Can we avoid another financial crisis? Ten years after the Global Financial Crisis (GFC), we’ll hear the opinions of countless pundits about the likelihood of a new crisis. However, few commenters will be able to answer the question as profoundly as professor Steve Keen. Keen elaborated his views in the 2017 book with the appropriate title Can we avoid another financial crisis?

In this short (129 pages, excluding notes) book, Keen starts with a brief intellectual history of (macro)economics. In the early 2000’s, there was a consensus among leading economists that macroeconomic management had succeeded. Inflation, output and unemployment showed little volatility.

Mainstream academics weren’t thinking about a repeat of the Great Depression. Their research programs focused on the link between micro- and macroeconomics. The complicated mathematical models used by central banks didn’t produce any warning signals in the run-up to 2008.

However, some economists were not convinced that the approach of their colleagues was the right one. Heterodox economists like Hyman Minsky and Steve Keen were interested in the crisis-prone nature of financial capitalism. Unlike mainstream models, which simply ignored the role of money and credit in the economy, heterodox models put debt at their core.

Why does debt matter? Consumption and investment can be financed from previous savings and current income. But as anyone with a mortgage can tell you, you can buy more stuff by taking out a loan. Rising debt levels support GDP growth.

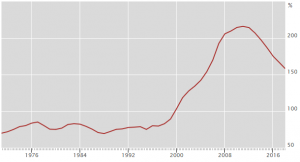

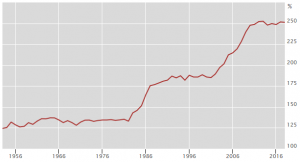

Just look at the following pictures from the Credit statistical database of the Bank for International Settlements:

When credit growth stops or turns negative, that’s a drag for economic activity. In other words: households and businesses consume and invest less.

Of course, debt to GDP cannot rise forever. At some point, borrowers will default. Professor Keen notes that politicians love to take credit (pun not intended) for a good economy under their leadership, while they really should be grateful that there’s a credit boom.

Once you understand the role of credit, it all makes sense. So why did mainstream economists ignore debt? Keen writes in chapter 4, The smoking gun of credit (p. 74):

You might wonder how economists trying to understand Japan’s sudden transition from economic powerhouse to economic basket case could miss as stark a piece of evidence as Figure 14 (note Jan: the figure shows the relation between Japanese GDP and credit). The reason is that they did not even consider this data when they went looking for clues. Their approach to sleuthing has more in common with Peter Sellers and his comic invention, the bumbling detective Inspector Clouseau, than it has with Sir Arthur Conan Doyle and Sherlock Holmes. Through a series of plausible but false propositions, they have blinded themselves to the obvious.

Casual readers of Can we avoid another financial crisis, who haven’t followed macroeconomic debates over the past years, will probably get tired of Keen’s rage against mainstream economics. ‘OK Steve, we get it, you really don’t like these fellows.’

However, you should realize where he’s coming from. Keen has been a critic of wrong economic models for decades. In a movie, the financial crisis of 2008 would have discredited the old models and their proponents. Unfortunately for heterodox economists, this is the real world.

The same economic ‘experts’/’thought leaders’ still get the attention of fellow academics and journalists. Consider Larry Summers. Summers claimed that the US economy had entered a secular stagnation. Like his predecessors during the Great Depression, he was wrong. There were no technical reasons for poor GDP growth – it was the (lack of) debt, stupid!

Furthermore, there is a nefarious rewriting of history underway. In the years following the global financial crisis, a lot of macroeconomists did at least some soul searching about the nature of their field. Now, there’s a tendency to claim that everything is fine. See for an example the paper Is something really wrong with macroeconomics? by professor Ricardo Reis. Reis cites Keen exactly… zero times. In my opinion, this is unprofessional. Either Reis doesn’t know what heterodox economists are saying, which would indicate a poor knowledge of the field. Or he deliberately ignores these views, without explaining why they are wrong, which is worse.

Academic fights aside, let’s return to the question in the title. Can we avoid another financial crisis? Technically, most certainly. Professor Keen prefers a ‘Modern Debt Jubilee’: a direct injection of money into all private bank accounts, with the requirement that the money is first used to pay off debt. This would reduce debt levels and boost the economy.

However, there is a huge difference between what is technically possible and the political will to do it. On the political front, Keen is a pessimist (p. 123-124):

We could escape this trap (note Jan: a credit crunch that leads to ‘debt zombies’) with only moderate difficulty, using the policies outlined in this chapter. But these are unlikely even to be discussed in the portals of power, let alone implemented, because today’s power brokers are still in thrall to the delusional vision of the economy promulgated by mainstream economists.

Policies and reforms like those suggested above rely upon persuading politicians that mainstream economics advice can’t be trusted, and that it’s worth risking unconventional policies instead. Even if that could be done, large swathes of the public would oppose those policies because of a mindset about both economics and public morality which has been shaped by that same unrealistic view of the economy.

However, things do change. Although the Vollgeld proposal was rejected in the Swiss referendum, books like Can we avoid another financial crisis can influence politicians, voters and (future) economists.

Op-ed for a newspaper?