On March 10, 2016, Mario Draghi announced that the European Central Bank (ECB) will purchase 80 billion EUR worth of bonds per month. That sounds pretty impressive. But how does the purchase of bonds by the ECB actually work? How does it affect debtors and savers? And what are the risks of this policy?

In this (long) post, I explain the mechanics of what the ECB is doing. If you are familiar with the relationship between bond prices and interest rates, you can skip the first part and start at the sentence that begins with “Central banks like the ECB…”

First of all, we need to understand the basics. A bond is a special type of loan. When countries or large corporations borrow money, the investor who lends the money receives a bond. This bond is a promise by the issuer of the bond to pay back the principal (the money the issuer got from the investor), plus interest. The bond specifies the payback dates for principal and interest, as well as the duration of the bond.

Here is an example: consider the Belgian government bond with ISIN code1 BE6000712016. The federal government2 has collected 700 million EUR with this bond emission. The bond was issued on March 29, 2010. Exactly 30 years later, the holders of the bond will get their principal back. In the meantime, they receive an annual interest payment (called a coupon) of 3.9% of their principal. Suppose someone has invested €1000 in this bond at the issue date. Belgium has to pay that person a coupon of €39 every year3.

An advantage of bonds is that they can be sold to other investors. This gives the bond holder the opportunity to get his investment back in cash before the maturity date. When an new investor judges that he is content with a lower interest income, he can pay more than the nominal principal bond value to someone willing to sell the bond. For example, an investor can buy the bond for €1500 from the bond holder who originally bought it for €10004. Let us say that the transaction is done on March 30, 2016. The original bond holder has received a total of 6 x €39 = €234 in coupon payments from 2011 to 2016. In return for selling the bond (and thus giving up future interest payments), the seller receives €1500 in cash from the buyer. So in total, the original investor has made €1734 on an initial investment of €1000.

The new investor will receive a total of (24 x €39) + €1000 = €1936 over the next 24 years. This is equivalent to accepting an annual interest rate of about 1% for 24 years on an invested amount of €15005.

For the bond issuer, Belgium, nothing changes for its obligations on existing bonds. The government still needs to pay back a principal of €1000 to the person holding the bond in the year 2040. Every year, the new investor will receive a coupon of €39. However, when Belgium issues new bonds, it will set the rates according to the market prices of its existing bonds. It would not make sense to offer a coupon of 3.9%, when a sufficient number of investors are willing to accept a coupon of 1%.

Long story short: bidding up bond prices means lowering interest rates.

Now that we understand what bonds are and how their prices move, we will focus our attention on (central) banks.

Central banks like the ECB in the Eurozone or the Federal Reserve (Fed) in the USA act like a bank for banks. Retail clients or businesses cannot open an account at the central bank. Banks like BNP Paribas or ING can.

The purchase of bonds by the central bank is called Quantitative Easing (QE). Let us illustrate with an extreme example what QE means for banks and depositors.

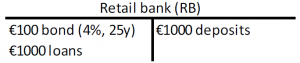

Suppose a retail bank6 owns a 25 year bond with an annual coupon of 4% and a nominal value of €100. This information is stored in the balance sheet of the bank. A balance sheet gives an overview of what a person or a company owns (its assets) and what it owes to others (its liabilities). The balance sheet can be represented in a T-figure. The assets of the bank (in this example the bond and some other loans) are written on the left-hand side of the T-figure. Its liabilities (the clients’ deposits7) are written on the right-hand side:

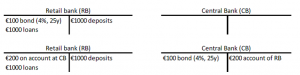

The central bank (CB) believes it can stimulate the economy by manipulating the interest rate for long term government and corporate debt to 0%. So it buys the 25 year bond from the retail bank (RB) for €200, as is shown in the next figure.

“Whoa, wait a minute!”, you might think. “Where does the money that the central bank uses to buy the bond come from? Before the transaction, its balance sheet was empty.”

This is the essence of how banks create money. The money in bank accounts does not “come” from anywhere. When a bank pays someone, it creates a liability: numbers are written into the bank account of the person who gets paid. This is the case when the bank buys a bond, as in the example. But also when the bank grants a new credit: the borrower “sells” a future cash flow to the bank (this loan is the bank’s asset) and gets money in his bank account in return8.

Note that this also means that banks do not need money at the central bank to make loans. So when people claim that QE makes money available to banks so they can provide loans, they are mistaken! This fallacy is based on the assumption that banks “multiply” central bank money by lending it out a finite number of times. According to this flawed logic, the central bank stimulates the granting of loans to consumers and businesses by making more money available to the banks.

In reality, once the retail bank has money in an account at the central bank, this money cannot disappear by lending it out. There are 4 ways the retail bank can get rid of the money in its account at the central bank.

First of all, the RB can use the money to settle a transaction with another retail bank. For example, ING could buy an office building from BNP Paribas, and use the CB money to pay for that real estate. This transaction does not remove the money from the banking system as a whole. It merely shifts the ownership.

Secondly, the RB can withdraw the money from its CB account in the form of physical cash. Many central banks9 now charge negative interest rates on the deposits of retail banks. The deposit rate at the ECB is -0.4% at the moment of writing10.

The negative deposit rate is an incentive for banks to store the physical cash in a vault. At least cash keeps it nominal value. In our example, the RB would lose €0.8 on its €200 deposit at the CB after one year. This does not sound like much, but the balance sheet of the ECB will increase by about 1000 billion (12 x 80 billion) EUR after single year of bond buying. This means the total deposits of retail banks at the ECB will grow by the same amount. So the banking sector as a whole will pay an annual 4 billion EUR in interest on its deposits at the ECB.

A third way by which the RB can reduce its deposit at the CB, is by buying the bond back. This is not likely at the moment, because why would it have sold the bond in the first place? Maybe in the future the RB can buy the bond at an effective interest rate that is above zero. In that case, the RB will have made a profit and the CB a loss (because the CB gets back less in interest and principal from the bond than the €200 it originally paid for it).

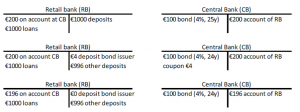

The fourth way for the RB to get rid of the money in the CB, is when the bond issuer pays the money back. The next figures show in detail how it works:

The balance sheets on the top show the situation immediately after the bond sale. One year later (balance sheets in the middle), the CB has a right to a coupon payment of €4. The bond issuer has earned €4 from the other depositors11. This money is used to make the interest payment to the CB, who owns the bond. When the bond issuer wires the money to the CB, the RB deletes its liability to the bond issuer (it removes €4 from the account of the bond issuer). At the same time, the RB pays 4€ to the CB: the CB subtracts €4 from the RB’s account. This final situation is shown at the bottom. Note that both the assets and the liabilities of the RB have decreased by an equal amount. The RB did not make a profit or a loss by making this payment for the bond issuer.

Only options 3 (bond selling by CB) and 4 (maturing of bonds) shrink the balance sheet of the central bank.

What is the effect of QE on the banks and their customers? Depending on accounting conventions, one could claim that the RB has made a one-time profit of €100 when it sold a €100 bond for €200 in the example. However, the bank now operates in a world where long term interest rates are very low. Not just for large corporates and governments, but also for mortgages and small enterprises. This is because banks typically set interest rates on loans by adding a certain percentage to the interest rate on “risk free” government debt of the same maturity. So QE reduces the interest income for banks12. On the other hand, borrowers evidently benefit from low interest rates on their debts.

When the income of banks decreases, it is normal that they have less money for interest payments on deposits of savers. But there is a more fundamental reason why interest rates for savers are low. Bank deposits can be withdrawn at any moment. The bank’s assets on the other hand are illiquid. When a lot of clients want their money (either in cash or by transferring it to another bank), the bank would need to sell some of its assets (bonds and loans). This forced selling would happen at low prices and hence result in a loss for the bank. To prevent the outflow of deposits, banks used to offer a modest return on savings accounts before QE. However, because of the bloated balance sheets of central banks, savers have lost their bargaining power against the banks. Depositors would need to withdraw billions from the banking system before banks get worried about the outflow. Instead of making losses by selling assets that yield an interest, the banks would be happy to be freed from the cash they are currently holding at the central bank at negative interest rates13

Does QE pose any risks to the central bank? It does indeed, in the case its assets (the bonds it bought) lose value. Although the ECB only buys corporate bonds with a high credit rating, it might happen that a company does not pay back its bond. For ease of the argument, suppose that the central bank has bought a bond for €200, and the issuer immediately defaults. The CB now has assets worth €014 and a liability of €200. The equity value of the central bank is the difference between its assets and liabilities: negative €200. Because the ECB is owned by the countries of the Eurozone, it is ultimately tax payers who will have to recapitalize the central bank to make up for the loss.

However, not all is bad for taxpayers. The ECB can also make a profit by QE. In the theoretical example of this blog post, we have always assumed that the ECB pays €200 for the bond with a nominal value of €100 and 25 coupons of €4. But what if the ECB had only paid €150 for the bond? The total cash flows of €200 when the bond matures would result in a €50 profit for the CB. This profit could be distributed to the treasuries of the Eurozone members15.

In conclusion, QE is a giant asset swap to manipulate interest rates down. This has succeeded. However, QE does not change how much people are willing to save and spend. In that sense, quantitative easing has been an exercise in futility when it comes to stimulating the real economy. There is no mechanism from QE to lowering unemployment or stimulating GDP growth.

The effects of QE on the real economy, on the psychology of equity investors and on inequality are topics for other posts.

===

Check out my book Bankers are people, too for much more on money, banking, or QE.

- The ISIN number is a unique code for bonds. You can easily find information on bonds by googling the ISIN code.

- The issuance of bonds for the federal government is handled by the Belgian Debt Agency

- Belgian retail investors have to pay a 27% withholding tax on interest income. In our example, the bond holder will receive a net interest payment of €28.47 (=€39 x (1 – 0.27)) on his nominal bond value of €1000. Foreign investors may be forced to pay additional taxes in their home country on top of the Belgian withholding tax, reducing the net interest even further.

- In this example, we ignore taxes and do not reinvest the interest.

- (1936/1500)^(1/24) = 1.01

- In the rest of this post, I will use the term retail bank to differentiate ‘normal’ banks from the central bank

- Deposits like current and savings accounts.

- Banks do not always acquire an asset when they pay somebody. For example when they pay interest on savings accounts, or when they pay their employees.

- Including the Swiss National Bank, the Swedish Riksbank and the Bank of Japan.

- https://www.ecb.europa.eu/mopo/implement/sf/html/index.en.html

- For ease of the presentation, we assume that there is only one RB in the world. This has no impact on the essence of the argument.

- Don’t feel too sorry for the banks, because they have other sources of income next to earning interest on their credit portfolio.

- Belgium has instated a mandatory minimum interest rate of 0.11% on money in savings accounts that stays untouched for a year. Banks are lobbying to lower this interest rate floor even further. For current accounts, the interest rate is 0% at most banks.

- In reality, the bond will be restructured and the bond holder will almost always recover some of the investment, albeit a lower amount and at a later date

- The other obvious effect is the fact that interest payments on government debt are lower than they would be without QE.

The ECB is IMO a bad example because it also lends money to banks (against collateral). So banks basically can get rid of the base money by lending less.

Yes, it is often said that the QE targets higher inflation via lower interest rate. As those are not very compatible goals, inflation means generally higher interest rate, I’m not sure it successes in either.

When a private central bank buy an asset by issuing money we have an appropriation of property by a private corporation using a sovereign right: money creation and disposing of the purchasing power thereof. This is why the bank has a liability from the issuance of currency into circulation: a liability toward the sovereign Treasury of the hosting nation where the currency was issued. This liability – a private debt and a public credit – currently is unresolved because the central bank don’t pay it to the Treasury AND the Treasury fails to record a correspondent asset in his books. In this way we have a paradox of a private entity (the ECB or the Federal Reserve, as examples) that can buy the world issuing money without discharging her seigniorage debt to the Treasury. We have a false representation in the books of the bank as if the bank has discharged her debt to the public by recording an unresolved liability. It is the fault of the Treasury and of the government of the hosting nation not to spot this absurdity and to let the bank enrich herself at the expense of the public purse. The correct way for accounting of FIAT money creation is to expose a liability for the central bank called CURRENCY IN CIRCULATION where you have to include banknotes AND electronic money. This liability must find a correspondent and equal asset in the Treasury books called SEIGNIORAGE RECEIVED FOR CURRENCY CREATION. The example above can be adopted by analogy by any retail bank that do create electronic money by stealth as it is currently happening.