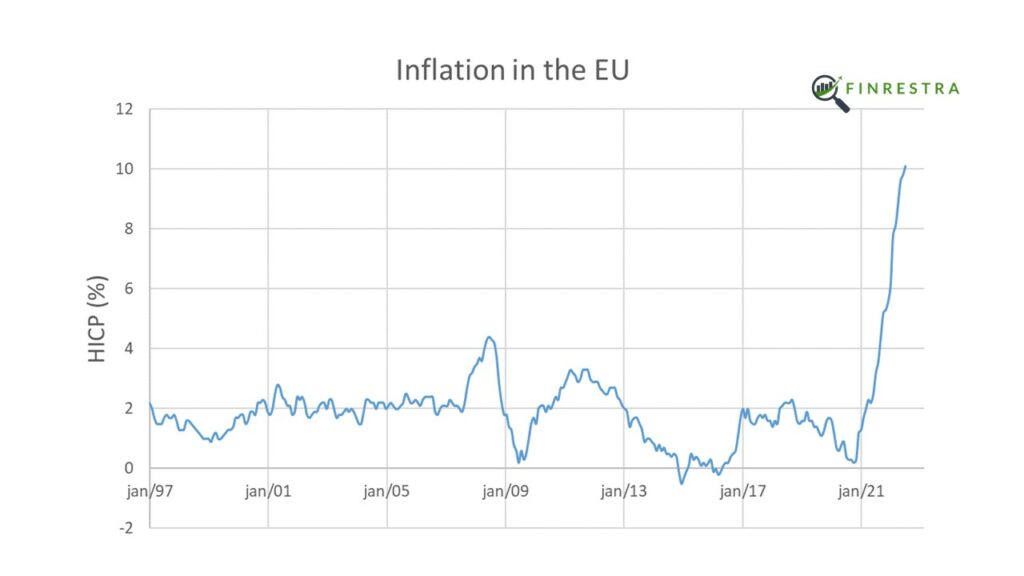

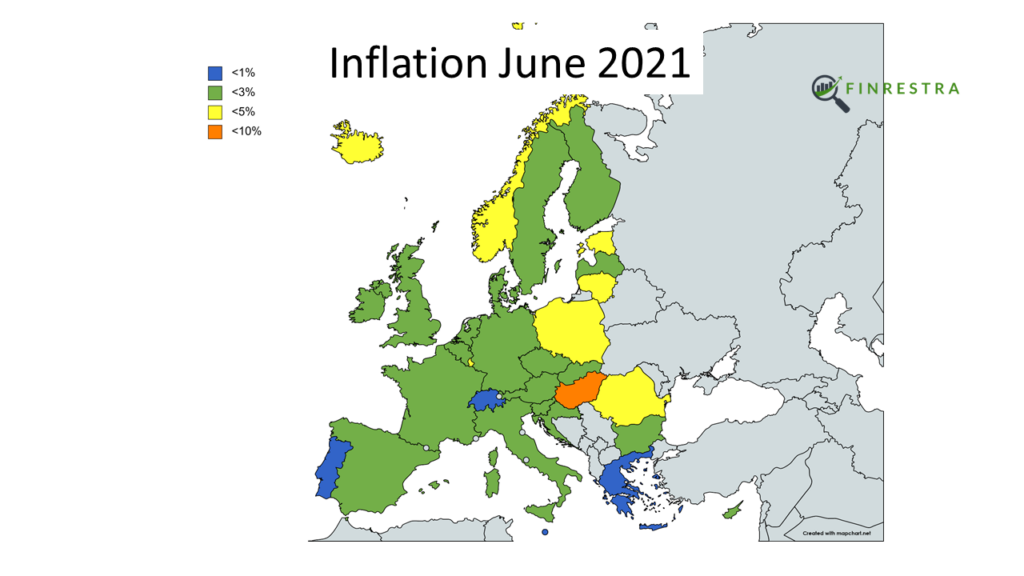

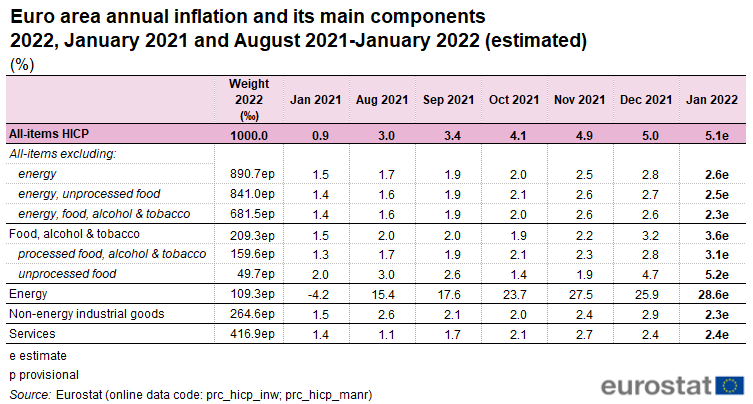

So inflation was supposed to have been a hump, gradually coming down to the 2 percent target over the course of 2022.

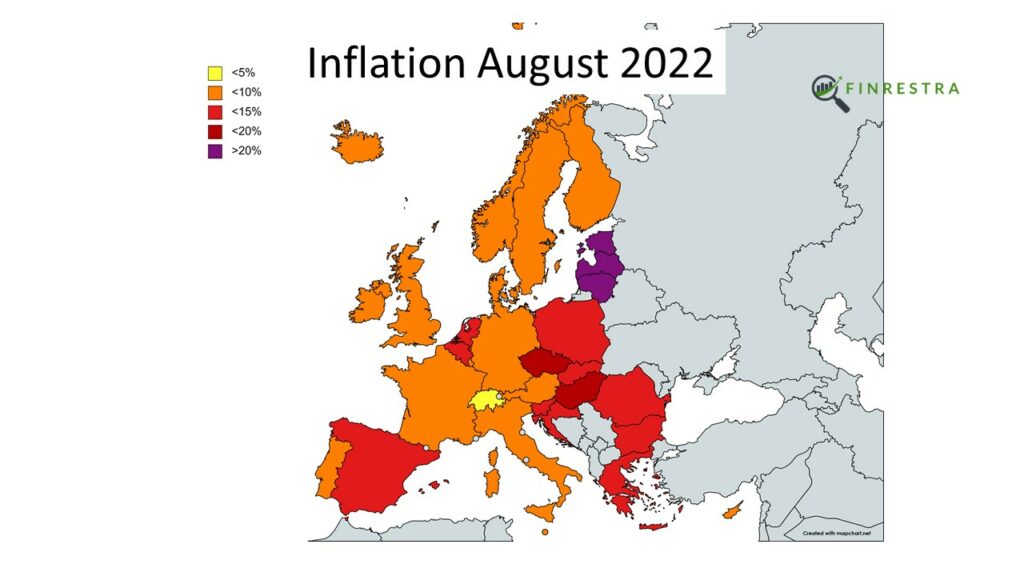

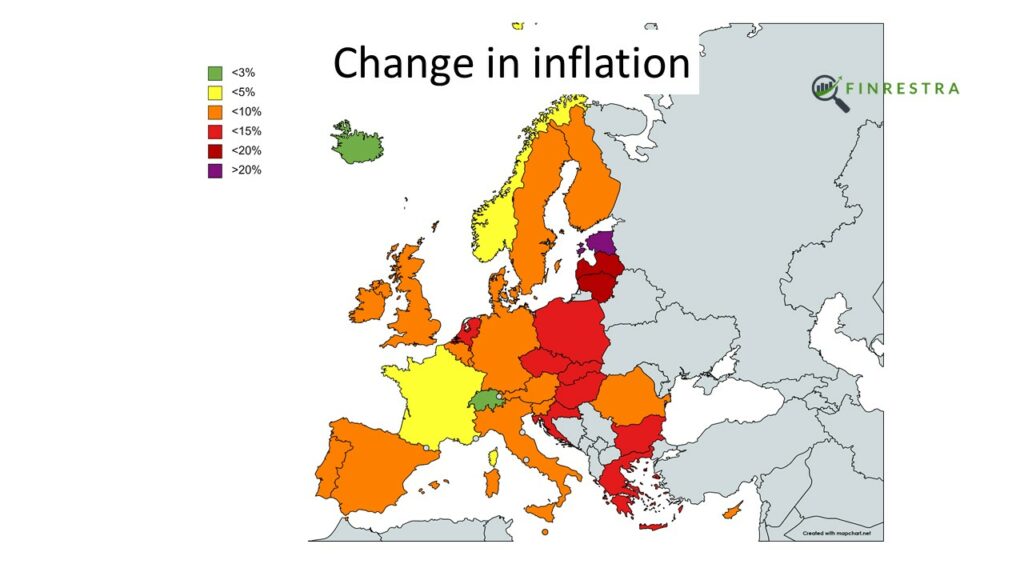

But in fact, inflation had been too high since the summer of 2021, and it basically kept on going up for the entirety of 2022. In December of 2022, it dropped a little, but it was still 9.2 percent according to Eurostat.

The ECB’s economists have been worried a lot about inflation expectations and wage-price spirals.

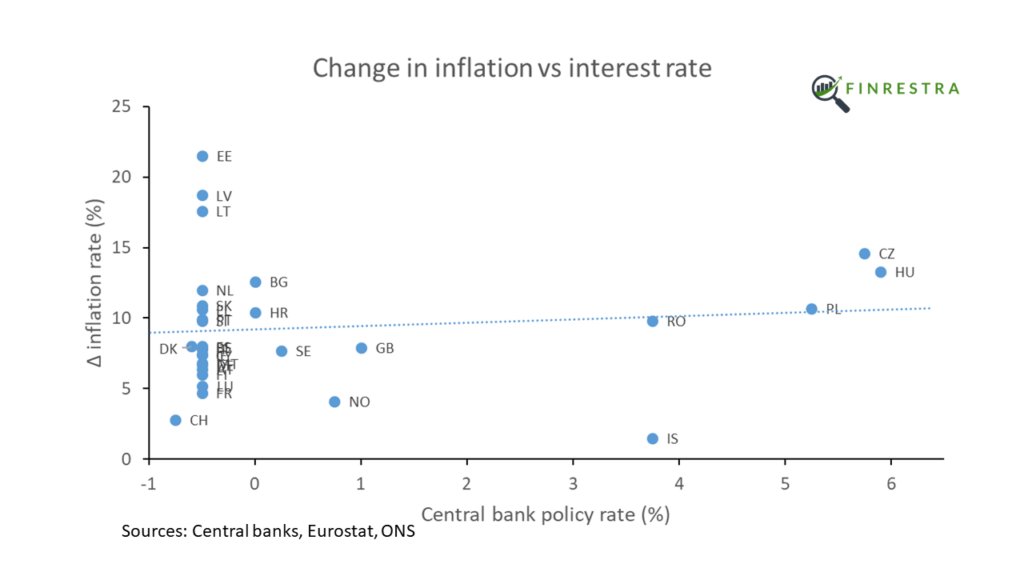

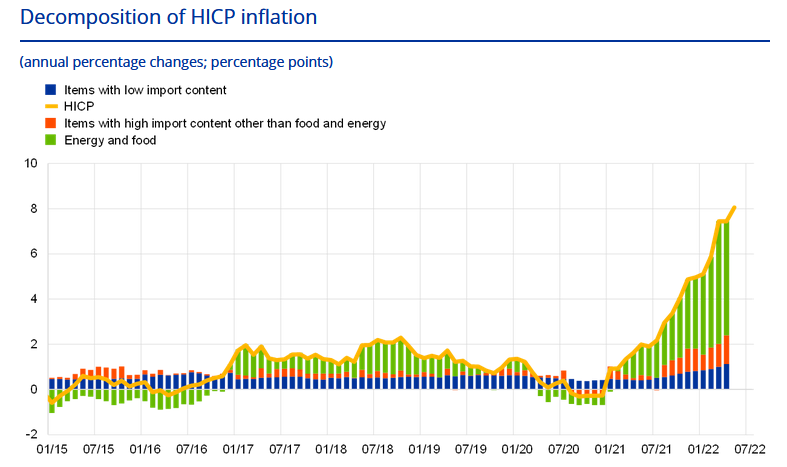

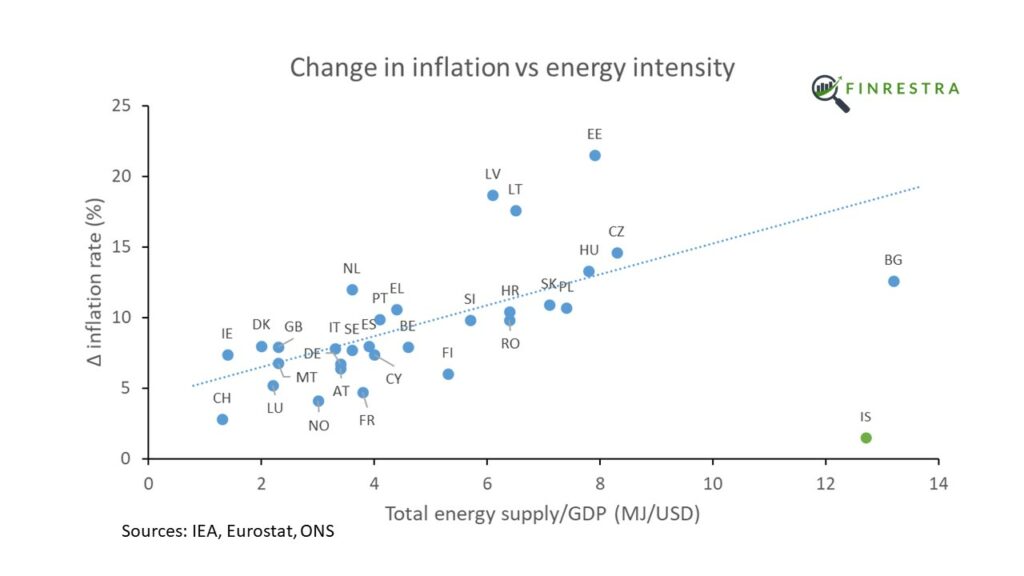

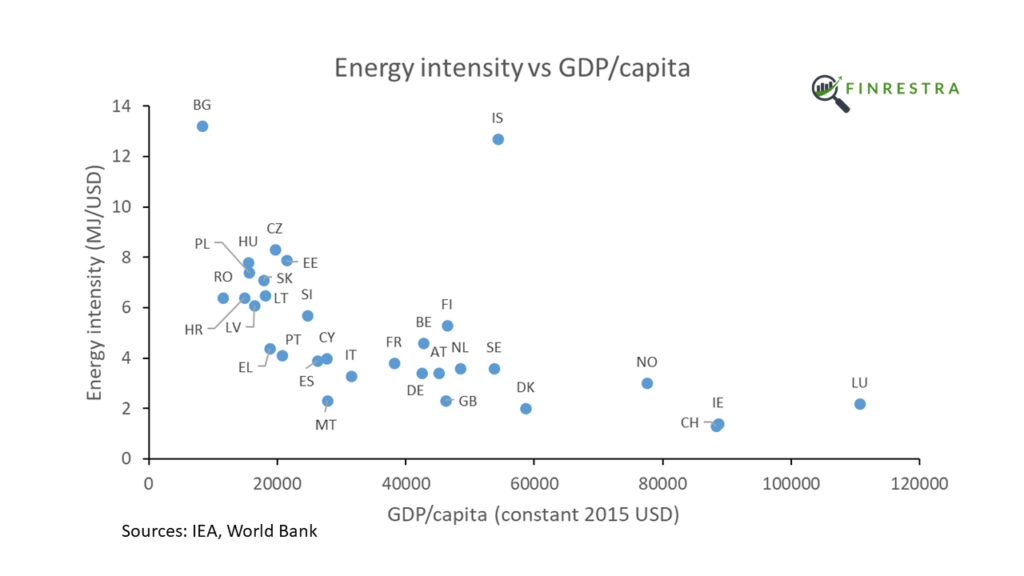

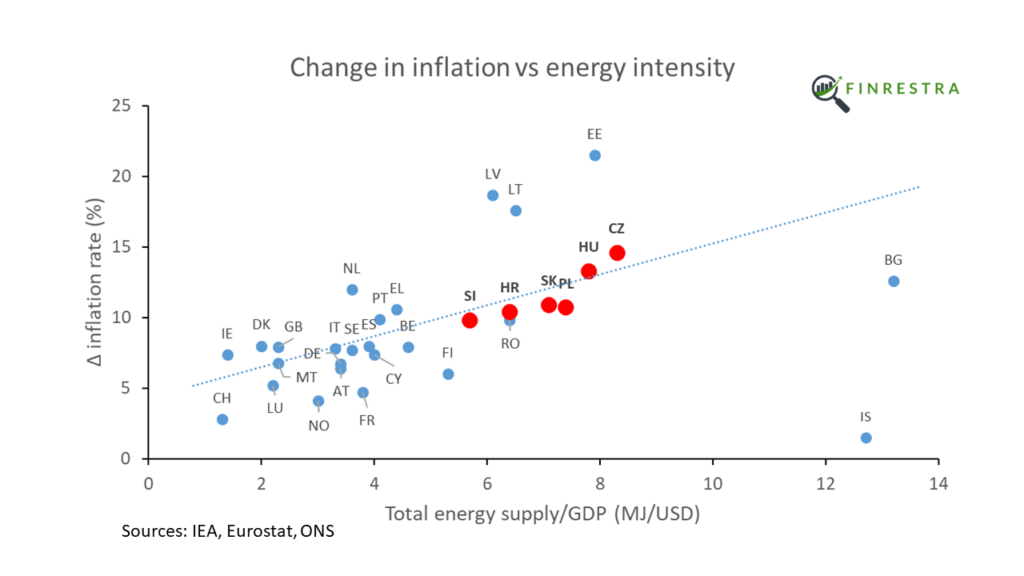

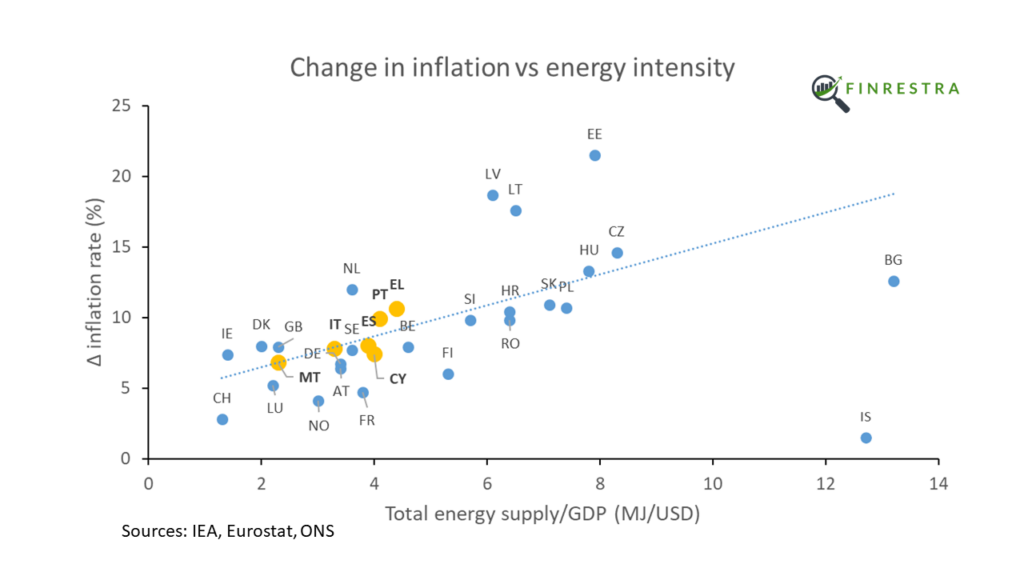

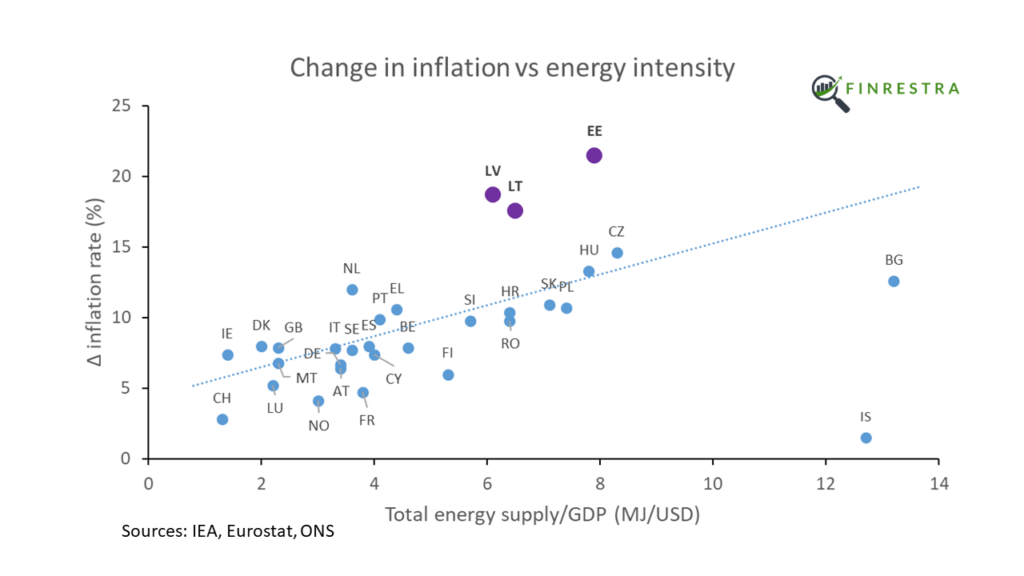

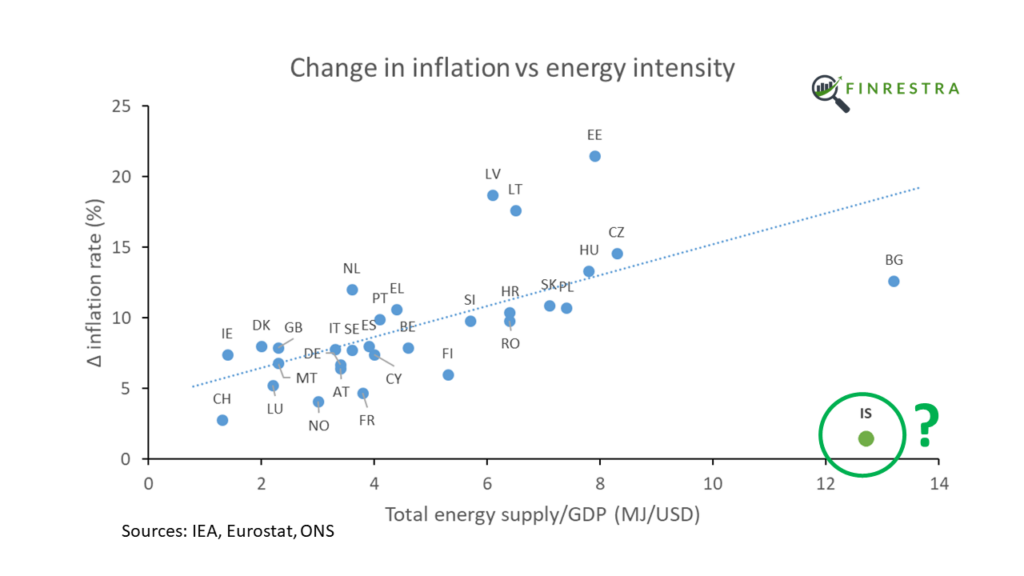

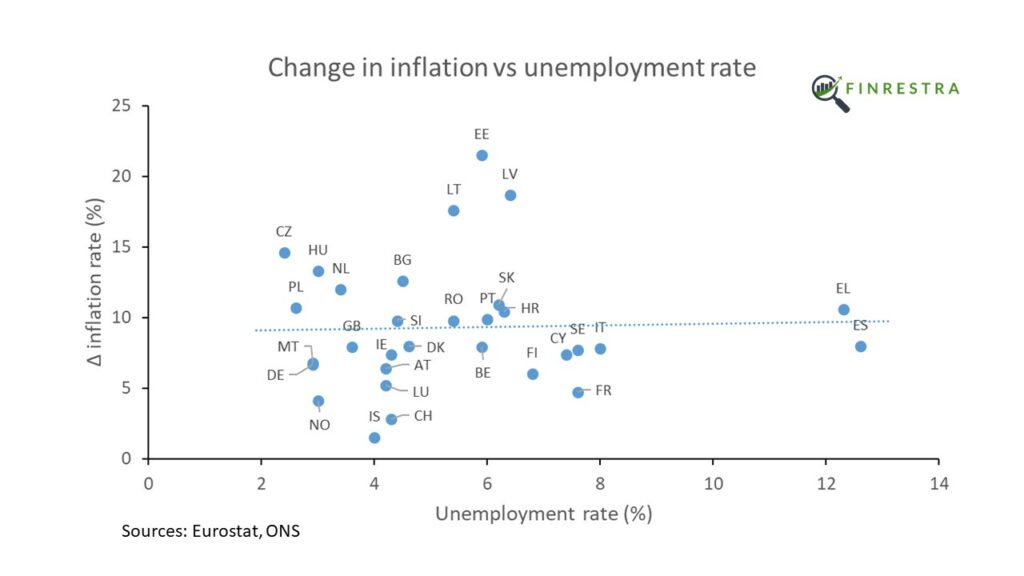

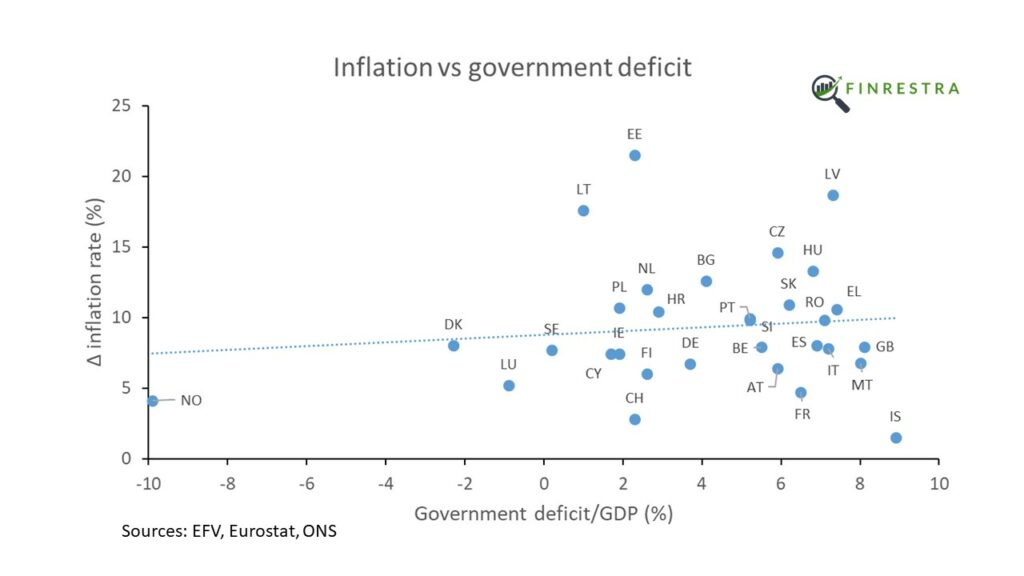

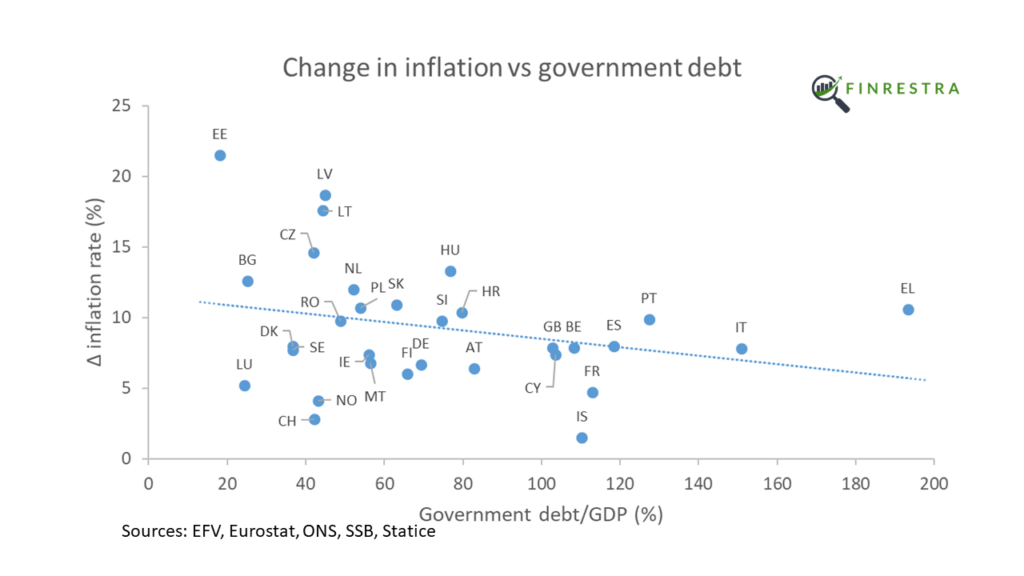

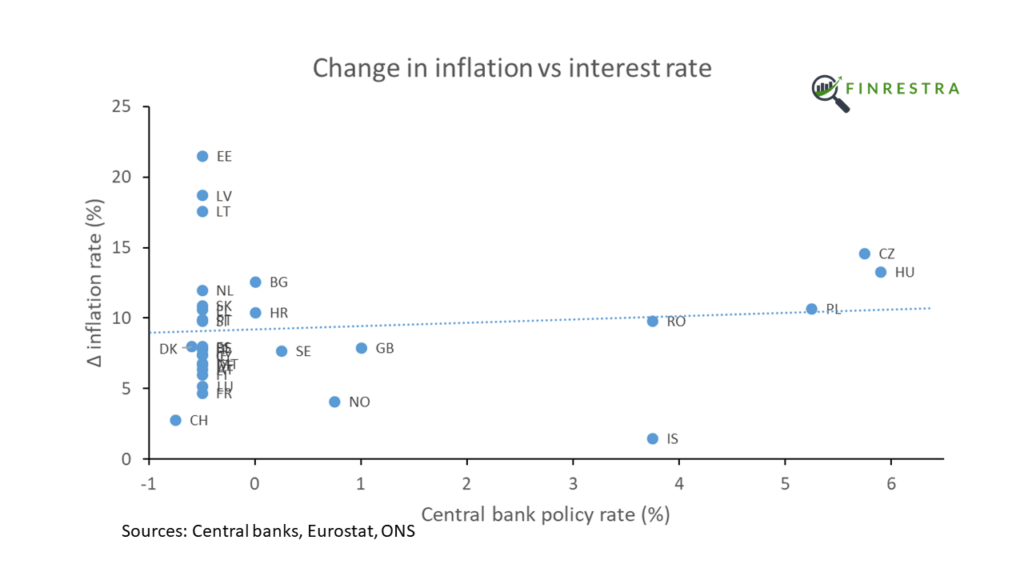

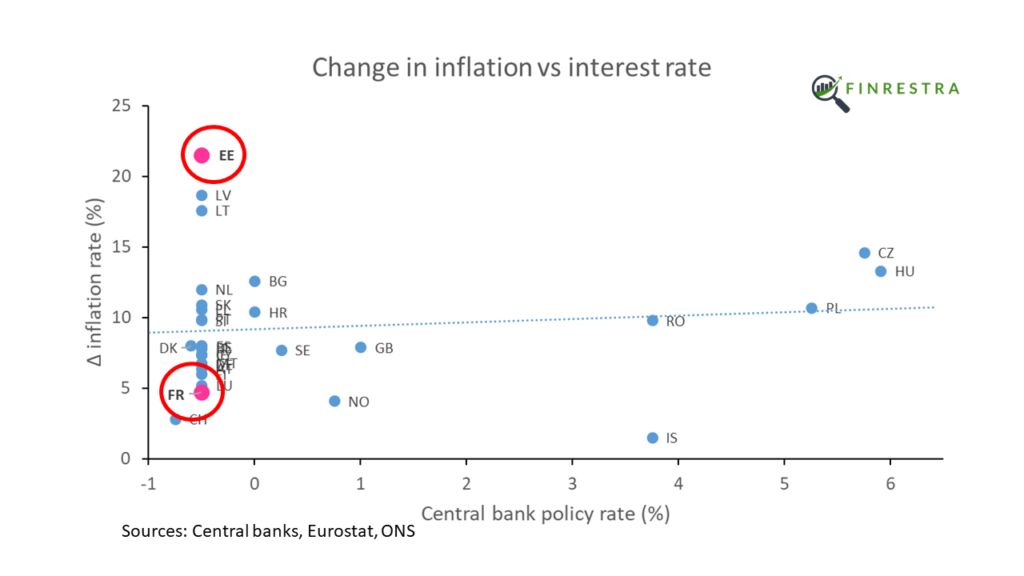

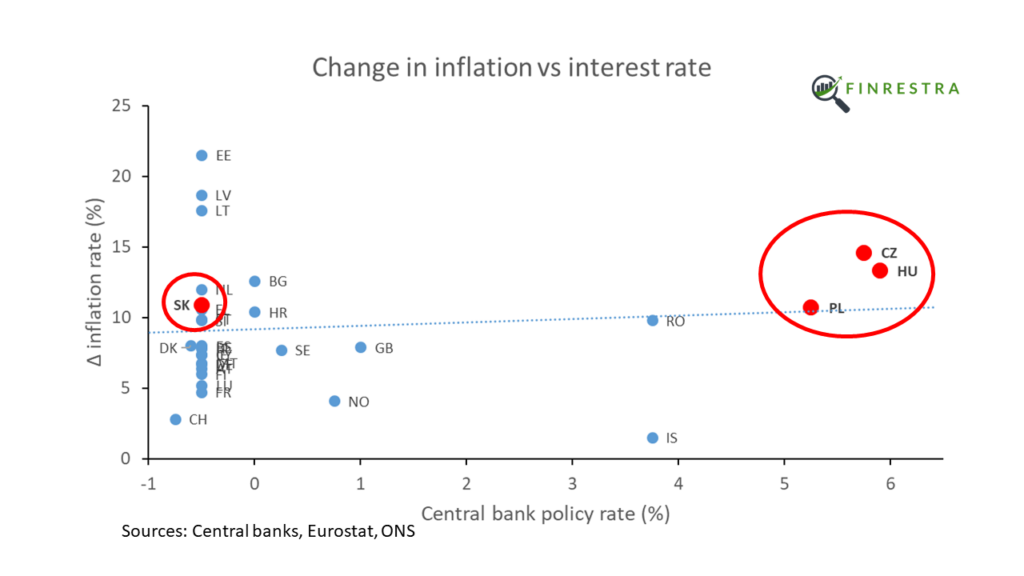

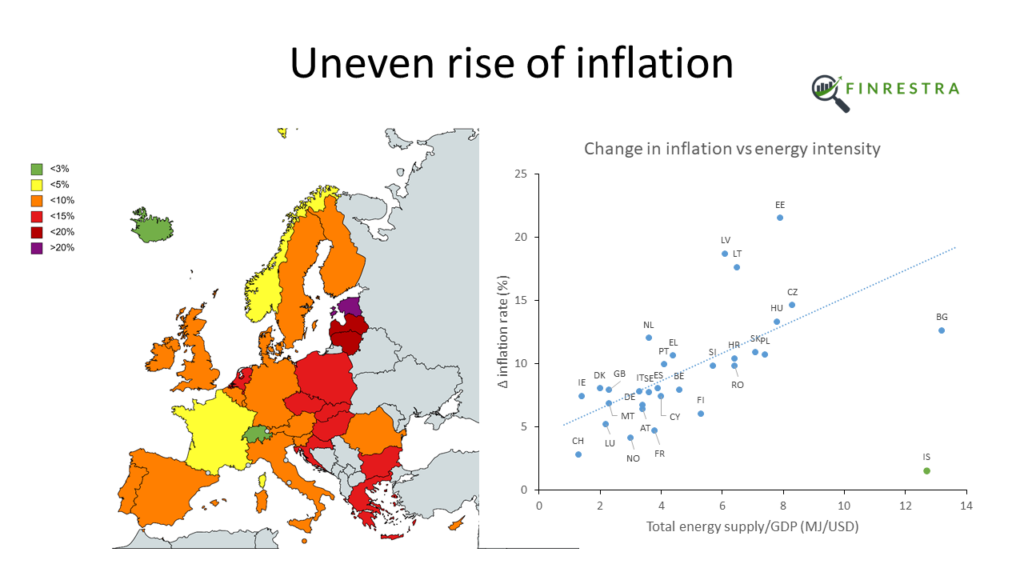

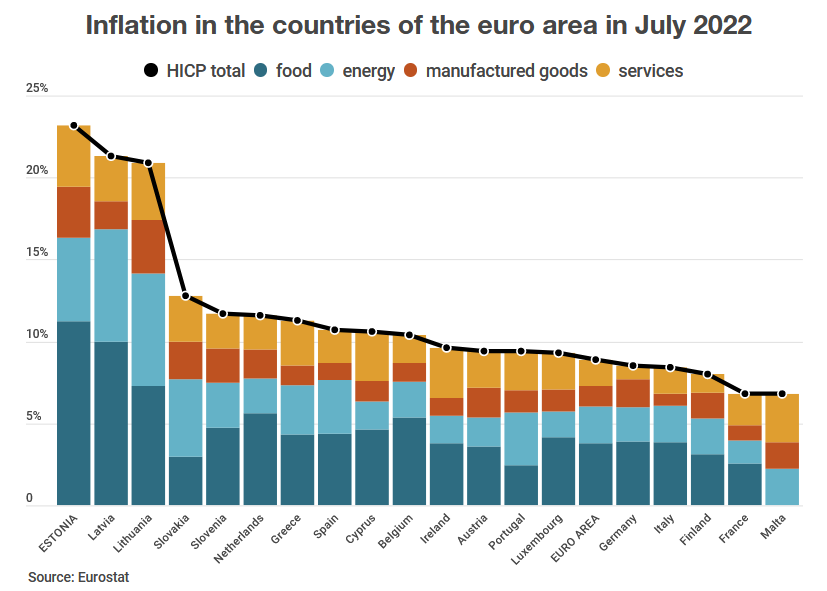

But what’s been driving Europe’s inflation for more than a year has been the cost of energy. It’s not clear at all how the metrics that central banks usually look at are relevant for this kind of inflation. I did some research last year that showed that if you look at government deficits, the unemployment rate, or the central bank interest rate, these are basically irrelevant when it comes to predicting the inflation that we observed.

What’s mostly correlated to the current inflation is the amount of energy economies use relative to their size. In other words, energy intensity is what drives inflation.

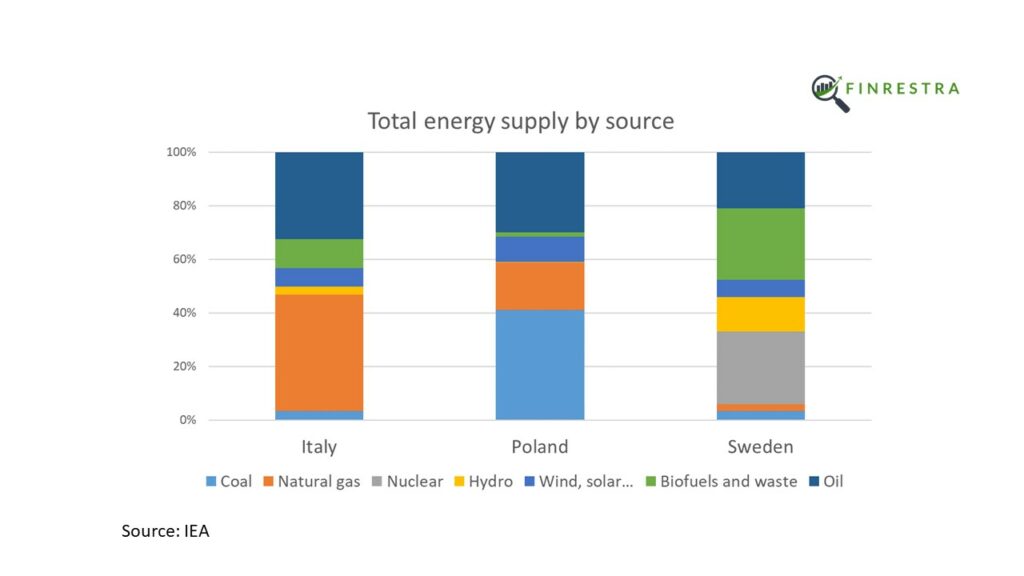

And when it comes to energy, the ECB has screwed up. Yes, central bankers made a lot of speeches about climate change since Lagarde is in charge. But I can’t heat my home with speeches and tweets.

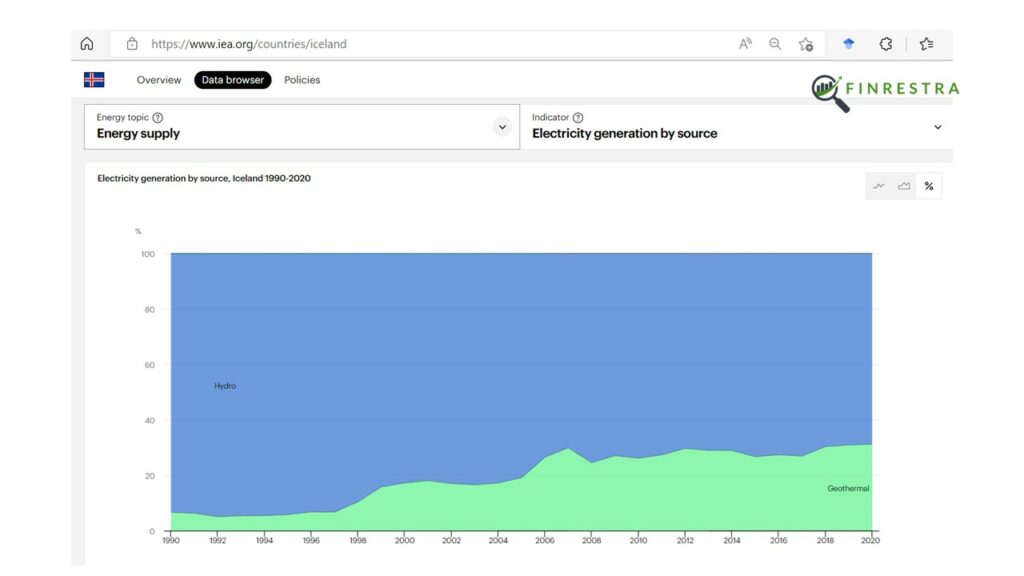

If the ECB had funded investments to make us less dependent on imported fossil fuels, inflation would have been much lower.

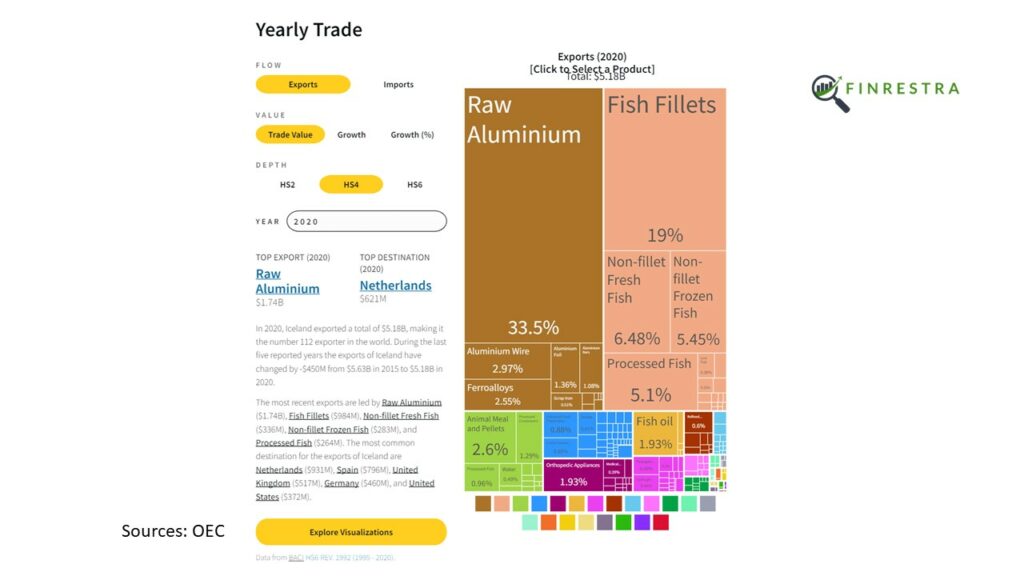

Imagine that the EU had invested massively in building renovation, heat pumps and clean energy sources while inflation was below target.

This would have reduced our vulnerability to Russia and other geopolitical rivals.

And fossil fuels would be a much smaller part of the consumer price index.

On top of that, Europe’s industry would have plenty of cheap energy right now…

So energy-driven inflation was the first tide that showed that the ECB was swimming naked.

Now on to the second tide.

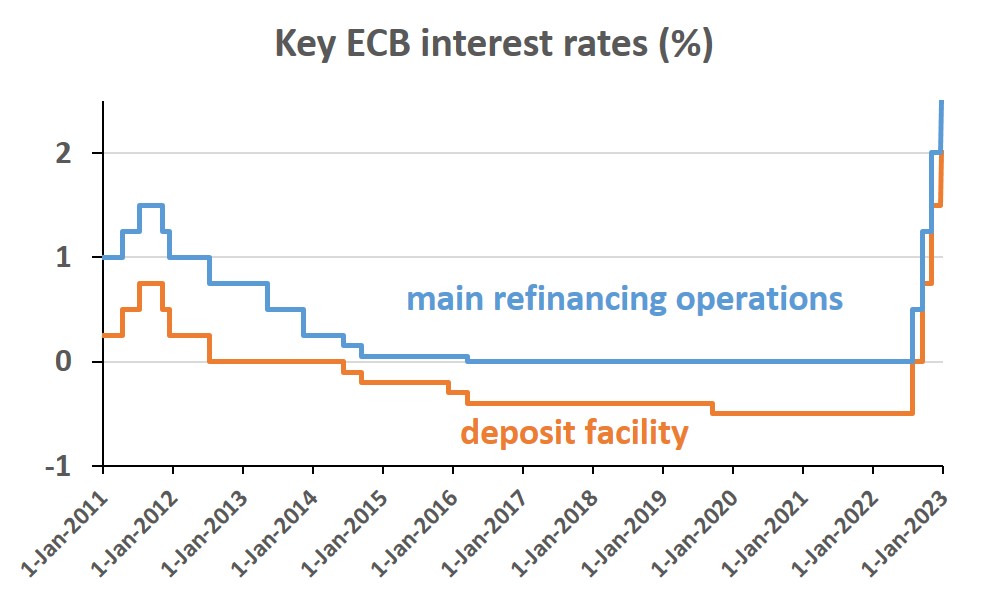

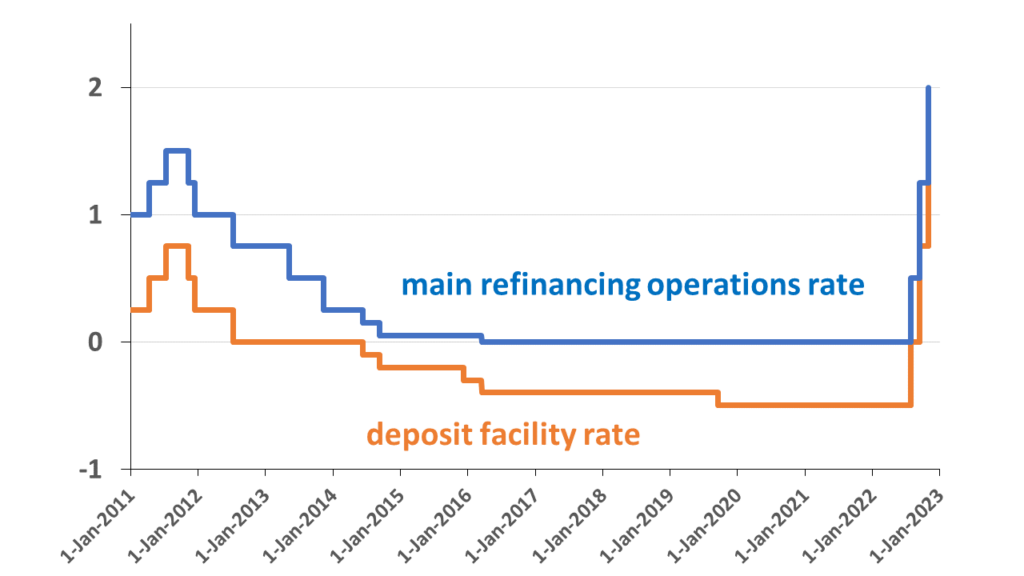

With inflation out of control, the ECB needed to do something. While Lagarde said in 2021 that it was unlikely they would raise rates in ‘22, the central bank has raised rates 4 times since the summer. The deposit facility rate went from negative 0.5 percent to positive 2 percent.

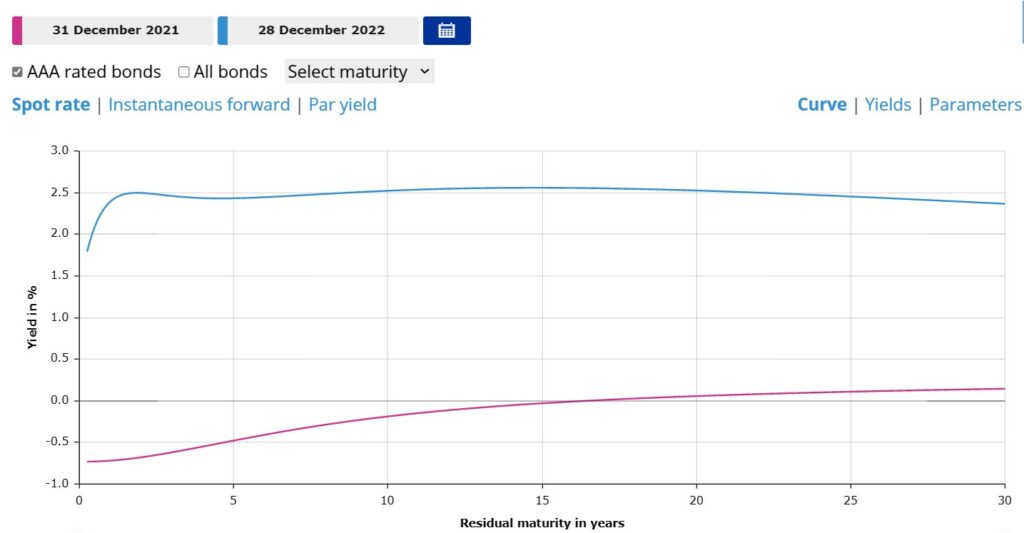

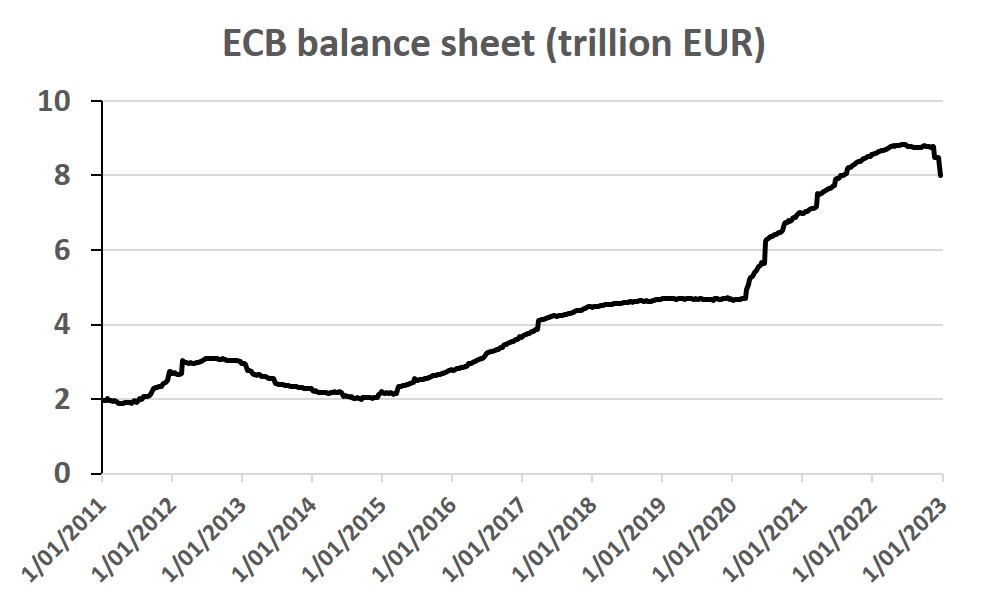

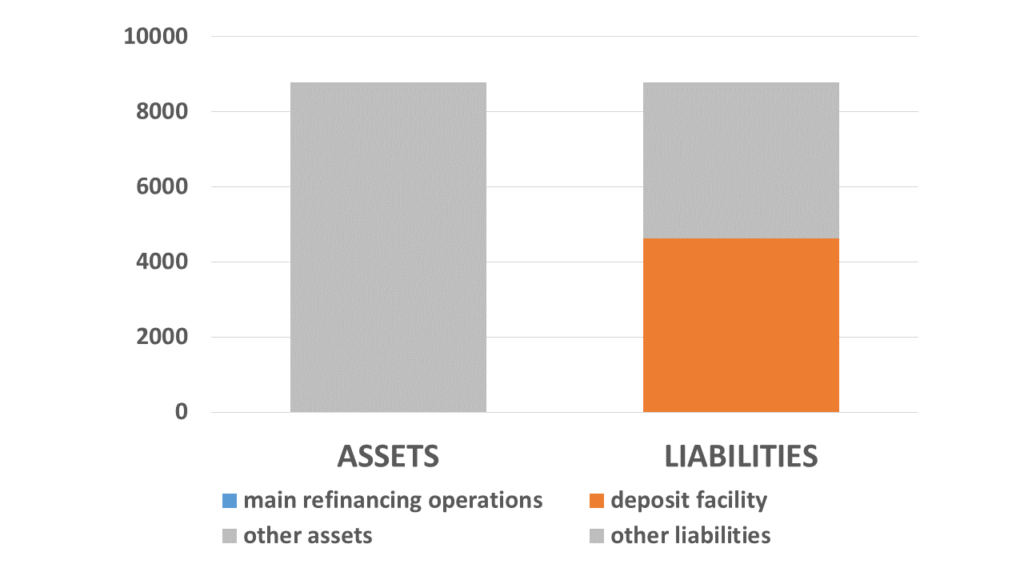

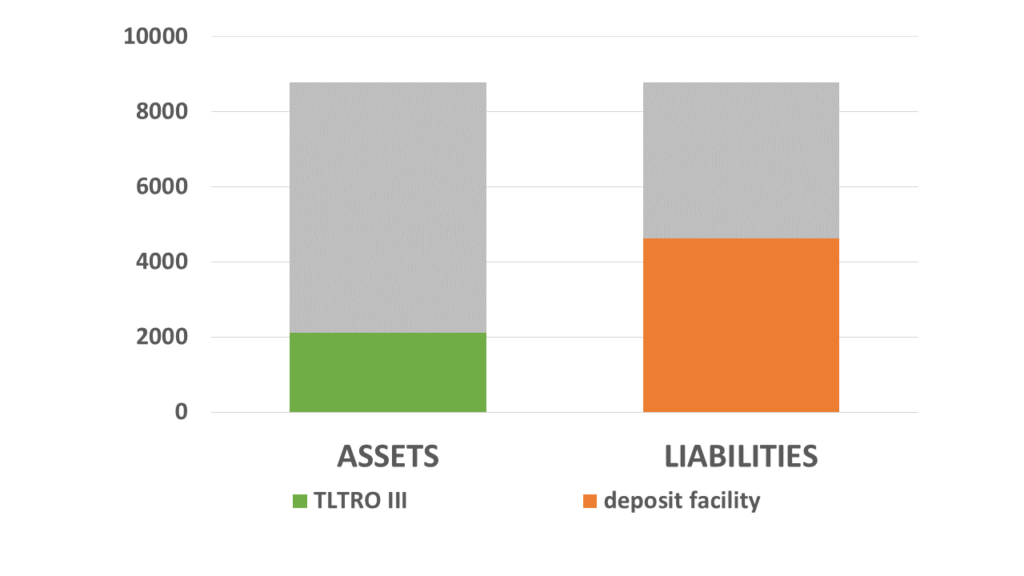

But this exposes the ECB to another problem, which is the mismatch between its assets and liabilities. While inflation was below target, the ECB bought trillions of euros of bonds. A lot of these have a fixed, negative yield. Under the PEPP, the pandemic emergency purchase program, the ECB put a turbo on this QE.

And how were these bond purchases funded? With bank deposits.

Now what happens when interest rates go up? The central bank starts to pay interest on these bank deposits, while its assets have a fixed yield.

According to one estimate, the Eurosystem is going to lose about 600 billion euro because of this failing risk management.

Anyone with a basic grasp of finance could have predicted this.

I even told the ECB to issue bonds instead of funding their assets with reserves.

Of course, they didn’t listen, because they’re so smart…

And what’s extra sad, is that the ECB has been complaining that governments haven’t invested enough in infrastructure.

Central bankers also complain about how untargeted government relief to help citizens and companies with their energy bills contributes to inflation.

The problem is again that the ECB didn’t put its money where its mouth was.

For years, QE has kept government funding costs in check, without any conditions on how governments should spend to keep inflation in check.

Maybe as a serious, non-political central bank, the ECB should have actually made sure that these crucial investments got done?

Instead, the ECB basically acted as a financial speculator, counting on low inflation and low interest rates forever.

Again, just imagine that the ECB would have invested not in securities, but in real infrastructure over the past decade.

How much better off Europe would be right now!

The final tide that went out in 2022 is that of Lagarde’s leadership.

Everybody knows that she’s not an economist. So maybe we shouldn’t blame her for failing to anticipate the inflation or the financial losses.

But she was previously a minister in France and the head of the International Monetary Fund.

So she must be a strong leader, right?

For those of you who’ve been listening to the podcast for a while, you might remember what I wrote in my New Year’s letter to Lagarde a year ago.

I suggested that either she quit, or she starts doing her job.

Obviously she’s still the President, so she didn’t quit.

But as the President, she should have fired the people who’ve been feeding her false predictions for all of this time.

At the end of 2021, ECB staff projected that euro area inflation would be about 3% in 2022. And core inflation would be below 2%.

I don’t know if it’s even possible for Lagarde to fire the most high profile economists like Isabel Schnabel or Philip Lane. But you’d expect some heads to roll.

But we didn’t see that at all. What we did see, was ECB staff asking for higher wages, to keep up with inflation.

Irony is dead…

Now before I go, I want to thank everybody who has supported this podcast and my YouTube channel. It’s not always easy to combine this with my other work, but I do appreciate your feedback!

In the coming year, I’m planning to release one podcast episode per month. And I want to do about a dozen deep dives into central banking and the financial system on the Finrestra Youtube channel.

So if you want to keep informed, please subscribe!

This has been another episode of the Finrestra podcast.

You can follow me on Twitter @janmusschoot.

You can mail me at jan.musschoot@finrestra.com

Thanks for listening and till next time!

(P.S.: Lagarde cartoon created with Dream by Wombo)