The Unleashed podcast with Will Bachman offers practical advice:

An EU super rebate would solve a lot of problems

European Union leaders agreed on a package of measures to support the economy after the damage done by Covid-19.

The summit took four days, because of tensions between member states that will be net payers and those that will be net receivers of EU funds.

However, I had a more elegant alternative, as I explained on Twitter (thread):

The EU missed an opportunity to provide macroeconomic support that matches the size of the corona shock, to increase safe assets and to avoid transfers between member states.

Government debt and inflation

Do deficits automatically lead to default or high inflation? No.

Here are some good reads:

Will deficit spending lead to inflation? There is a difference between developed and developing countries.

Who pays for this? How the United States dealt with its national debt after the Second World War.

Historical lessons from large increases in government debt. The debt was set aside in a sinking fund for repayment at a later date.

Startup videos

Peter Thiel explains why competition is for losers and why you should start with small markets. He also answers the question “if you’re so smart, why aren’t you rich?”

Kevin Hale on how to evaluate startup ideas:

Multinational banks in Africa

- Absa (South Africa)

- Attijariwafa Bank (Morocco)

- BancABC (Botswana)

- BCP (Morocco)

- Citi (USA)

- Ecobank (Togo)

- First National Bank (South Africa)

- GTBank (Nigeria)

- Société Générale (France)

- Standard Bank (South Africa)

- Standard Chartered (UK)

- United Bank for Africa (Nigeria)

The Asian Banker has an overview of the largest banks in Africa and the Middle East.

The blood boys from Brazil, and other corona stories

Some things that could happen1:

- Blood farms sell the antibody plasma of recovered Covid-19 patients.

- Jerome Powell, Steve Mnuchin and Dave Portnoy win the Nobel Prize for Economics.

- As Tesla files for bankruptcy, its stock goes to $6000 – vindicating both $TSLAQ and Cathie Wood.

Aircraft leasing confirms all economic clichés

Cliché ideas of how the international economy works (see the work of Brad Setser and many others):

- Companies use “financial centers” aka tax havens to minimize their tax bills.

- Financial institutions in surplus countries invest the money abroad, but are not good at it.

Let’s have a look at how the aircraft leasing business works in reality.

Financial center? Check:

“Ireland is one of the biggest centres for airline leasing in the world. Many of the world’s biggest and best airline leasing companies are based in the Republic”, which explains why Ireland has 17,000 aircraft orders. [To be fair, financial centers also benefit from the concentration of specialized workers and firms.]

Financiers from Germany, Japan and China investing in low-margin, high risk businesses? Check:

Between 2010 and 2014, [Dublin-based aircraft leasing company] Avolon also raised US$6.1 billion in debt from the capital markets and a range of commercial and specialist aviation banks including Wells Fargo Securities, Citi, Deutsche Bank, BNP Paribas, Credit Agricole, UBS, DVB, Nord LB and KfW IPEX-Bank. In 2017, Avolon entered the public debt markets and raised a total over US$9 billion in debt finance. In November 2018, Avolon announced that Japanese financial institution, ORIX Corporation had acquired a 30% stake in the business from its shareholder Bohai Capital, part of China’s HNA Group. (source: Wikipedia)

European Payments Initiative

A group of 16 European banks are working on a unified card and digital wallet that can be used across Europe.

The founders of the European Payments Initiative (EPI) include all major French, German and Spanish banks.

I’m curious why Intesa Sanpaolo1 and the Austrian and Nordic banks haven’t joined.

A pan-European payment solution is long overdue. Payment providers like Visa, Mastercard and PayPal have profit margins that European banks can only dream of. Increased competition and lower prices would be great for sellers and consumers.

Het fabeltje van de Italiaanse krekel en de Nederlandse mier

Stroomt het geld van de Nederlandse en Duitse belastingbetalers naar de luie Italianen? Philipp Heimberger en Nikolaus Krowall zetten enkele feiten over de Italiaanse economie op een rijtje in dit artikel.

Korte versie op Twitter:

Links: Yemeni money, IT migration screw-up, ECB response to Covid-19 and more

Some interesting articles I came across recently:

Yemen has two governments (civil war), one currency, and two monetary systems.

IT project management horror story at German Apobank (in German).

Overview of the Eurosystem response to the pandemic.

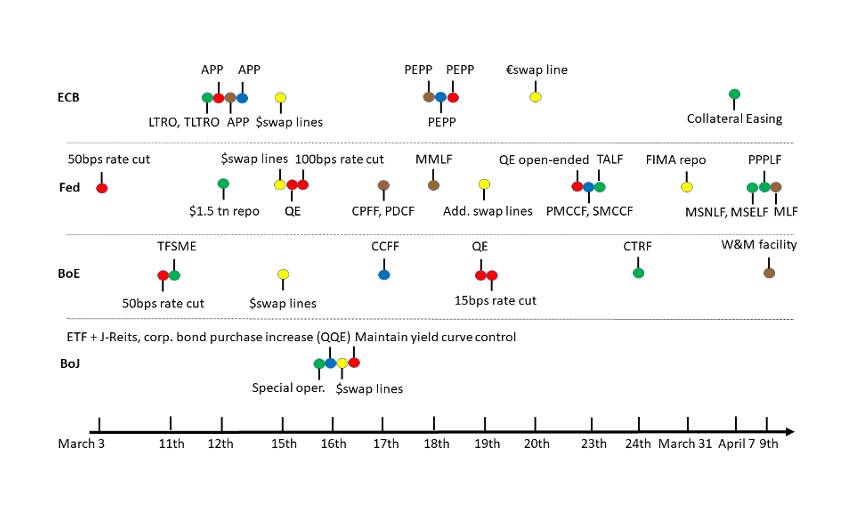

What central banks have done to help the economy survive Covid-19

Historical lessons from large increases in government debt

Euro area economic expansions are like Tolkien’s Elves: they don’t die of old age. The most recent one was murdered by corona.

(On a sidenote: I’ve been critical about the lack of blogging at the ECB. But it turns out that the Banque de France’s Eco Notepad is an excellent blog, as the four articles above show!)

All of the World’s Money and Markets in One Visualization

How may clicks to open a bank account? (Built for Mars on the user experience of retail banking)

The Economic Foundations of Industrial Policy: an amazing longread (very long!) on productivity, explaining why rich nations are rich

Ancient history: “In 2003, refinancing via LTROs amounts to 45 bln Euro which is about 20% of overall liquidity provided by the ECB.” (On June 18, 2020, banks borrowed 1.31 trillion euro from the ECB via TLTRO!)