There is a lot of talk about helicopter money on economics blogs and in newspapers lately. As usual, accounting and drawing pictures to explain their ideas are not economists’ strong suit. The predictable result are heated discussions, but not much enlightenment1. This post gives an introduction into what helicopter money is and how it affects the balance sheets and income of economic agents. In a future post, I will explain what helicopter money is supposed to achieve and under which conditions it can be an appropriate macroeconomic policy.

The idea of helicopter money is exactly as the name suggests: money is thrown from helicopters, free for all to take. Formulated a bit less poetically, somebody gives all citizens of a country a certain sum of money. This immediately raises two questions: who throws the money, and where does the money come from?

Based on what I have read, is always implicitly assumed that the government throws the money2. Some would argue that the central bank is the ‘person’ in the helicopter. Actually, this distinction is irrelevant when the central bank is owned by the state. The state and central bank can be consolidated into one entity. In any case, the bottom line of helicopter money as discussed here is that citizens end up with money given by the state.

The government can either borrow or own the money it gives away. Let’s have a closer look at these possibilities.

1. The money is borrowed

When the government borrows money and gives it away, the result will be that citizens are richer3 and the government has a debt. It does not matter who lends the money to the government, as illustrated in the three following cases. In case you are not familiar with accounting and how banks create money, please read my previous post first. Quick reminder: T-figures represent balance sheets. Assets (what somebody owns) are on the left; liabilities (what is owed to others) are on the right.

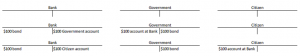

a) The money is borrowed from a bank

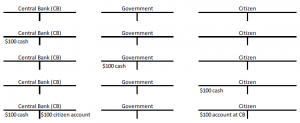

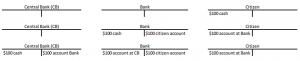

The picture shows how this works: the government issues a bond. The bank buys this bond by crediting the account of the government. The government then wires the money into the accounts of its citizens. The government is now in debt ($100 in this example), the bank has not earned any money4 and the citizen is $100 richer.

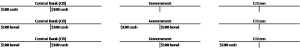

b) The money is borrowed from the central bank

The example above also works if the bank is the central bank5. What distinguishes the central bank from other banks, is that it has the right to issue physical cash (coins and bank notes). All banks can create money by creating liabilities (=deposits of its clients), but only the central bank can print paper money. When the central bank lends out physical money, it must also create a corresponding liability on its balance sheet, as a “reminder” that it is not richer because it has printed money (do read this post entirely before freaking out, especially scenario 2a!). The central bank buys a bond issued by the government with $100 cash. The government now gives this cash to the citizen, who is $100 richer while the government is $100 in debt. The central bank has not made any money in this transaction:

Just for completeness, it should be noted that the end result of this scenario is equivalent to scenario 1a, where the bank is the central bank. When the citizen deposits his $100 bill at the central bank6, the central bank has the cash back as an asset and has created a deposit for the citizen. The central bank now can destroy the physical cash, and at the same time delete the “reminder” in its liabilities that it had printed $100:

c) The money is borrowed from citizens

This scenario speaks for itself. The citizen lends $1007 to the state and gets a bond in return. Then the state makes a gift of $100 to the citizen:

2. The money is not borrowed

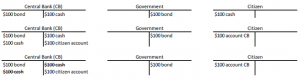

a) The money is printed by the central bank

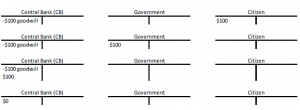

Suppose that the central bank prints money, but does not add a corresponding liability in its balance sheet. The equity (equity = assets – liabilities) of the central bank rises by $100 in our example below. The central bank pays this profit as a dividend to its shareholder, the state. The government then gives the money to the citizens, who might deposit it at the central bank:

Note that there is no increase in government debt in this scenario, the money is literally printed out of thin air. The central bank does not acquire a claim on another entity (in contrast to scenario 1b, where it swapped its cash for a bond) with the money it printed, nor does it pay for an asset such as gold. Under a gold standard, central banks were only allowed to issue paper money proportional to the amount of gold it owned. People could swap their bank notes for gold. Fiat money systems do not work like that. You cannot ask anything from the central bank in return for your bank notes. The only thing backing the value of the money is the fact that other people accept to be paid with it (for goods, services or taxes).

Mind you that there is nothing special about physical money. In a cashless society, digital money “printing” is just as easy. All that is required is that the central bank increases its assets. For example, it might revalue its banking license. This is comparable to how regular companies use goodwill as an intangible asset. Or the central bank might make platinum coins and give them an arbitrary value8. The central bank pays the government its $100 dividend through a regular bank. In return, the regular bank gets a $100 deposit at the central bank.

It is important to realize that the money ‘printed’ (physical cash or digitally) by the central bank as in scenario 2a can never go away by actions of the central bank alone9. No economic agents have any contractual obligation to pay money to the central bank. This is an important contrast to the scenario in which the central bank owns bonds.

That does not mean that the money printed by the central bank needs to exist in eternity. In principle, the central bank could write down its goodwill. This results in a negative equity value. The government could then recapitalize its central bank with taxes, thus reducing the amount of money held by its citizens:

Another possibility is that the government defaults on the currency itself, and starts a new one. The most famous example of this is the abandonment of the Papiermark by the German Reichsbank after the hyperinflation of the early 1920’s.

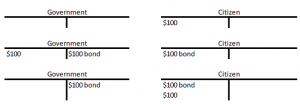

b) The money was saved previously

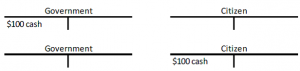

In an ideal situation, the state acts as a countercyclical agent in the economy. It does helicopter drops in an cyclical downturn, using money it has saved while the economy was doing great:

This could be done without borrowing money or having the central bank print it. Given how politics works in real life, this is a highly unlikely scenario.

A related scenario would be if the government sells assets as a form of ‘dissaving’. The result is that the government is poorer (although not in debt), and the citizens are richer.

c) The money is taxed from citizens

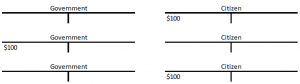

Taxing and spending is trivial:

Neither the government nor the private sector (on an aggregated basis) is any richer or poorer by tax and spend. Of course, even if helicopter money were raised with taxes, the money would not end up in the same pockets it was taken from. In this post, all citizens (and companies) have been lumped into one ‘Citizen’. The distributional aspects of helicopter money will be discussed in a future post.

Wrapping up

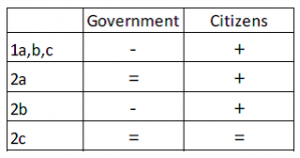

The scenarios sketched above can be summarized in the following table, describing how the helicopter money shifts the nominal financial wealth (increase +; stays equal =; decrease -) of both sectors (the state/government and the private sector/citizens):

When economists talk about helicopter money, they all seem to imply scenario 2a. The government gives money to the people. The money has not been borrowed, but has been created by central bank printing.

Quantitative easing (QE) on the other hand corresponds to scenario 1b10. The central bank lends money to the government in return for bonds. The private sector ends up with central bank money (physical cash or at an account of the central bank), but there is an explicit commitment (the bond) of the government to pay back this money to the central bank.

This has been a quite pedantic post, because I wanted to be very explicit about my assumptions and be transparent about all balance sheets. I am glad you made it to the end 🙂 If you spot any errors or have questions about this post, please let me know in the comments!

===

There is a chapter on helicopter money in my book Bankers are people, too: How finance works.

- This opinion of economics and its practitioners is cleverly captured in the book title More heat than light.

- Theoretically, the entity throwing the money does not need to be the government. I see no reason why it could not be an extremely generous private entity.

- In this post, ‘richer’ means that they have a larger nominal amount of money than before the ‘helicopter drop’.

- Except for the interest on the bond, which is not relevant for this discussion.

- If you are very meticulous, you might object. In the post on QE I wrote that private persons cannot have an account at the central bank. You would be right, but this does not matter for the core of the argument. The person then has an account at a regular bank, who has an account at the central bank:

- Or at a regular bank, which then deposits the $100 bill at the central bank.

- It does not matter whether this is physical cash or on a bank account.

- This idea circulated in the US a couple of years ago, see this for a brief explanation.

- Here I ignore the possibility that the central bank would default on the account that regular banks have at the central bank. Because that money cannot be claimed in anything else than physical money of the same currency, default would not make any sense.

- I am aware that the Fed and ECB do not directly buy the bonds at the issue date in their QE programs. Rather, they buy them from private investors. This does not change anything to the end result: the government bonds are owned by the central bank, while regular banks hold accounts at the central bank.

“central bank prints money, but does not add a corresponding liability in its balance sheet.”

Money needs to be a liability for the central bank, a (any) bank cannot issue assets to itself. Naturally printing needs to be subtracted from the equity, as there is no corresponding asset. But it can still give away the money.

Yet, I think it is often useful to think that the government as an owner then looses equity (this is the accounting logic anyway). But equity here is not relevant itself but how it affects the economy as a whole.

In accounting “everything comes from somewhere and everything goes somewhere’s”. You might enjoy this book:

http://dl4a.org/uploads/pdf/Monetary%2BEconomics%2B-%2BLavoie%2BGodley.pdf