Professor Christopher Balding has published a blog post with his views on the link between the China’s banking system and its currency: Can China Address Bank Problems without Having Currency Problems?

He believes that “it is much more likely that if there are systemic banking issues that currency problems will also arise.”

It is laudable that Prof. Balding summarizes his arguments. By being explicit about the assumptions, readers don’t just have to trust his opinion. Instead they can follow the logic and evaluate the strong and weaker points themselves.

The goal of this post is to counter some of the points listed by Balding to support his conclusion.

First two disclaimers:

- Unlike Prof. Balding, I am no China expert. My knowledge of the country’s economy is mainly based on reading Michael Pettis, FT Alphaville and other media.

- I don’t have a complete theoretical framework to think about the combination of asset prices, exchange rates, and the financial system.

My objections are based on (a) technical banking issues and (b) similar episodes in other countries.

In point 4.A, Balding writes: “Assume that China opts to issue bonds to recapitalize its banks. It cannot sell the bonds to banks, who by definition lack the capital”.

This statement doesn’t make a lot of sense. Recapitalization of the banks means that their assets should increase more than their liabilities (i.e. deposits). If the banks were to buy government bonds, their assets and liabilities would rise by the same amount, which doesn’t increase their capital.1

As a side note, banks technically don’t need capital to buy bonds, as they create money (deposits) when they pay for things.2

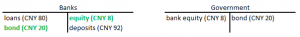

Most likely, the government would recapitalize the banks by giving them new bonds in return for a stake in their equity. The government does not have to sell its bonds to anyone to do this transaction.

Here is how it works schematically:

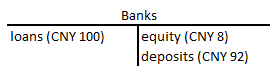

Suppose China’s banking system is given by figure 1. For every CNY3 100 in loans, there is CNY 92 worth of deposits and the banks have a CNY 8 capital buffer. The 8% capital buffer is based on figures compiled by the World Bank.

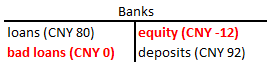

Many China observers think that the banks hold a lot of loans that will turn out to be bad. In 2016, non-performing loans made up only 1.7% of the total amount of loans.

Let’s say that the real amount of bad loans will turn out to be 20% of all loans, as suggested by ratings agency Fitch.

Figure 2 shows what happens when the bad loans are written off, assuming that the loss given default is 100%. The banks’ capital buffer is negative. In other words, they don’t have enough assets to cover their liabilities to savers.

In figure 3, the government issues CNY 20 worth of bonds and hands them to the banks. The total assets of the banks are now again CNY 100. If the previous shareholders are wiped out, the government’s equity stake is worth CNY 8.

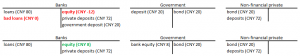

By the way, an option Balding doesn’t mention is that the government would sell bonds to the non-financial private sector. People who mistrust the safety of their bank deposits and that do not need the money in the near future would prefer to hold debt issued directly by the central government.

Figure 4 shows this option in two stages. First money moves from private bank accounts to a government account. The private sector swaps CNY 20 bank money for a CNY 20 bond. Next the government converts its deposit into bank equity. In this scenario, the assets of the banks stay the same, but their liabilities decrease.

But let’s return to Balding’s post. He continues his argument that commercial banks cannot buy bonds with:

“so it [the government] sells the bonds to the PBOC who increases the money supply above an already strong growth pace.”

The PBoC is the People’s Bank of China, the Chinese central bank. In this scenario, banks would be recapitalized with new reserves. Figure 5 shows the accounting aspects of such an operation.

The banks get recapitalized with an injection of new reserves, which by definition have a fixed nominal value. The deposits of the private sector are safe, as the banks are solvent again.

Mind that the amount of money (bank deposits) held by the non-financial private sector does not change because of this operation. There is only more base money within the banking sector.

Balding worries that “[e]ven stronger money growth would place significantly stronger pressure on the RMB. It seems inconceivable that China could materially grow the money supply above current trends and would not face some type of major currency adjustment.”

This sounds very much like a repeat of the 2010 open letter to Ben Bernanke, warning that QE2 could lead to currency debasement. Nothing of the sort happened.

Moving on to point 4.B, which says that the PBoC cannot bail out the banks, because it doesn’t have enough money: “Depository corporations in China have total assets of 236 trillion RMB. $3 trillion converted into RMB is only 20.7 trillion RMB or only 8.8% of assets. Any significant loss or recapitalization is going to require more than the amount of FX reserves held by the PBOC.”

The limited amount of foreign exchange relative to the total liabilities of the banks could be a serious issue, but only on condition that bank liabilities or private sector debts are denominated in a foreign currency. That was the case during the 1997 Asian financial crisis. In that crisis, the domestic central banks had no control over the currency that the private sector needed.

But Chinese bank deposits are in renminbi, which the central bank can create at will. The PBoC does not need to sell any FX reserves to get CNY. Just as the Bank of England or the Bank of Japan wouldn’t need to sell dollar reserves to obtain pounds or yen, respectively.

To be fair, I don’t deny that it is possible that fears about the bank bailouts would cause a weakening of the CNY, which in turn would prompt the PBoC to support the CNY by selling USD. But the amount of FX reserves doesn’t constrain the ability to conduct bailouts in local currency.

Point 4.C describes the possibility to transfer bad loans to distressed asset management firms, i.e. bad banks. This point repeats that losses would be enormous and lead to growth in the money supply: “Ultimately, we return to the problem that any significant increase in capital to bailout the Chinese banking system will require an enormous increase in the money supply on top of the already robust rates.”

As shown above in figures 3, 4 and 5, bailouts would in fact not increase the amount of bank money. Only in figure 5 do reserves grow, which is probably what Balding means by the money supply. In figure 4 the amount of bank money held by the private sector even goes down.

So the statement that a “large increase in money is going to place enormous downward pressure on the RMB” is not very convincing, since there would not be a large increase in the amount of money!

Please note that I am not saying the amount of money held by the non-financial sector cannot rise. Indeed, it the government were to borrow from the PBoC and spend that money on the non-financial private sector, without taxing it back, the volume of bank deposits would grow rapidly. This scenario would most likely lead to inflation, which makes it easier for debtors to pay back their loans.

Balding describes such an ‘inflationary bank bailout’ scenario in point 6. He considers the possibility that the bailout is accompagnied with rapid loan (and thus money) growth. I don’t know if that would “result in significant pressure to move capital out of China”, but there is a case to be made that fast money growth would indeed lead to a depreciation of the CNY.

The opposite scenario under point 6, in which Beijing constrains lending, is more interesting. Tighter credit conditions would lead to a collapse in asset prices. People wouldn’t be able to get mortgages to buy apartments that are very expensive compared to their annual incomes anymore. Balding writes: “What will happen to prices? They will fall and when they fall people will most likely look to get their money out of China. If people are worried about the fall of the CNY and try to get money out, imagine what will happen when real estate prices (responsible for about 75% of household wealth) starts falling. It is very reasonable to believe this will increase real estate price pressures with people looking to move money out of China.”

As Prof. Balding anticipates in point 7, I am one of those people who takes issue with this. I do not understand why you would want to move money out of China if asset prices fall (on condition that the banks are bailed out and don’t collapse). Even if you don’t trust the banks, you could hold your savings in physical cash. Because if asset prices fall, the buying power of your cash goes up. Falling asset prices and restricted money growth are catalysts for an appreciating currency.

This is not just theory. The Japanese stock market bubble popped on the last day of 1989, soon followed by falling real estate prices. Yet the yen appreciated relative to the US dollar from 1990 to 1995.

The logic of point 7 is that Chinese firms and citizens would prefer foreign assets to domestic ones, if domestic asset prices fall. Nobody would like to buy Chinese assets at overvalued prices. Balding argues that would be a problem if the government intends to sell public sector assets to fund the bailouts.

But I wonder if asset sales by the government would not in fact be a great opportunity to rebalance the economy. Michael Pettis has been arguing for years that there needs to be a shift of wealth and/or income from the public sector to households. If Beijing sells land and shares in state owned enterprises (SOEs) to the public at low prices, that would be a massive redistribution of resources towards the private sector. GDP could continue to grow thanks to increased household consumption.45 At the same time, credit intensive government investment would fall, something that had to happen sooner or later.

Lastly, point 8 puts the magnitude of the challenge in perspective. Total bank loans stand at 316% of Chinese GDP. Because most debt is considered to be de facto backed by the state – although Beijing has allowed defaults before – bailouts would lead to a large rise in government debt: “it wouldn’t take a large bailout as a percentage of total asset to take Chinese central government debt soaring into Grecian territory.”

Instead of drawing similarities to Greece, think about the experience of Ireland and Spain. Both countries had to bail out their banks after real estate bubbles burst. As a result, their government debts exploded.

However, I think there is a case to be made that the sudden rise in government debt would not have resulted in major capital flight or currency depreciation, if Ireland and Spain still had had their own currencies. Why? Because the US and the UK also had large deficits at the time, which did not lead to currency crises. Of course, in reality Ireland and Spain depended on the European Central Bank.

The point is, even a rapid run-up in Chinese sovereign debt to bail out its commercial banks would not automatically lead to a weakening CNY. Japan is probably again the best reference point6: it has a high government debt – much of it funded by the central bank, but its currency has not collapsed, although many predicted for years that it would.

Let me conclude with two thoughts.

What is strangely missing from Prof. Balding’s discussion is any mention of interest rates. If the PBoC wants to control FX rates, interest rates would be the most straightforward tool to keep money in the country, rather than outright selling FX reserves. But high interest rates could lead to more defaults. Any complete analysis of China’s financial predicament should take interest rates into account.

Finally, I fully concur with Prof. Balding that one has to think in probabilities. What ultimately happens will be the result of choices by politicians, central bankers, and the corporate and household sectors. Nobody – certainly not me – knows for sure what will happen to China’s banks and currency. But at least we can try to think through all the relevant pieces.

===

If you like this analysis with balance sheets, you’ll love my book Bankers are people, too.

- Strictly speaking, this isn’t fully correct. The government could pay interest on the bonds while it doesn’t receive an interest on its bank deposits. This would result in a gradual recapitalization of the banks.

- Besides, government bonds have a 0% risk weight, so there wouldn’t even by any legal problems if banks with low capital ratios wanted to buy more bonds.

- I use CNY instead of RMB as symbol for the renminbi.

- Evidently, there will be winners and losers among private sector entities. Those with a lot of cash and without real estate/stocks before prices crash would be in the best position to pick up assets on the cheap. Families whose wealth was locked up in their home will suffer a negative wealth effect.

- I am aware that more household spending can result in more imported consumer goods, putting pressure on the CNY.

- Better than Ireland and Spain, as China has a trade balance surplus and a domestic central bank, just like Japan.

“Most likely, the government would recapitalize the banks by giving them new bonds in return for a stake in their equity.”

Sure, but keep in mind that’s essentially printing money and exchanging it for (potentially worthless) equity while putting that equity on the PBOC balance sheet where it creates all kinds of economic distortions (imagine the Fed doing this with BofA). It’s a kludge but it can work for a while, as long as investors don’t see an endless string of recapitalizations stretching over the horizon that would dilute the equity to near zero.