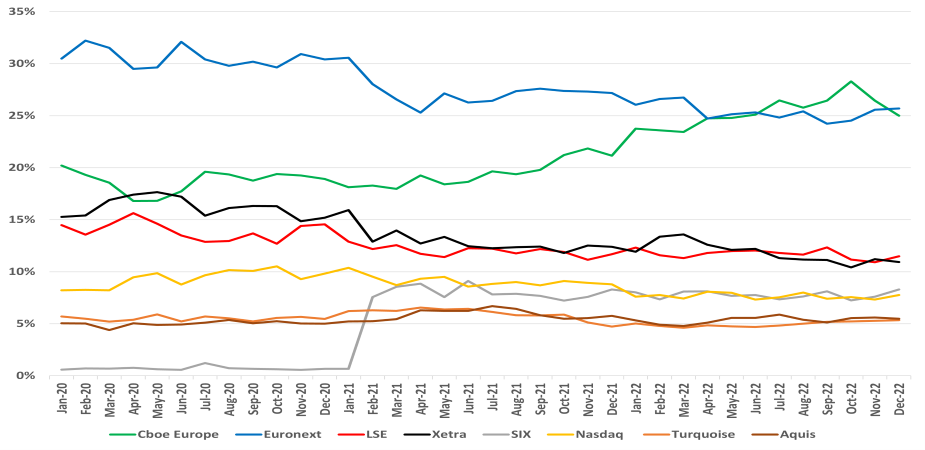

European equity exchanges market share (source: Cboe)

Labour earnings by economic activity (Eurostat)

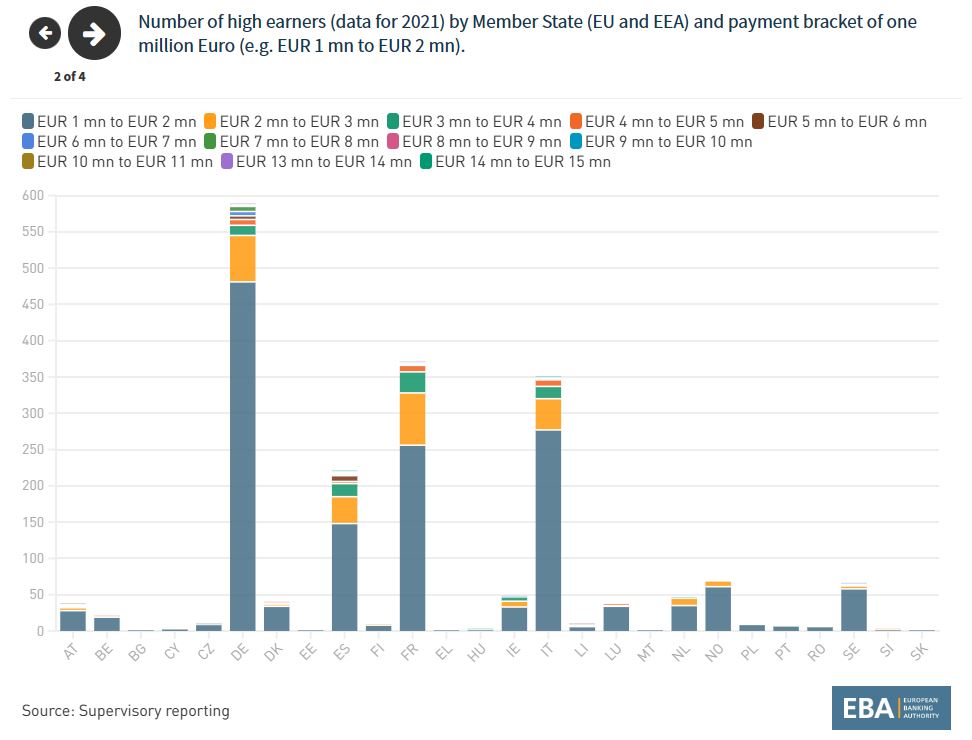

High earning bankers (EBA)

Why was Charles' Imperial Chinese bond issued in… Brussels 🇧🇪? 🤔 https://t.co/KCiBIkBoQ4 pic.twitter.com/wIQL8BuYPH

— Finrestra 🎙️ podcast (@JanMusschoot) January 27, 2023

Belgium (Antwerp) is Europe's largest diamond importer ($8.6 billion in 2020, of which $1.5 billion from Russia).

— Finrestra 🎙️ podcast (@JanMusschoot) January 30, 2023

Only a handful of countries mine diamonds. https://t.co/AK9dhgzC0E pic.twitter.com/THAXFkpqXn

Would be great if monetary and fiscal policy makers could agree on how to deal w 👇 https://t.co/LNXqCu4l3v pic.twitter.com/KMcztUBh9X

— Philippa Sigl-Glöckner (@PhilippaSigl) January 31, 2023

All high debt Eurozone economies continue to reduce public debt at a pace exceeding that required by the existing fiscal rules – even France (just about) 😱

— Daniel Kral (@DanielKral1) January 24, 2023

Among them, Greece and Portugal stand out – both have fully eliminated the pandemic-era debt surge. Impressive! https://t.co/RZjAn0LOiy pic.twitter.com/1PkKmtQlAs

Another problem of the EPCs is that they are not harmonized across the EU. Thresholds and criteria are determined at the national level, creating major issues of comparability across countries. This is of course a problem for those who want to use EPCs as a proxy for risk. 8/12 pic.twitter.com/LYvu7Vu39I

— Fabio Tamburrini (@FabioTamburrini) January 18, 2023

Can anyone explain why wind-turbine orders are down in EU?? @RikHJHarmsen https://t.co/bbZfQxYYRS pic.twitter.com/GrzpuJ7Tsj

— margriet kuijper (@MargrietKuijper) November 26, 2022

Credit availability has a crucial role in aiding firms invest in #GreenTech, & thus credit crunches could slow down the #GreenTransition.

— VoxEU (@voxeu) January 6, 2023

M Tomasi @UniTrento, E Garcia-Appendini @UZH_en, @giorgiabarboni @warwickecon, @mcascarano, A Accetturo @bancaditalia https://t.co/x62DucRKUT pic.twitter.com/SFb7SbPrTZ

Our @voxeu column today, on local #jobs and investments in #renewable energy ☀️🌬️🍃:

— Natalia Fabra (@NataliaFabra) January 5, 2023

Do jobs remain in the municipalities where the ventures are built? https://t.co/OPnkX6hK7s

#Chart These charts show that fiscal support measures in the euro area were mostly untargeted and that public investment was very low. 18/19 pic.twitter.com/oqbB5s2Bx6

— Isabel Schnabel 🇪🇺🇺🇦 (@Isabel_Schnabel) January 4, 2023

The SNB reported a loss of CHF132 bn in 2022, of which CHF131 bn came from losses on foreign currency positions. This is by far the largest loss on record. pic.twitter.com/UbykA8QNa1

— Nadia Gharbi (@nghrbi) January 9, 2023

Huh virtually everything seems to stagnate or get an awful lot worse from around about the 2010 mark. Wonder what happened! pic.twitter.com/TfDUg3NUR8

— 🌲 Leia 🌲 (@lmurrz) December 23, 2022

Signs are emerging of diversification in global solar PV supply chains, with the US & India set to boost investment in solar manufacturing by up to $25 billion in the next 5 years

— Fatih Birol (@fbirol) December 6, 2022

China remains the dominant player, but its global share may decrease from 90% today to 75% by 2027 pic.twitter.com/GJrBUTN0Z5

The asset management units of Deutsche Bank and BNP Paribas are adding to a tidal wave of ESG fund downgrades https://t.co/CAAkmpf4Sl @ntashawhite @greg_ritchie @StevenArons

— Christoph Rauwald (@Rauwald) December 2, 2022

https://t.co/bYRA2W8DH0 pic.twitter.com/8gayKwpbE7

— Jordi Schröder (@SchroderJordi) November 28, 2022