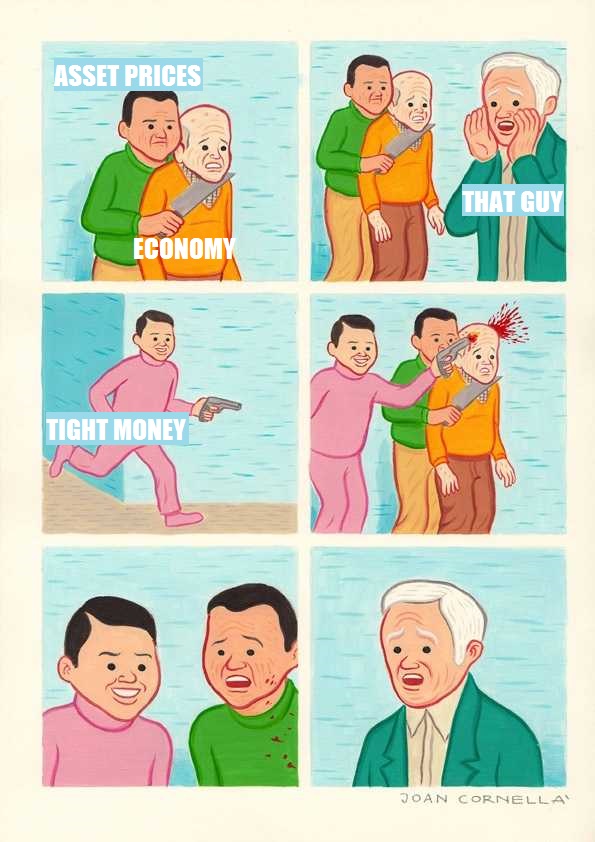

The coronavirus pandemic once again demonstrates that a lot of prominent economic commentors are dangerous. Their recommendations will amplify the economic shock caused by the virus.

People who claim that

- the coronavirus is not the job of central banks

- this is mainly a supply chain issue

- we have to beware of the long term consequences of doing fiscal/monetary stimulus now

- we should continue business as usual

are spreading falsehoods.

Here is a selection of people who do grasp the importance of acting now in order to prevent an economic meltdown later.

Scott Sumner and David Beckworth: How central banks should respond to the coronavirus threat (podcast)

John Cochrane: Corona virus monetary policy

Skanda Amarnath: