BIS Statistics: international banking, debt securities, derivatives…

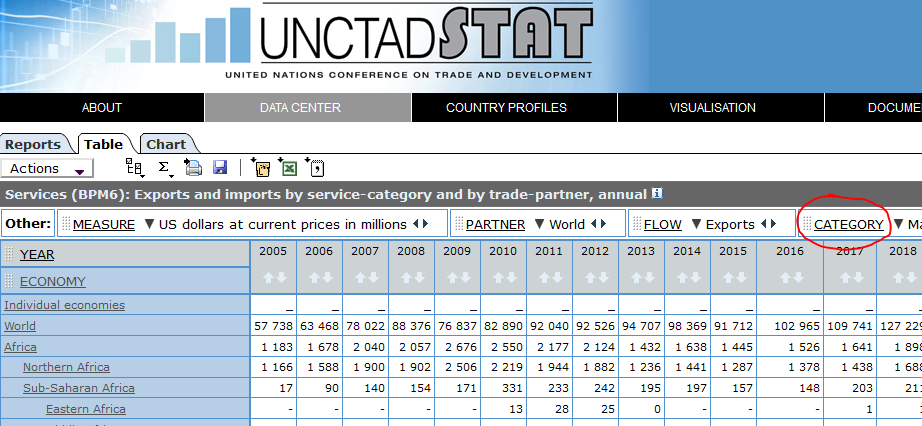

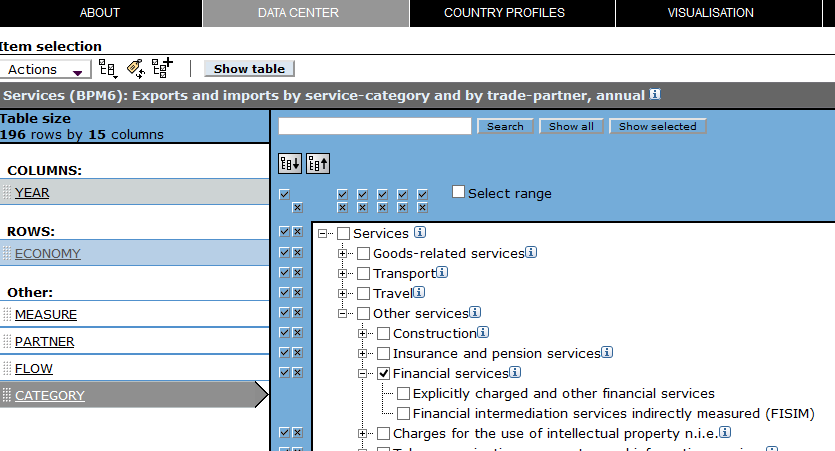

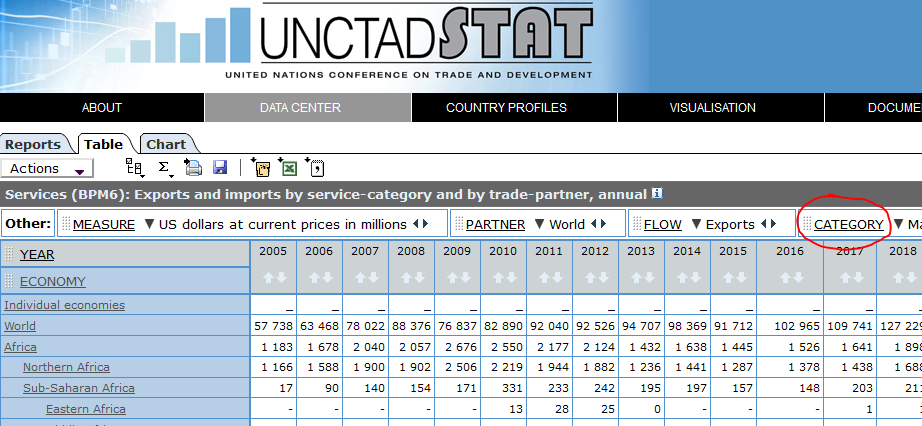

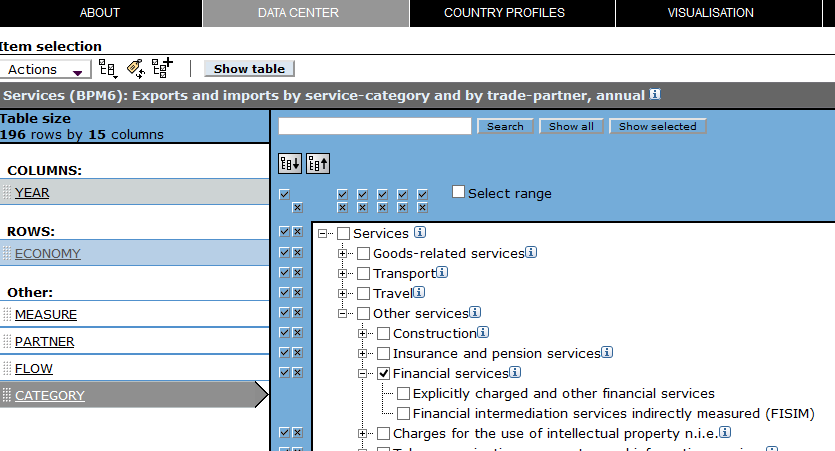

I-TIP Services (World Trade Organization and World Bank): imports and exports of financial (and other) services

BIS Statistics: international banking, debt securities, derivatives…

I-TIP Services (World Trade Organization and World Bank): imports and exports of financial (and other) services

Financial Market Reports, includes outstanding bonds

Aggregate assets and liabilities of Financial Institutions (banks, insurers, securities institutions)

Monetary Policy Reports, includes breakdown of loans and deposits by borrower (households, enterprises and public entities, non-banking financial institutions, overseas), lending volumes according to size of banks, Aggregate funding to the real economy according to loans, bonds, other funding; balance of payments, foreign exchange reserves

Monetary Policy Instruments, including Open Market Operations (short term reverse repo), Required Reserves (required reserve ratios), Interest Rates, Lending Facilities

Interest rates and exchange rates

Money and Banking Statistics, includes Balance Sheet of Monetary Authority (i.e. People’s Bank of China)

Dubai (query for bank/banc/banque/credit in the company name and status = active)

European Union (query for individual banks available here)

New York (query ‘Foreign Agency’ and ‘Foreign Branch’ to find the international banks in NY)

United States (national banks, supervised by the OCC)

If you know where to find official lists of banks in China, please let me know in the comments!

Productivity isn’t everything, but in the long run it is almost everything.

Paul Krugman

International datasets on productivity:

EU KLEMS (‘measures of economic growth, productivity, employment, capital formation, and technological change at the industry level for all European Union member states, Japan, and the US’)

CompNet (‘micro-based competitiveness dataset for European countries, unprecedented in terms of coverage and cross-country comparability’)

How are economic statistics collected? Do economic models correspond to observable reality?

In a world where markets and politicians respond strongly to things like gross domestic product (GDP) figures and economic forecasts, these are important questions. Unfortunately, discussion often jumps directly to the interpretation of new data or the output of models. Students are rarely challenged to question what the data and the models represent.

I recently came across two great articles that dig into these issues. Continue reading “Economics is hard”