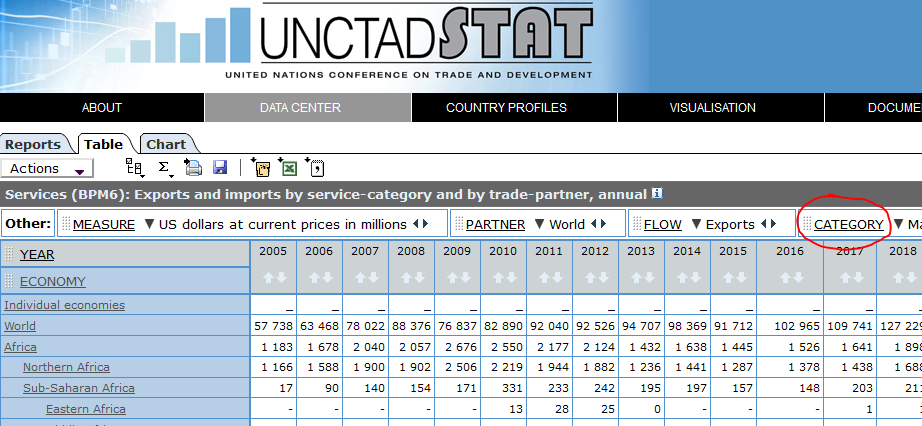

OCCRP published a series of articles on “OpenLux“. French newspaper Le Monde scraped a database with the ultimate beneficial owners (UBOs) of companies registered in Luxembourg.

To check the register yourself, go to the Luxembourg Business Registers website, click Portail LBR, click RBE, click Rechercher un dossier RBE. (I cannot provide a direct link, as the URL is time-sensitive and would show up as broken.)

The investigation did not find anything that shocks me. There is quite some research that shows Luxembourg is a popular location for holding companies (in addition to it being an investment fund center and a banking hub).

Something to keep in mind when reading such stories is that Luxembourg is quite transparent relative to its peers:

“According to EU regulations, member states were supposed to adopt publicly available beneficial ownership registers by January 10, 2020, but most have not done so. Luxembourg is one of only five member states to have implemented a register that is free and publicly accessible. The others are Bulgaria, Denmark, Latvia, and Slovenia.

Though other EU member states also have registers, seven have put up paywalls and 17 have not made theirs available to the public. The U.S. Corporate Transparency Act, which passed last month, calls for the United States to set up a UBO register as well, but it will be made available only to law enforcement.” (source)