BIS Statistics: international banking, debt securities, derivatives…

I-TIP Services (World Trade Organization and World Bank): imports and exports of financial (and other) services

BIS Statistics: international banking, debt securities, derivatives…

I-TIP Services (World Trade Organization and World Bank): imports and exports of financial (and other) services

Bank of China and ICBC are obviously Chinese banks. Less well-known, the following banks are also controlled by Chinese shareholders:

ATLANTICO Europa (Portugal) is owned by “a Hong Kong financial group“

Banque Internationale à Luxembourg (Luxembourg) is owned by Legend Holdings (Hong Kong)

Bison Bank (Portugal) is owned by Bison Capital Holding (Hong Kong)

Haitong (Portugal) is owned by Haitong Securities (Shanghai)

Nagelmackers (Belgium) is owned by Anbang, which is owned by the Chinese Ministry of Finance (Beijing)

Saxo Bank (Denmark) is owned by Zhejiang Geely Holding Group (Hangzhou)

During my research on banks in Europe, I came across some strange things. Here’s an example. Some banks have a banking license in a country, while the banks themselves say they are no longer active there:

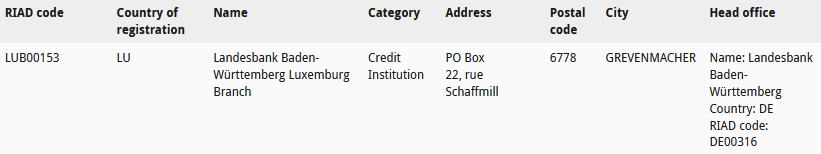

LBBW has a banking license in Luxembourg according to the ECB.

LBBW doesn’t mention Luxembourg on its global locations site. A 2012 article says LBBW pulled out of Luxembourg.

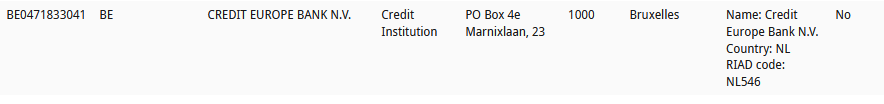

Credit Europe has a banking license in Belgium according to the ECB.

But Credit Europe says it has stopped its activities in Belgium in 2016.

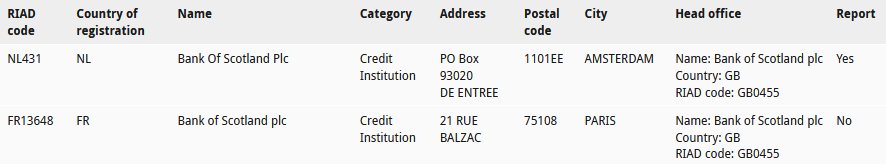

Bank of Scotland has a banking license in France and in the Netherlands, according to the ECB. But the bank says it does not operate internationally.

What’s going on here?

From the 1990s until the global financial crisis, there was a wave of consolidation and international expansion by Western European banks. Over the past decade, M&A activity has been a fraction of what it used to be. International banks have sold part of their foreign subsidiaries, either voluntarily or because regulators forced them to slim down.

Who did they sell to? Often to local or regional banks.

Examples (note that this is a work in progress! – most recent update 29 March 2024):

Barclays (UK) sells its controlling stake in Absa (South Africa and 9 other African countries) to investors (2017)

BNP Paribas (France) sells its holdings in Gabon, Mali and the Comoros to Ivorian Atlantic Financial Group (2020)

BNP Paribas (France) sells its subsidiaries in Burkina Faso and Guinea to Guinean Vista Bank (2021)

BNP Paribas (France) sells most of its stake in UBCI (Tunisia) to Tunisian Carte (2021)

Standard Chartered (UK) exits seven countries, 5 in Africa and 2 in the Middle East (2022)

BNP Paribas (France) sells its majority stake in BICIS (Senegal) to pan-African SUNU (2022)

BBVA (Spain) sells BBVA USA to American PNC Financial Services Group (2020)

HSBC (UK) sells it retail business in the USA to American Cathay Bank and Citizens Bank (2021)

MUFG (Japan) sells MUFG Union Bank (USA) to American U.S. Bancorp (2021)

BNP Paribas (France) sells Bank of the West (USA) to Canadian BMO (2021)

HSBC (UK) sells its subsidiary in Canada to Canadian RBC (2023)

Dexia (Belgium) sells Denizbank (Turkey) to Russian Sberbank (2012)

National Bank of Greece (Greece) sells Finansbank (Turkey) to Qatari QNB (2016)

Sberbank (Russia) sells Denizbank (Turkey) to (United Arab) Emirates NBD (2019)

ABN AMRO (Netherlands) winds down its corporate banking activities in Asia, Australia, Brazil and the US (2020)

UniCredit (Italy) sells most of its stake in Yapi Kredi (Turkey) (2020)

HSBC (UK) wants to exit Turkey (2020)

Citigroup (US) sells its retail banking activities in 13 markets, mainly in Asia (2021)

HSBC (UK) sells HSBC Oman to Omani Sohar International Bank (2022)

AIB (Ireland) sells its stake in Bank Zachodni (Poland) to Spanish Santander (2010)

Barclays (UK) sells Expobank (Russia) to Russian financier Igor Kim (2011)

KBC (Belgium) sells Kredytbank (Poland) to Spanish Santander (2012)

KBC (Belgium) sells its minority stake in Nova Ljubljanska Banka (Slovenia) to Slovenia (2012)

KBC (Belgium) sells Absolut Bank (Russia) to Russian investors (2012)

Erste (Austria) sells its subsidiary in Ukraine to Fidobank (2012)

KBC (Belgium) sells KBC Banka (Serbia) to French Société Générale and Norwegian Telenor (2013)

National Bank of Greece (Greece) sells UBB (Bulgaria) to Belgian KBC (2016)

UniCredit (Italy) sells its controlling stake in Pekao (Poland) to local investors (2016)

RBI (Austria) sells its bank in Slovenia to Biser Bidco (2016)

Alpha Bank (Greece) sells Alpha Bank Srbija (Serbia) to Serbian AIK Banka (2017)

Cyprus Popular Bank (Cyprus) sells Marfin Bank (Serbia) to Expobank CZ (Czech Republic) (2017)

Eurobank (Greece) sells Bancpost (Romania) to Romanian Banca Transilvania (2017)

National Bank of Greece (Greece) sells its subsidiaries in Serbia to Hungarian OTP (2017)

Piraeus Bank (Greece) sells its unit in Serbia to Serbian Direktna Banka (2017)

Société Générale (France) sells most of its Central and Eastern European subsidiaries to Hungarian OTP (2017-2019)

Société Générale (France) sells Euro Bank (Poland) to Portuguese Millennium bcp (2018)

Bausparkasse Schwäbisch Hall (Germany) sells its stake in CMSS (Czech Republic) to Belgian KBC (2019)

Piraeus Bank (Greece) sells PBB (Bulgaria) to Greek Eurobank (2019)

Danske Bank (Denmark) sells its unit in Estonia to Estonian LHV Pank (2020)

Danske Bank (Denmark) sells its business in Latvia to Latvian Citadele Bank (2020)

Handelsbanken (Sweden) closes its branches in Germany and Poland (2020)

ING (Netherlands) exits retail banking in the Czech Republic (2021)

Crédit Agricole (France) sells its subsidiary in Serbia to Austrian RBI (2021)

Crédit Agricole (France) sells its subsidiary in Romania to Romanian Vista Bank (2021)

RBI (Austria) sells its subsidiary in Bulgaria to Belgian KBC (2021)

Apollo (USA) sells NKBM (Slovenia) to Hungarian OTP (2021)

AnaCap (UK) sells Equa bank (Czech Republic) to Austrian RBI (2021)

Commerzbank (Germany) sells its subsidiary in Hungary to Austrian Erste (2021)

Sberbank (Russia) planned to sell its subsidiaries in 5 CEE countries to local banks (2021), but Sberbank Europe was closed by the ECB in 2022

Igor Kim (Russia) sells AS Expobank (Latvia) to Latvian Signet Bank (2022)

Société Générale (France) sells Rosbank (Russia) to Russian Interros (2022)

JC Flowers (USA) sells First Bank (Romania) to Italian Intesa Sanpaolo (2023)

Alpha Bank (Greece) sells its operations in Romania to Italian UniCredit (2023)

Eurobank (Greece) sells Eurobank Direktna (Serbia) to Serbian AIK Banka (2023)

HSBC (UK) sells its unit in Russia to Russian Expobank (2024)

HSBC (UK) sells its unit in Armenia to Armenian Ardshinbank (2024)

For more on bank consolidation in Central and Eastern Europe, see this report by Deloitte.

Citigroup (US) sells its retail banking activities in Belgium to French Crédit Mutuel Nord Europe (2012)

Crédit Agricole (France) sells Emporiki (Greece) to Greek Alpha Bank (2012)

Barclays (UK) sells its retail branches in Italy to Italian Mediobanca (2015)

HSBC (UK) wants to sell its retail banking operation in France (2020) Update: sold to French My Money Group (2021)

Degroof Petercam (Belgium) sells its private banking activities in Spain to Andorran Andbank (2020)

Rabobank (Netherlands) shuts down its online savings bank in Belgium (2021)

ING (Netherlands) sells its retail banking activities in Austria to Austrian bank99 (2021)

KBC (Belgium) sells its subsidiary in Ireland to Bank of Ireland (2021)

Crédit Agricole (France) sells Bankoa (Spain) to Spanish Abanca (2021)

Handelsbanken (Sweden) will exit Denmark and Finland (2021)

Degroof Petercam (Belgium) sells its private bank in Switzerland to Swiss Gonet & Cie (2022)

RBC (Canada) sells RBC Investor Services (Luxembourg) to Franco-Spanish1 Caceis (2022)

HSBC (UK) sells its retail bank in Greece to Greek Pancreta Bank (2022)

Caixabank (Spain) increases its stake in Banco BPI (Portugal) to 84.5% (2017)

BNP Paribas (France) buys Raiffeisen Bank Polska (Poland) from Austrian RBI (2018)

Crédit Agricole (France) buys three small banks in Italy (2017) and another one in 2020.

KBC (Belgium) buys OTP Banka Slovensko (Slovakia) from Hungarian OTP (2020)

BBVA (Spain) increases its stake in Garanti (Turkey) to 49.85% (2017) and launches a bid for the remaining shares (2021)

Eurobank (Greece) merges its subsidiary in Serbia with local bank Direktna Banka (2021)

Société Générale (France) buys LeasePlan (Netherlands) (2022)

Intesa Sanpaolo (Italy) buys Compagnie de Banque Privée Quilvest (Luxembourg) (2022)

Crédit Agricole (France) acquires Degroof Petercam (Belgium) (2023)

Dubai (query for bank/banc/banque/credit in the company name and status = active)

European Union (query for individual banks available here)

New York (query ‘Foreign Agency’ and ‘Foreign Branch’ to find the international banks in NY)

United States (national banks, supervised by the OCC)

If you know where to find official lists of banks in China, please let me know in the comments!

Vanessa Ogle on the history of tax havens and decolonization (academic paper, yet reads like a “normal” article). Twitter summary here.

The Tax Justice Network has more articles on offshore history.

How oil companies use captive insurance companies in tax havens to minimize their taxes.

How much money from public tenders in the EU goes to tax havens? (Article has some discussion of methodology)

The strategy of European banks ever since the Global Financial Crisis has been to focus on profitability1. How do you achieve a higher return on equity? There are two commonly followed options. Either you cut costs, e.g. by merging banks in the same geography and closing down the redundant branches. Or you sell the business, especially when you’re an also-ran outside of your home market.

Marc Rubinstein writes about the financial industry in his weekly newsletter Net Interest.

I especially liked his discussion of “front book, back book“. Banks and insurers accumulate a long-term book of assets. These generate a predictable stream of income (interest and premiums). Unfortunately, this “back book” exposes them to unexpected losses. As a result, financial firms need a lot of capital.

The business model of Software-as-a-Service (SaaS) companies is also based on a back book. However, unlike banks, their portfolio of subscribers does not require a lot of capital.

In the same newletter, Rubinstein discusses the possibility of bank M&A funded by badwill, as I suggested earlier.