This post highlights the financial problems caused by (the reaction to) the coronavirus. I look at the balance sheets and cash flows of five sectors. The five sectors are (1) businesses that continue operations, (2) businesses that are closed due to the coronavirus, (3) households, (4) the government and (5) banks.

Key findings:

- Businesses face a cash crunch

- The net worth of households falls by about 50% of GDP due to lower stock prices

- Each month of lockdown costs about 2% of annual GDP

- The accrual of fixed costs while revenue is down is the fundamental problem of the corona crisis

- Loans and tax deferrals can prevent bankruptcies for a while

- However, loans and tax deferrals don’t protect businesses and households against insolvency

- Therefore, the government should transfer resources to those hit by the crisis

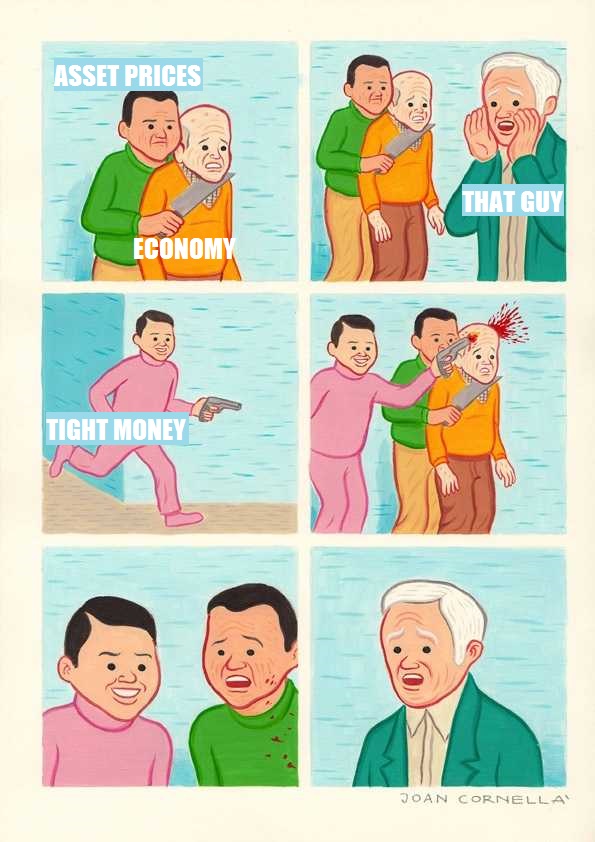

- Fiscal consolidation after the health crisis is over imperils the recovery