What do crypto enthousiasts have in common with defenders of independent central banks?

Based on the “Buy Bitcoin”-replies to ECB/Fed tweets, it seems the answer is “not much”.

However, that’s incorrect. Both groups think that their projects are apolitical.

Many central bankers view themselves as technocrats, divorced from politics.

But that’s a fantasy.

You see, anything a central bank does – even within its mandate – has political consequences.

Should monetary policy take into account climate change?

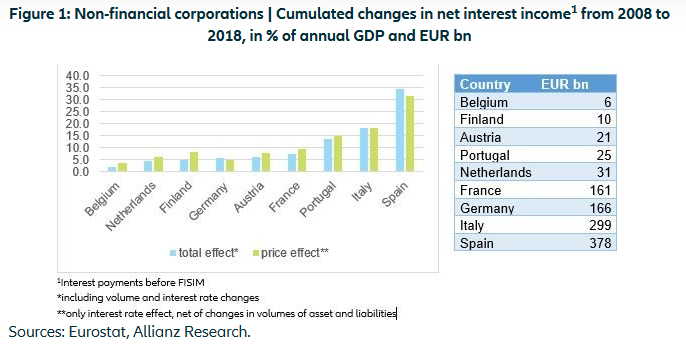

Should the central bank change interest rates or do QE to reach its inflation goal? Whatever option is chosen, monetary policy has distributional effects. For example, the German government has saved hundreds of billions in interest costs.

These two dilemmas illustrate that central banking is inherently political.

Therefore, economists should calculate the consequences of different monetary policy options. These scenarios will make the politics of the central bank’s actions explicit. For example, I estimated the effect of deeply negative interest rates (a proposal of Miles Kimball) on banks, governments, the ECB and the private sector.

Especially in the euro area, the ECB should take differences in asset mixes between countries into account.

Increased transparency will enable central bankers to defend monetary policy against criticism.

Update 26 January 2020: my arguments are obviously not new, see for example: