- ALD, the leasing subsidiary of Société Générale, acquires LeasePlan for 4.9 billion euro

- In Italy, the state fund that controls troubled bank Carige has picked BPER Banca to negotiate a sale of Carige

- Meanwhile, a rumored acquisition of Russian Otkritie by Italian UniCredit was dropped

- Belgian Degroof Petercam sold its Swiss private bank to Gonet & Cie

- Latvian Citadele also sold its Swiss subsidiary, Kaleido Privatbank

- BNP Paribas completed the transfer of DB’s global prime finance and electronic equities (for more on these banks, see my two minute profiles of BNP Paribas and Deutsche Bank)

- Ireland has the 8th largest international banking sector in the EU and the 17th largest in the world, according to a BPFI report

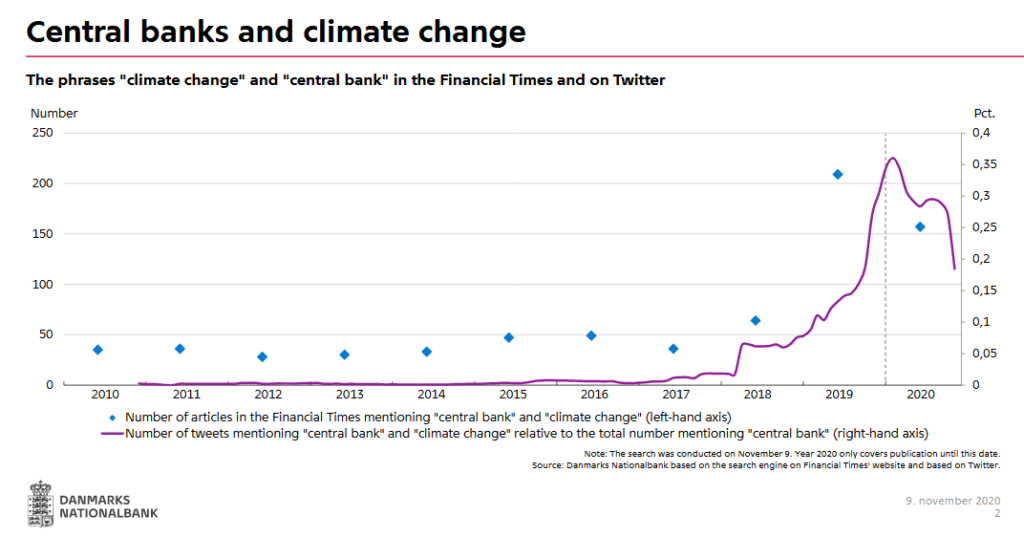

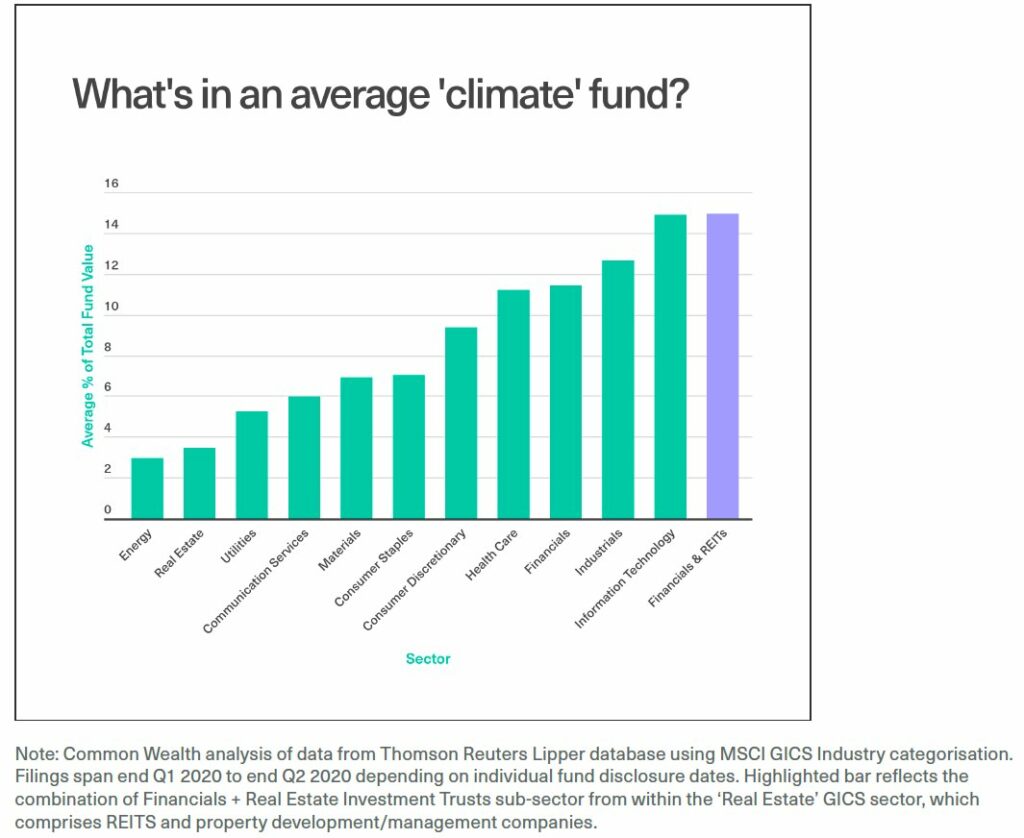

- The ECB launched its 2022 climate stress test. Results will be published in July.

- Euro area inflation rose to 5.1% in January 2022

- A Brussels court rejected the case of ClientEarth against the National Bank of Belgium

As always, I start the first Finrestra podcast episode of a month with a selection of the financial news of the previous month. Listen to the episode of 7 February 2022 on Spotify, Apple Podcasts or YouTube.