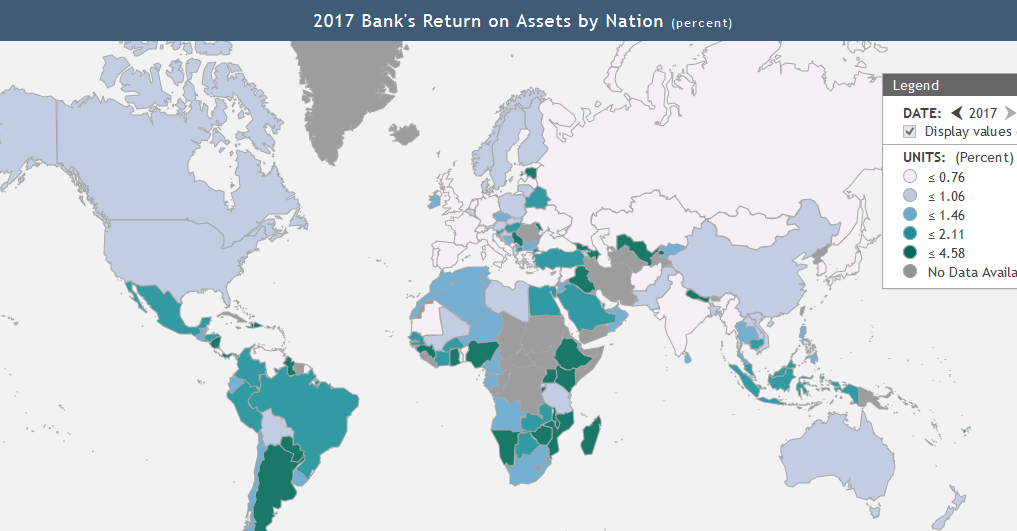

The FRED (Federal Reserve Economic Data) database is a treasure trove for bank geeks.

Bank’s return on assets by nation is one of many statistics that can be visualized with GeoFRED (click this link).

As you scroll through the years, you’ll notice a few patterns.

Return on assets is low in Western and Southern Europe, as well as in Japan.

Banks in the Americas, Africa and Central Europe achieve higher returns.

I’m curious to know what conclusions bank CEOs and regulators draw from these maps.

What are your thoughts?

Further reading:

Where in the world are banks profitable? (FRED blog)

Rethinking bank profitability (FT Alphaville, free but registration needed)