From the 1990s until the global financial crisis, there was a wave of consolidation and international expansion by Western European banks. Over the past decade, M&A activity has been a fraction of what it used to be. International banks have sold part of their foreign subsidiaries, either voluntarily or because regulators forced them to slim down.

Who did they sell to? Often to local or regional banks.

Examples (note that this is a work in progress! – most recent update 2 May 2025):

Africa

Barclays (UK) sells its controlling stake in Absa (South Africa and 9 other African countries) to investors (2017)

BNP Paribas (France) sells its holdings in Gabon, Mali and the Comoros to Ivorian Atlantic Financial Group (2020)

BNP Paribas (France) sells its subsidiaries in Burkina Faso and Guinea to Guinean Vista Bank (2021)

BNP Paribas (France) sells most of its stake in UBCI (Tunisia) to Tunisian Carte (2021)

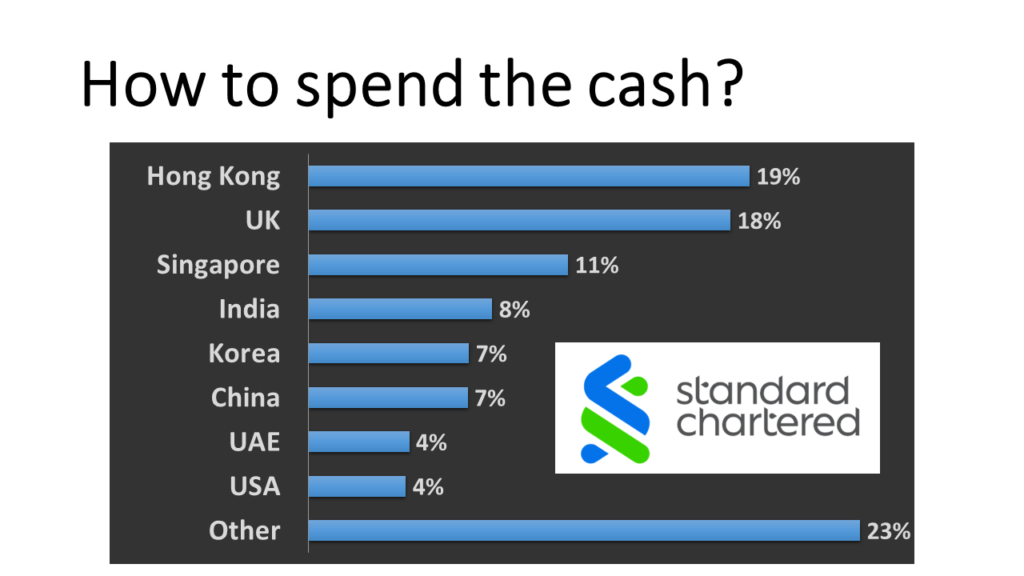

Standard Chartered (UK) exits seven countries, 5 in Africa and 2 in the Middle East (2022)

BNP Paribas (France) sells its majority stake in BICIS (Senegal) to pan-African SUNU (2022)

Société Générale (France) sells its subsidiaries in Congo Brazzaville and Equatorial Guinea to Guinean Vista Bank (2023)

Société Générale (France) sells its subsidiaries in Mauritania and Chad to Burkinabe Coris Group (2023)

Société Générale (France) sells its subsidiaries in Burkina Faso and Mozambique to Guinean Vista Bank (2023)

Société Générale (France) sells its subsidiary in Morocco to Moroccan Saham Finances (2024)

Société Générale (France) sells its subsidiary in Benin to the state of Benin (2024)

Société Générale (France) sells its stake in Société Générale Madagasikara (Madagascar) to French BRED Banque Populaire (BPCE) (2024)

Société Générale (France) sells its subsidiary in Guinea to Ivorian Atlantic Financial Group (2024)

Americas

BBVA (Spain) sells BBVA USA to American PNC Financial Services Group (2020)

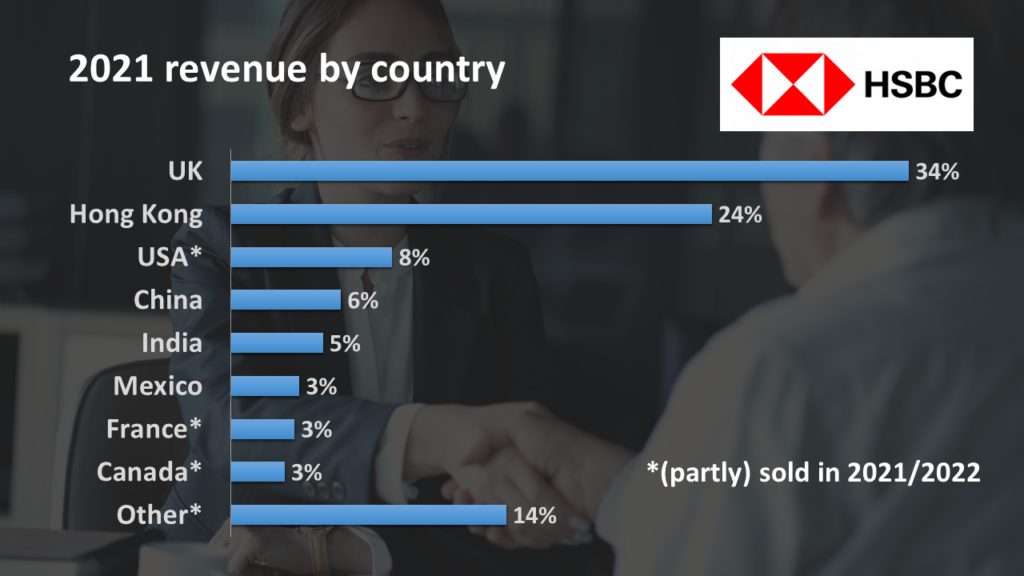

HSBC (UK) sells it retail business in the USA to American Cathay Bank and Citizens Bank (2021)

MUFG (Japan) sells MUFG Union Bank (USA) to American U.S. Bancorp (2021)

BNP Paribas (France) sells Bank of the West (USA) to Canadian BMO (2021)

HSBC (UK) sells its subsidiary in Canada to Canadian RBC (2023)

HSBC (UK) sells HSBC Argentina to Argentinian Grupo Financiero Galicia (2024)

Asia and the Middle East

Dexia (Belgium) sells Denizbank (Turkey) to Russian Sberbank (2012)

National Bank of Greece (Greece) sells Finansbank (Turkey) to Qatari QNB (2016)

Sberbank (Russia) sells Denizbank (Turkey) to (United Arab) Emirates NBD (2019)

ABN AMRO (Netherlands) winds down its corporate banking activities in Asia, Australia, Brazil and the US (2020)

UniCredit (Italy) sells most of its stake in Yapi Kredi (Turkey) (2020)

HSBC (UK) wants to exit Turkey (2020)

Citigroup (US) sells its retail banking activities in 13 markets, mainly in Asia (2021)

HSBC (UK) sells HSBC Oman to Omani Sohar International Bank (2022)

Central and Eastern Europe

AIB (Ireland) sells its stake in Bank Zachodni (Poland) to Spanish Santander (2010)

Barclays (UK) sells Expobank (Russia) to Russian financier Igor Kim (2011)

KBC (Belgium) sells Kredytbank (Poland) to Spanish Santander (2012)

KBC (Belgium) sells its minority stake in Nova Ljubljanska Banka (Slovenia) to Slovenia (2012)

KBC (Belgium) sells Absolut Bank (Russia) to Russian investors (2012)

Erste (Austria) sells its subsidiary in Ukraine to Fidobank (2012)

KBC (Belgium) sells KBC Banka (Serbia) to French Société Générale and Norwegian Telenor (2013)

National Bank of Greece (Greece) sells UBB (Bulgaria) to Belgian KBC (2016)

UniCredit (Italy) sells its controlling stake in Pekao (Poland) to local investors (2016)

RBI (Austria) sells its bank in Slovenia to Biser Bidco (2016)

Alpha Bank (Greece) sells Alpha Bank Srbija (Serbia) to Serbian AIK Banka (2017)

Cyprus Popular Bank (Cyprus) sells Marfin Bank (Serbia) to Expobank CZ (Czech Republic) (2017)

Eurobank (Greece) sells Bancpost (Romania) to Romanian Banca Transilvania (2017)

National Bank of Greece (Greece) sells its subsidiaries in Serbia to Hungarian OTP (2017)

Piraeus Bank (Greece) sells its unit in Serbia to Serbian Direktna Banka (2017)

Société Générale (France) sells most of its Central and Eastern European subsidiaries to Hungarian OTP (2017-2019)

Société Générale (France) sells Euro Bank (Poland) to Portuguese Millennium bcp (2018)

Bausparkasse Schwäbisch Hall (Germany) sells its stake in CMSS (Czech Republic) to Belgian KBC (2019)

Piraeus Bank (Greece) sells PBB (Bulgaria) to Greek Eurobank (2019)

National Bank of Greece (Greece) sells Banca Românească (Romania) to Romanian Eximbank (2020)

Danske Bank (Denmark) sells its unit in Estonia to Estonian LHV Pank (2020)

Danske Bank (Denmark) sells its business in Latvia to Latvian Citadele Bank (2020)

Handelsbanken (Sweden) closes its branches in Germany and Poland (2020)

ING (Netherlands) exits retail banking in the Czech Republic (2021)

Crédit Agricole (France) sells its subsidiary in Serbia to Austrian RBI (2021)

Crédit Agricole (France) sells its subsidiary in Romania to Romanian Vista Bank (2021)

RBI (Austria) sells its subsidiary in Bulgaria to Belgian KBC (2021)

Apollo (USA) sells NKBM (Slovenia) to Hungarian OTP (2021)

AnaCap (UK) sells Equa bank (Czech Republic) to Austrian RBI (2021)

Commerzbank (Germany) sells its subsidiary in Hungary to Austrian Erste (2021)

Sberbank (Russia) planned to sell its subsidiaries in 5 CEE countries to local banks (2021), but Sberbank Europe was closed by the ECB in 2022

Igor Kim (Russia) sells AS Expobank (Latvia) to Latvian Signet Bank (2022)

Société Générale (France) sells Rosbank (Russia) to Russian Interros (2022)

JC Flowers (USA) sells First Bank (Romania) to Italian Intesa Sanpaolo (2023)

Alpha Bank (Greece) sells its operations in Romania to Italian UniCredit (2023)

Eurobank (Greece) sells Eurobank Direktna (Serbia) to Serbian AIK Banka (2023)

HSBC (UK) sells its unit in Russia to Russian Expobank (2024)

HSBC (UK) sells its unit in Armenia to Armenian Ardshinbank (2024)

OTP (Hungary) sells OTP Bank Romania to Romanian Banca Transylvania (2024)

RBI (Austria) sells Priorbank (Belarus) to a UAE investor (2024)

ING (Netherlands) sells its business in Russia to Russian Global Development JSC (2025)

For more on bank consolidation in Central and Eastern Europe, see this report by Deloitte.

Western Europe

Citigroup (US) sells its retail banking activities in Belgium to French Crédit Mutuel Nord Europe (2012)

Crédit Agricole (France) sells Emporiki (Greece) to Greek Alpha Bank (2012)

Barclays (UK) sells its retail branches in Italy to Italian Mediobanca (2015)

HSBC (UK) wants to sell its retail banking operation in France (2020) Update: sold to French My Money Group (2021)

Degroof Petercam (Belgium) sells its private banking activities in Spain to Andorran Andbank (2020)

Rabobank (Netherlands) shuts down its online savings bank in Belgium (2021)

ING (Netherlands) sells its retail banking activities in Austria to Austrian bank99 (2021)

KBC (Belgium) sells its subsidiary in Ireland to Bank of Ireland (2021)

Crédit Agricole (France) sells Bankoa (Spain) to Spanish Abanca (2021)

Handelsbanken (Sweden) will exit Denmark and Finland (2021)

Banco Comercial Português (Portugal) sells Millennium Banque Privée (Switzerland) to Swiss UBP (2021)

Degroof Petercam (Belgium) sells its private bank in Switzerland to Swiss Gonet & Cie (2022)

RBC (Canada) sells RBC Investor Services (Luxembourg) to Franco-Spanish Caceis (2022)

HSBC (UK) sells its retail bank in Greece to Greek Pancreta Bank (2022)

Crédit Mutuel (France) sells Targobank Spain to Spanish ABANCA (2023)

Fosun International (China) sells private bank Hauck Aufhäuser Lampe (Germany) to Dutch ABN AMRO (2024)

Société Générale (France) sells its private banking subsidiaries in the UK and Switzerland to Swiss Union Bancaire Privée (2024)

Santander (Spain) sells its 30.5% stake in Caceis (France) to French Crédit Agricole (2024)

Exceptions

Caixabank (Spain) increases its stake in Banco BPI (Portugal) to 84.5% (2017)

BNP Paribas (France) buys Raiffeisen Bank Polska (Poland) from Austrian RBI (2018)

Crédit Agricole (France) buys three small banks in Italy (2017) and another one in 2020.

KBC (Belgium) buys OTP Banka Slovensko (Slovakia) from Hungarian OTP (2020)

BBVA (Spain) increases its stake in Garanti (Turkey) to 49.85% (2017) and launches a bid for the remaining shares (2021)

Eurobank (Greece) merges its subsidiary in Serbia with local bank Direktna Banka (2021)

For examples from 2022 and later, see this post.