It is not my ambition to police the blogosphere, but since helicopter money is such a hot topic, this post will point out some inconsistencies in yesterday’s post of Nick Rowe. Keep in mind that I do not criticize him as a person! I have a lot of respect for people who are open about their thinking process, free for the whole world1 to see. Especially when they have a professional stake in this (Dr. Rowe is a professor of economics).

I have copied Nick’s post below in its entirety and put it in italics. The pictures and normal text are mine. For ease of discussion in the comments or on Twitter, I have labeled the pictures as Cases.

Helicopter Bonds as Qualitative Easing

Accounting can be fun.

Helicopter Bonds is when the government prints some bonds and drops them out of a helicopter, so whoever picks up the bonds now owns them.

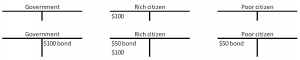

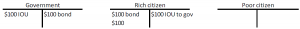

If we assume that everybody picks up the same amount of bonds from the helicopter, this is what this statement looks like in terms of balance sheets:

Case 12:

Note that this is a creative twist on helicopter money: instead of giving money to people, the government throws bonds from its helicopter.

It’s identical to a bond-financed lump-sum transfer payment. It’s identical to a bond-financed lump-sum tax cut (because only net taxes=taxes-transfers matter). The government borrows money from the population by selling bonds, then gives them the money back, and lets them keep the bonds.

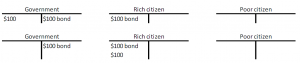

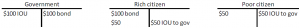

This is saying something different than the statements above. Translated in balance sheets, Nick is now arguing that this happens (first line: government borrows money by selling bond, second line: government gives the money back to those who bought the bond):

Case 2:

Alternatively, Nick could be saying that citizens in aggregate “get the money back”. Then he is saying this:

Case 3:

If I were a rich citizen, this would not quite be my idea of getting my money back.

Anyway, Cases 2 and 3 are equivalent to what I called scenario 1c in my first post on helicopter money, but now being explicit about the distributional aspects of borrowed helicopter money.

At the end of the day the population has the same amount of money, and more government bonds.

I agree, but the distribution is different as the pictures show.

If Ricardian Equivalence were true, Helicopter Bonds would have no effect on anything. It is exactly as if, when the government gives me a government bond worth $100, the government demands I give it my personal IOU3 (my personal bond) for $100 worth of future taxes. It is exactly as if the government and I simply swapped a government bond for my personal bond. And in the world of Ricardian Equivalence, where it doesn’t matter whose name is on the bond, the net effect is zero.

Yes, this is true. But Ricardian equivalence is based on the flawed assumption that people (1) can perfectly predict the future and (2) when they get a tax cut or subsidy from the government today, they will have to pay the exact amount later in taxes. (1) is obviously incorrect. (2) is incorrect because taxes vary over time and the people who pay them: taxes depend on income, consumption, Panamanian shell companies… and people do not live forever.

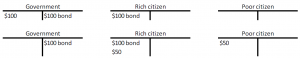

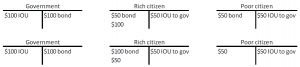

But let’s run with the idea and see what it means in terms of balance sheets. The citizens who were given government bonds now have a corresponding liability to the government:

Case 1-RE:

In case 2, I guess that Nick would say that the rich citizen owes the IOU to the government (as he was given the bond for free, were it not for the theoretical Ricardian IOU):

Case 2-RE:

In case 3, where money was thrown from the helicopter instead of bonds, the balance sheets with Ricardian equivalence would look like this:

Case 3-RE:

In terms of accounting, the government would not be poorer by doing helicopter money/helicopter bonds, because it acquires an asset (IOU) in return if Ricardian equivalence holds. This is not how it works in reality.

Now let’s consider a simple case where Ricardian Equivalence is false. Half the population is borrowing-constrained. They can’t borrow. That means they want to sell their personal bonds (IOUs) but nobody will buy them.

No. First of all, the concept of IOUs makes no sense when Ricardian equivalence is false.

Furthermore, Nick is confusing assets with liabilities. The IOU of the borrowing-constrained (=poor citizen) in case 1-RE and case 3-RE is a liability if you believe in Ricardian equivalence. Why would the poor citizen want to sell this liability? It would be like when the poor person withdraws $50 using a credit card and now has a $50 debt. He supposedly worries about the $50 debt, borrows $50 from somebody else and pays $50 to the credit card company. It does not change one iota to his total wealth or liabilities, only the counterparty of the liability changes.

So Helicopter Bonds causes half the population to sell their government bonds to the other half, so they can spend the proceeds.

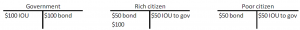

Based on this sentence, I am pretty confident that Nick is thinking about Case 1-RE. This is what happens when the poor man sells his government bond to the rich citizen for cash:

Case 1-RE-bond sale:

Note that the end result is the same as in case 3-RE.

Again, it is exactly as if the government and I swapped a government bond for my personal bond. But in this case, where Ricardian Equivalence is false, it does matter whose name is on the bond. Because only the government will buy a bond with my name on it, if I am one of the borrowing-constrained half of the population.

This gives some more clues about what Nick is thinking. He assumes that the poor do not spend money because they cannot borrow it in the private market. If they could, we would have this situation:

Case 4:

Nick implies this does not happen because the potential lender worries about the credit worthiness of the poor person. This will undoubtedly be the case for a fraction of the poor. However, a lot of poor people do not spend because they do not have the net wealth to do so, and they do not want to get in debt in order to spend4.

In case 1 (helicopter bond) and case 3 (helicopter money, financed by government borrowing), the wealth of the poor does increase.

The confusion of Nick arises by insisting on fictional IOUs, which do not exist in reality because Ricardian equivalence does not hold.

Quantitative Easing is the silly new name for Open Market Operations. It’s when the central bank prints money to buy a bond. It expands both sides of the central bank’s balance sheet.

I agree. See my post on how QE works for details.

Qualitative5 Easing is when the central bank changes the composition of the asset side of its balance sheet, leaving the liability side unchanged. It sells government bonds, and buys some riskier or less liquid asset.

If we consolidate the balance sheets of the central bank and the government that owns that central bank, that means we can see Helicopter Bonds as a form of Qualitative Easing. The government/central bank swaps safe and liquid government bonds for less safe and less liquid private bonds. In my example above, where half the population is borrowing-constrained and unable to sell their personal bonds at all, Helicopter Bonds is just an extreme case of Qualitative Easing where their personal bonds are extremely unsafe or illiquid. In a less extreme case, the borrowing-constrained can borrow, but only from loan sharks.

This is how QE works: a citizen had invested in a government bond. The central bank swaps the bond for cash. Result: nobody is any richer6. Only the form of the citizen’s assets has changed:

The way Nick describes the ‘qualitative easing’ helicopter bonds idea in his last paragraph is as follows. We start from the above figure on QE. The government wants its bond back from the central bank, and gives an IOU in return. Next, the government distributes the bonds among the citizens, and pretends that they have given the government an IOU in return:

Even for government accounting, this is extremely dubious. The citizens did not sign any IOU. For the central bank, this is a grotesque instance of “cash for trash”: it is supposed to hand over its assets (the bond) to the government and receive an IOU from the government in return, which is itself backed by a non-formal claim on a third party (the citizens).

The only purpose this IOU idea serves, is to act like a reminder that the central bank should be recapitalized later on, by taxing the citizens. But as I have shown in scenario 2a of my first post on helicopter money, the central bank can just print the money for the government and be done with it. There is no need for any future recapitalization.

This whole discussion is turning into Nick being too smart for his own good 🙂 Central banks really can print money for nothing. It is called seigniorage.

===

I discuss (central) bank accounting and much more in Bankers are people, too – How finance works.

- OK, this means interested econo-nerds ;)

- Practical note: when I write $100 on a balance sheet without qualifier, I mean this amount in cash. As opposed to ‘$100 bond’ or ‘$100 IOU’, where the non-cash asset is specified.

- IOU is phonetical for ‘I owe you’, an acknowledgement of a debt to somebody, but without conditions for repayment dates, making it different from usual bonds or loans.

- If you don’t believe this, you need to get out of your ivory tower more often.

- Emphasise mine, because I read quantitative instead of qualitative the first time.

- Assuming the interest on the bonds is 0%. I am always talking in nominal terms, not real wealth (I have never talked about inflation this far).

Thanks, good effort and I like the approach (balance sheets). Yet, I think you need to think about this also in terms of liquidity. Add that and I think you agree with Nick (I think Nick is aggregating, so case 3).

“Why would the poor citizen want to sell this liability? It would be like when the poor person withdraws $50 using a credit card and now has a $50 debt. He supposedly worries about the $50 debt, borrows $50 from somebody else and pays $50 to the credit card company. It does not change one iota to his total wealth or liabilities, only the counterparty of the liability changes.”

Nope, it changes their liquidity position, the critical part is that they can again go shopping with their credit card and accumulate more debt.

“No. First of all, the concept of IOUs makes no sense when Ricardian equivalence is false.”

Why not? Did you mean “…is true”? But IOUs always make sense because liquidity is an important concept.

And ref footnote 3: IOU (http://www.investopedia.com/terms/i/iou.asp)

Jussi, I’m glad you liked the post. My problem with Ricardian equivalence is this: “The Ricardian equivalence proposition (also known as the Ricardo–De Viti–Barro equivalence theorem[1]) is an economic hypothesis holding that consumers are forward looking and so internalize the government’s budget constraint when making their consumption decisions. This leads to the result that, for a given pattern of government spending, the method of financing that spending does not affect agents’ consumption decisions, and thus, it does not change aggregate demand. Thus, this theorem is used as an argument against tax cuts and spending increases aimed to boost aggregate demand.” (emphasis mine).

So that is why I can only imagine any point in adding the concept of citizens’ IOUs when Ricardian equivalence (RE) is true. According to RE, the citizens know that the government will tax them later for the helicopter money/bonds they have received. This means they will not spend the money, so the helicopter money would be totally useless to get the people to spend more. It does not matter if they are liquidity constrained when RE holds and the government gives them cash. People supposedly fear future taxes, and keep the money in their pockets.

Hi Jan,

Very interesting blog – and very good points. I am a researcher for the organisation Positive Money in the UK, as well as, the QE for People campaign for the Eurozone. I have written a few papers and recently gave a presentation on the subject at European parliament. I would be very interested in exchanging thoughts and ideas on this matter. However, I was unable to find a contact email address on this site, and received delivery notification failure when trying to email you via the University of Gent address. I will tweet you my most recent paper, and if you are interested in furthering our communication, you can contact me on frank.vanlerven@positivemoney.org.uk.

Thanks for taking the time! And keep up the good work!

Cheers

So Helicopter Bonds causes half the population to sell their government bonds to the other half, so they can spend the proceeds.