In a 2017 blog post, I wondered why Germans remember the hyperinflation of the Weimar Republic era.

Nils Redeker, Lukas Haffert and Tobias Rommel have recently published a paper about this very question. In Misremembering Weimar: unpacking the historic roots of Germany’s monetary policy discourse, they show that

most Germans do not know that Germany’s interwar period was shaped by two separate crises, but rather see them as being one and the same.

Furthermore,

Looking back into a skewed version of their own history, many Germans conclude that mass unemployment and high inflation are just two sides of the same coin. What makes this worse is that this misconception is especially prevalent among well-educated and politically interested Germans. Hence, the group of people following the ECB’s monetary policy most closely is also the group most likely to draw the wrong lessons from German history. But public thinking about Weimar economic history is not just substantially flawed. We can also show that the skewed memory of the Weimar Republic still affects the way in which at least some Germans think about monetary policy today.

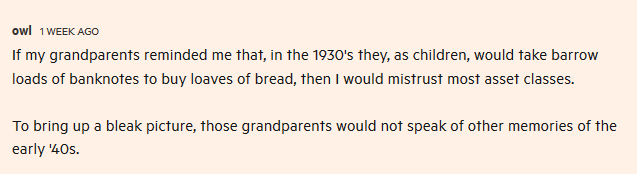

Update 15/02/2020: The following comment on a FT Alphaville article about German financial assets corroborates Redeker et al‘s thesis:

The commenter is probably well-educated, or he wouldn’t read Alphaville. But he makes two mistakes. First of all, the hyperinflation did not occur in the 1930s. Secondly, there is a logical inconsistency. If Germans fear hyperinflation, why do they hold 40% of their assets in currency and deposits? That doesn’t make any sense, as a new hyperinflation would make these assets worthless.