This paper by Guerrieri, Lorenzoni, Straub and Werning (GLSW) looks at the macroeconomic effects of Covid-19.

The authors argue that

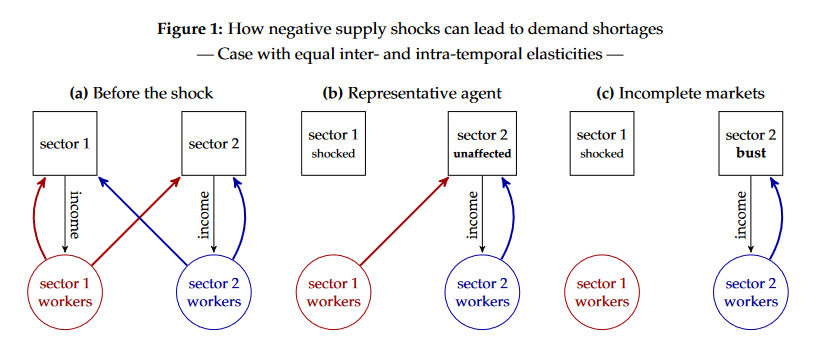

- the economic shocks associated to Covid-191 can cause a fall in aggregate demand that exceeds the original shock

- fiscal stimulus is less effective than usual because some sectors are shut down

- monetary policy can prevent firm exits and is more effective

- the best policy is to close contact-intensive sectors and to provide insurance payments to affected workers

My summary of the GLSW model (their paper is 37 pages long, so obviously I’m oversimplifying and probably missing important things!):

There are two sectors (one shuts down and the other remains open), similar to my approach. Firms exit when they can no longer pay their fixed costs. They fire their workers, who can then buy less, causing some of the remaining firms to exit. This business exit cascade causes demand to fall more than we would expect by the initial shock.

In order to prevent this cascade into a bad equilibrium with lots of unemployed workers, GLSW discuss two policies.

The first policy is a profit subsidy/payroll tax cut. More firms can remain profitable and they don’t exit.

The second policy is monetary policy. Lower real interest rates increase aggregate demand, which prevents firm exits.

GLSW also study the effect of labor movement between the sectors. They conclude “the optimal policy to face a pandemic in our model combines as loosening of monetary policy as well as abundant social insurance“.

My comments:

The paper studies the real economy. Money and banks2 are taken into account implictly. Still, the GLSW model includes borrowing constraints, interest rates, wealth and taxes.

Subsidies are paid for by taxing employed workers in the model. In reality, the government can and does borrow to fund its deficits.

The net worth of ‘workers’ (in reality households, which include investors/business owners and consumers who don’t work) includes business equity and non-business wealth including real estate. It is not clear how GLSW take this into account.

How can the GLSW model estimate the size of the shocks and the amount of fiscal and monetary stimulus needed to prevent a recession?

My own ‘phenomenological’ analysis of the corona crisis also takes into account the open and closed sector. In addition, my model has three more agents: households, the government and banks.