Big shoes to fill

Christine Lagarde took over the ECB from Mario Draghi in 2019. Draghi was widely respected as the man who saved the euro. He promised to do ‘whatever it takes’ when prices for bonds of large euro countries were unsustainably low. Furthermore, Draghi introduced monetary policy tools that were considered radical at the time, such as quantitative easing (buying bonds) and targeted refinancing operations (lending to banks).

Critics suspected that Lagarde would be no match for her predecessor. Indeed, Draghi was an economist and former banker. By contrast, Lagarde was ‘merely’ a lawyer and politician.

Maybe that is why her opponents would systematically underestimate Lagarde. Time and again during her presidency, she followed the same strategy. Instead of trying to come up with new ideas herself, she listened to all options. Not just those of an inner circle of old central bankers and professors, but especially the alternatives suggested by junior staff and independent thinkers. Once Lagarde made up her mind on the right course to follow, she used her political skills to win the day.

The 2020 review

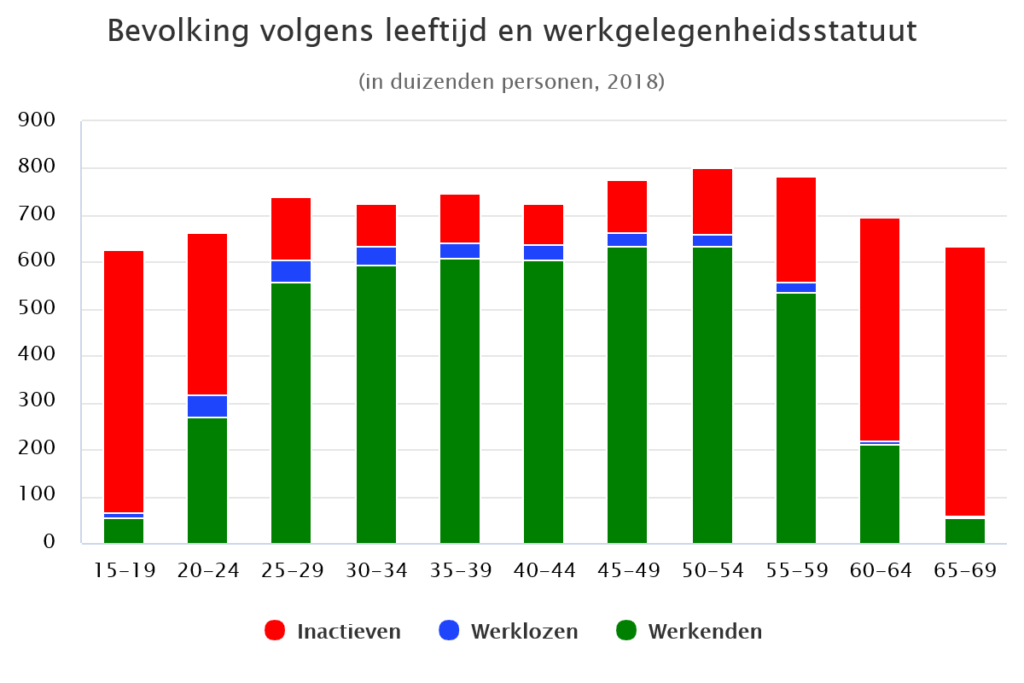

But let’s return to the start. Although Draghi’s ECB had performed better than under the disastrous Trichet, all was not well. Unemployment in the euro area was high. The ECB’s interest rates were negative. Inflation in the euro area was below the two percent target. The contemporary consensus said that the central bank was out of ammo.

It was in this context that Lagarde launched a monetary policy review. She wanted to know how the ECB could boost economic growth and fight climate change.

The policy review set in motion the bureaucratic cogs of the ECB. Meanwhile, Lagarde was subtly consolidating her power. She kept a tight grip on meetings and did not tolerate leaks. She also improved communication with national leaders and the European Parliament.

But most importantly, Lagarde read the Internet. And what she read did not make her happy. Lagarde’s advisors had assured her that the ECB’s hands were tied. They claimed that the institution was powerless in the current macroeconomic environment and that fiscal stimulus was needed.

But online, she discovered that central banks had historically used instruments that none of the very serious people were talking about. It was as if everybody suffered from amnesia.

In the spring of 2020, Lagarde held a secret meeting with three outsiders. The quartet of conspirators hatched a plan…

===

Next episode: the conference of the long knives

First episode: Paris, 2076