This post explores the consequences of deeply negative interest rates set by the ECB, as proposed by professor Miles Kimball. It’s a shorter version of my previous post, plus an estimation of the economic stimulus of the proposal. Continue reading “Negative rates: a massive transfer from savers to bank shareholders and governments with little impact on economic growth. (Post in response to Miles Kimball)”

Tag: banking

Books on money and banking: a classification

Let’s say you want to read a book about money and banking. What options do you have?

As it turns out, quite a few. Here’s my classification of the literature into six broad themes. The discussion is limited to books that deal with banking and the monetary system. I don’t cover the popular genre of personal finance books that tell the reader how to invest or how to minimize taxes. The books mentioned in this post are illustrations of categories. They should not be interpreted as endorsements. Continue reading “Books on money and banking: a classification”

Only the paranoid banks survive

“Sooner or later, something fundamental in your business world will change.” – Andrew Grove, Only the Paranoid Survive

Everyone hates banks. This has created an opportunity for business gurus, futurists and charlatans to proclaim the imminent death of banks. Stories on how technology will make traditional banks obsolete are eagerly picked up by the media. Continue reading “Only the paranoid banks survive”

My beef with bitcoin bulls

Everybody has heard of bitcoin by now. The price of the cryptocurrency is hitting all-time highs. John McAfee has bet that one bitcoin will be worth $500,000 in the year 2020. Bank chief Jamie Dimon called bitcoin a fraud. His statements were (predictably) followed by articles saying that bankers should be afraid of cryptocurrencies.

It seems there are two bitcoin camps: the true believers and the naysayers. Izabella Kaminska from FT Alphaville in particular has been explaining for years why cryptocurrencies are not the utopia some imagine them to be. In this post, I summarize my own reasons why I don’t think bitcoin is a credible threat to the banking industry.1 Continue reading “My beef with bitcoin bulls”

Bankers are people, too

My book is published!

Do you think banking is too hard for you? Are you convinced that all bankers are crooks? Would you like to follow the financial news, but you always get stuck on terms like derivatives, cryptocurrency or quantitative easing?

Then I have some good news. Continue reading “Bankers are people, too”

Problems with Christopher Balding’s analysis of Chinese banks and currency

Professor Christopher Balding has published a blog post with his views on the link between the China’s banking system and its currency: Can China Address Bank Problems without Having Currency Problems?

He believes that “it is much more likely that if there are systemic banking issues that currency problems will also arise.”

It is laudable that Prof. Balding summarizes his arguments. By being explicit about the assumptions, readers don’t just have to trust his opinion. Instead they can follow the logic and evaluate the strong and weaker points themselves.

The goal of this post is to counter some of the points listed by Balding to support his conclusion. Continue reading “Problems with Christopher Balding’s analysis of Chinese banks and currency”

A lost decade (for bank investors)

2007 seems ages ago. It was the final year of another era, the time before the Crisis. Whatever you prefer to call it – credit crisis, debt crisis, global financial crisis, banking crisis – the crisis has scarred the shareholders of banks. Even though ten years have passed, most bank stocks still have not recovered to their pre-crisis highs.

This post looks at the evolution of the stock prices of the largest banks1 in Europe and the US. For European banks, I made a distinction between institutions with headquarters inside and outside the euro area. Continue reading “A lost decade (for bank investors)”

WannaCry about cybersecurity? Consider this first

In an event that has been called the WannaCry ransomware attack, hackers encrypted data on computers all around the world. The victims – which included hospitals and car factories – had to pay ransom in Bitcoin to get their files back.

Computers without up to date operating systems were particularly vulnerable to the attack.

People who have never come into contact with the internal IT operations of a large company find this hard to understand. Why don’t companies just install the latest patches, like private persons do on their home computers?

Software engineer Jürgen ‘tante’ Geuter has a nice blog post that explains why things are not so simple in the real world: “Why don’t they just update?” Continue reading “WannaCry about cybersecurity? Consider this first”

Stop calling banking ‘monetary intermediation’

Banks create money. To be more precise, when a bank grants a loan, it simultaneously creates a deposit. Bank deposits are functionally equivalent to cash.

The insight that bank lending creates money is a direct result of basic accounting, and has been explained many times. See for example the Bank of England, Positive Money, this blog, and most recently the Bundesbank (h/t Benjamin Braun) and Norges Bank (h/t Frank van Lerven).

A while ago, Daniela Gabor pointed out that economists have know this for a long time (see the replies to her tweet for even earlier references):

Waldo Mitchell, writing in 1923(!) on banks' power to create money ex-nihilo. Incredible we're still debating this. https://t.co/rAuoG0ALeu pic.twitter.com/JI5vHN2dk6

— Daniela Gabor (@DanielaGabor) March 21, 2017

I wouldn’t be surprised if the Renaissance bankers who understood double-entry bookkeeping were well aware of the fact that they were creating money.

So how is it possible that some famous economists still don’t know that banks really do create money? Why do they insist that banks lend out savings?

Economics education apparantly fails to pass on some elementary knowledge to students.

It doesn’t help that the activities of banks are often described as ‘monetary intermediation’. Intermediation implies that bankers are the middle men between borrowers and savers.

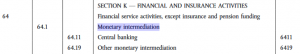

Monetary intermediation is even an official term in the statistical classification of economic activities in Europe:

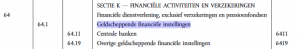

However, there exists a much better description for banks. In Dutch, the formal description of banks is “geldscheppende financiële instellingen”, which literally means “money-creating financial institutions”:

As far as I can tell, Dutch is the only European language in which banks are described as active money creators1. All other languages use ‘monetary intermediation’.

Maybe everybody should take a cue from Dutch and start saying ‘money creating institutions’ from now on, so we don’t have this debate a hundred years from now 😛

===

I explain how banks create money in Bankers are people, too. After you’ve read my book, you’ll know more about banking than many PhD economists!

Update 20 October 2019: the link to the Bank of England paper was broken. It’s fixed now, thanks to Anna for notifying me!

What I like about America, finance edition

Or to be more precise, debate about the financial institutional framework edition.

How should banks be regulated? Ten years ago, this question would have only interested a few specialists. Discussions about bank supervision and the role of the central bank were way too boring for the general public1. Besides, bankers surely knew what they were doing?

The global financial crisis and its aftermath changed this complacent attitude. The existing rules did not prevent the worse financial crisis since the 1930s. Governments had to bail out banks at a moment’s notice. Politicians took drastic decisions during the panic of September 2008. While those actions were taken with little democratic oversight, national leaders2 were the only agents willing and able to stop the collapse.

The crisis spurred a thorough update of bank regulation. Both in the United States and in Europe, legislation was passed to make banks safer. Avoiding a repetition of ad-hoc bailouts became a priority. The U.S. got its Dodd-Frank Act. The European Union (EU) set up the European Banking Authority (EBA) and worked towards a banking union3. America and Europe implemented capital and liquidity standards based on the Basel III recommendations. Continue reading “What I like about America, finance edition”